In a Strong Year for Stocks, Most Stock Market Sectors Have Flourished. But Which Should You Buy Now?

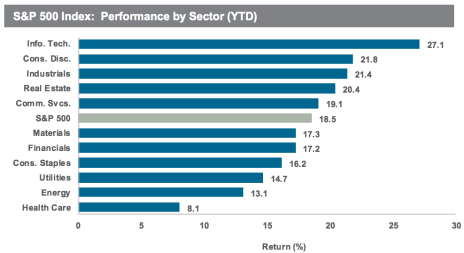

As you can see from the chart below, the top four stock market sectors from the first half of 2019 were:

- Information Technology, up 27.1%

- Consumer Discretionary, up 21.8%

- Industrials, up 21.4%

- Real Estate, up 20.4%

Those are excellent returns, especially in a fabulous market in which the Dow Jones Industrial Average gained 11.8%, the S&P 500 was up 14.3%, and the NASDAQ returned 16.1%, during the same period.

So, the next question is, where do we go from here? Each of our contributors to my Wall Street’s Best newsletters, of course, has his or her own ideas and forecasts for the rest of the year. But there are many recurring themes.

[text_ad]

In his latest issue, James Stack, editor of InvesTech Research, has the following allocation in his Mutual Fund portfolio:

- 13%, Health Care

- 12%, Technology

- 9%, Consumer Staples

- 7%, Industrials

But he did remark that he believes we are in a late-stage bull market, and therefore, investors might consider adding some gold and gold mining stocks to their portfolios—a sector that has reacted favorably to the Federal Reserve’s monetary easing efforts.

And contributor Richard Moroney, editor of Dow Theory Forecasts, recently ranked his favorite sectors, calculating his Quadrix score that includes rankings for Momentum, Value, Quality, Financial Strength, Earnings Estimates, and Performance. His top four stock market sectors are:

- Technology, with a ranking of 22.9%

- Healthcare, 21.8%

- REITs, 17.5%

- Materials, 16.6%

And, lastly, in my Top Stock Picks webinar last week, I offered these four sectors as my favorites for the rest of the year:

The 4 Best Stock Market Sectors to Buy Now

The REIT sector was hit hard at the end of last year, when investors feared interest rates were going to continue to rise. But rate fears have lessened, and the sector is doing very well with the strong economy, and with the average dividend yield of 4.14%, they remain very attractive for cash flow.

Financials

Due to the same interest rate fears, financials had a downturn at the end of the year. But, like REITs, they have started to pop back up, albeit with a bit more volatility. The average bank stock P/E (price-to-earnings) ratio is 18-21, but many banks are still undervalued, and trading at P/Es around 11-14. In addition, most banks pay at least a 1% dividend yield, so you get cash while you wait for appreciation. The strong economy should continue to boost bank stocks.

Consumer Defensive

I like to hedge my bets, so just in case the economy does begin to falter a bit, I like to have some fairly secure stocks, that do well even in a slower economy. And Consumer Defensive Stocks fit that bill.

Healthcare

All the political wrangling in D.C. has created much frustration and uncertainty in the Healthcare segment. However, our nation is not getting any younger, and there are plenty of opportunities for growth in this arena. You can be as speculative as you like, with biotechs, or stay a little more conservative, with medical device stocks.

3 Stocks to Buy

As for individual stocks, each of these four stock market sectors offer some great ideas, many of which are still undervalued. Here are three that I chose from our 2019 Top Stock Picks that I think offer excellent potential for the near future.

First US Bancshares, Inc. (FUSB) was chosen by Benj Gallander, editor of Contra the Heard Newsletter. At mid-year, Benj noted, “First US Bancshares, Inc. (FUSB), a deep-rooted bank founded in 1952, has jumped about 16% since we selected it at the beginning of the year. We think that there is much more ahead as it seems reasonable that better than a double is in the cards.

“In the past, when it was a smaller bank, it traded above $25. With the recent takeover of The Peoples Bank, there is an excellent chance that both revenues and the bottom line will fatten.

“In addition, the dividend, which currently rests at $0.02 a quarter may increase. It did hit $0.27 quarterly prior to the recession and while that is a leap beyond current expectations, a double or triple in the payout before the end of 2020 seems reasonable. That would almost assuredly push the stock price up.

“Financial ratios for this bank are excellent. The stock still trades well below the book value of almost $13. Insiders own about 5.8%. The same steady CEO, James House has guided this enterprise since 2011. It would not surprise at all to see a larger enterprise swoop in and take over FUSB with its 20 branches.”

Altria Group, Inc. (MO) was recommended by Bob Howard, editor of Positive Patterns. Bob’s update noted: “I have been in this business for going on 40 years and the entire time the conventional wisdom is that tobacco stocks are a bad bet. Nobody smokes anymore, the lawsuits will kill them, Wall Street doesn’t tout them, and Uncle Sam wants to put them out of business.

“Meanwhile, tobacco stocks have been some of the best SPX stocks to own for the last 40 years. They rank in the top 1-2% of the SPX for returns.

“The dividends have been raised steadily during all this ‘turmoil.’ One thing you should be aware of is that the pot revolution, when it’s over (2025?) will mean that Altria Group, Inc. (MO) will be selling Willie Nelson Reds right next to the Marlboro’s at your local 7-11. This will mean that soon MO will have a brand new revenue stream and it will be considerable.

“Vaping, Cigarettes and POT—that will be the business profile of MO by 2025, and it will be a very profitable picture. There are almost 300 publicly-traded POT companies now (many traded OTCBB), and most of them are smoke and mirrors, and they will disappear in a few years. MO pays a nice dividend, has a path ahead to growth, and below $50, it’s a real bargain.

“If you are looking for good income, with the prospects of much higher dividends as it reaps the rewards of selling POT, MO is a good buy, especially below $50.”

Smith & Nephew plc (SNN) was my Top Pick, and I recently updated it, noting, “Smith & Nephew pushes several of my analysis buttons, including its fundamental strength, its ability to boost its global growth, and its membership in the healthcare sector, which has seen average gains of 9.1% so far in 2019. SNN has returned 20.3%.

“The company makes medical devices—primarily for hips and knees—and sells them in more than 100 countries around the world. SNN also provides advanced wound care products for the treatment and prevention of acute and chronic wounds.

“Smith & Nephew is growing organically and by acquisition. For its first quarter, Smith & Nephew reported sales of $1,202 million, up 4.4%, with growth across the board, throughout its three franchisees. At the end of the first quarter, 13 hedge funds tracked by Insider Monkey were long on SNN, up 18% from the previous quarter.

“Although the shares have climbed nicely, I believe there is more room to grow. So, if you haven’t bought in yet, it is a good time to do so.”

[author_ad]

*This post has been updated from the original version, published in 2017.