The first step in determining how much money you need to fund your retirement is to create a retirement budget. Once you’ve established how much you need to spend, you can then determine how much you’ll want to spend each month in your ideal retirement. With those numbers in mind, you’ll then be able to look at all your income sources (Social Security, annuities, dividends, pension if you’re lucky, and profits from stock investing) and see how closely your income matches your spending.

Then, using retirement calculators and budgeting tools, you can extrapolate out just how big your nest egg will need to grow for you to confidently retire. Here’s how I recommend starting:

Setting Stock Investing Goals Based on Income Needs

List all your expenses. Include all your normal spending, including housing, taxes, internet, telephone, streaming/cable, automobile, utilities, food, etc.

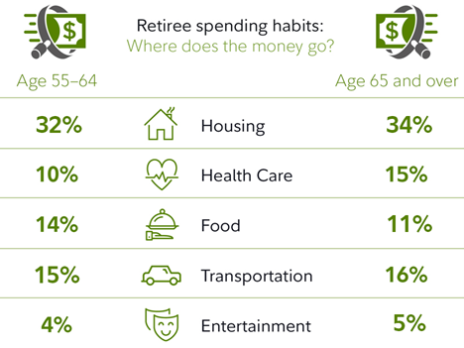

And then think about the expenses that will change during retirement—expenditures like increased entertainment, travel and health costs (Medicare premiums and deductibles that may be more than your employer-sponsored health plan), a second home, hobby spending (for example, golfing four days a week), and taxes on your retirement income that may have been tax-deferred.

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2022 may need approximately $315,000 saved (after tax) to just cover health care expenses in retirement. That’s scary, isn’t it?

[text_ad]

Next, include an emergency fund. You know they happen! Your car breaks down; your grandchildren need a loan; an unexpected medical expense puts added stress on your budget. It’s best to plan for unplanned expenditures.

Consider the costs of long-term care—an assisted living facility or nursing home—which can quickly demolish your retirement savings. According to Genworth Cost of Care survey, the average assisted living center will set you back $4,000 a month, and a nursing home will cost $7,756. You may want to factor in the cost of a long-term insurance policy, prior to retirement (current premiums average $300-$600 monthly).

Then, make sure to include expenses that will decrease, such as business clothing and commuting costs, lunches and dinners eaten at restaurants (although you probably won’t want to give up all your restaurant meals!), daily Starbucks spending, the elimination of your mortgage costs (if you are fortunate enough to have paid off your home), or lower housing expenses due to downsizing your home.

The following chart may be eye-opening for you, when you see that several expense categories actually grow in your retirement years, as a percentage of total income.

And don’t forget to consider your estate planning—how much do you want to leave for your heirs?

Estimate the yearly income you will need. And don’t worry; this number does not have to be set in stone; it will change as you adapt to your new lifestyle. One method that works well for many retirees is to start by estimating that your retirement budget should amount to 70% to 80% of your pre-retirement income. So, if you make $75,000 per year now, your retirement income would need to be $52,500 (at 70%), or $4,375 per month. And at 80%, you will require $60,000 annually or $5,000 per month.

But your expenses at retirement will surely dictate the amount of income you will need. Hopefully, your retirement income will include Social Security payments, annuities, dividends, and perhaps a pension (if you’re really lucky), as well as your withdrawals from your stock investing accounts.

Choose a budgeting tool, such as this spreadsheet available from Vanguard.

Or you can use any financial budgeting tool, such as Personal Capital, Tiller, or YNAB.

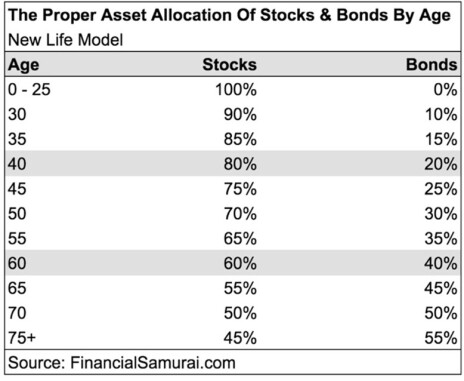

Lastly, you’ll need to consider those cycles when stock investing gets tough, the market declines, and you see your investment accounts shrinking. I recommend that you make sure that the monies you need to conduct your normal life are in conservative, safe investments. As you grow older, most financial experts recommend a more conservative asset allocation, as you can see below.

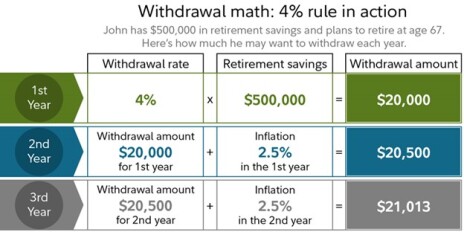

It may take you a couple of years into your retirement to figure out exactly what your annual, sustainable, withdrawal retirement rate should be. Most advisors recommend that you begin with a 4%-5% withdrawal rate in your first year, and see how that works for you. You will probably find that in your early retirement years that you may spend more on travel than in later years, while healthcare may take up more of your retirement budget as you age.

Fortunately, there are plenty of retirement calculators to assist you with estimating your withdrawal rates. Bankrate, Smartasset, and NewRetirement are a few that come to mind.

Don’t be shy about trying different scenarios—alternating different beginning amounts, inflation rates, sustainable retirement withdrawals, and then tossing in a variety of stock investing returns.

This post has been partially excerpted from the latest edition of Cabot Money Club Magazine. To read more, or explore previous editions, sign up for Cabot Money Club today!

[author_ad]