Many people like to make decisions based on hunches; sometimes they’re called “educated guesses” and sometimes “intuition.” And there’s some experimental support for the idea that snap judgments often prove quite sound. The vagueness of hunches only becomes a problem when they’re investing hunches and you start to use them to decide how to put real money at risk.

This happens all the time in the stock market, most frequently when potential investors decide that they know what the stock market is going to do in the future. Or they read about a stock and they just know that it’s going to be a real moon shot.

Right now, the investing world is filled with people with investing hunches that markets are just about to fall off a cliff. Maybe they have some evidence (a guy on a cable channel in a really good suit or an astrologer who’s never, ever been wrong), or maybe they just feel it in their bones that things are going to get worse and unimaginably worse.

[text_ad]

These people who are prepared for the end of the world as we know it are offset—though not always balanced—by a group of equally convinced investors who just know that the markets are gathering themselves to spring skyward in a massive rally that will deliver unimaginable wealth to anyone with the sense to see it coming.

All I have to say about this is that when we get a true consensus among investors that things are as bad as they could possible be and they’ll never get any better, that’s when the markets will turn back up. And ditto in reverse for the enthusiastic optimists.

I really hope I’m not harping on this too much. It’s easy to sound like a crank when you’re expressing skepticism.

But investing history provides plenty of evidence that markets top when people are at their happiest and markets bottom when people are most depressed. That’s both a historical fact and a demonstrable logical certainty.

So the lesson there is to look at what the market’s doing, not what you’re afraid/hopeful that it will do. Any guess about the future of the market is just a hunch. And while hunches can lead to interesting and useful decisions, they don’t really have a place in stock investing.

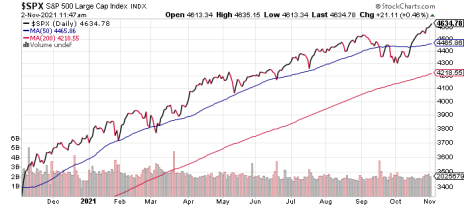

So, what’s the market doing? Well, this chart of the S&P 500 shows that despite fears of a “bubbly” market, we’re still in an uptrend. The S&P 500 is currently trading well-above both its 50- and 200-day moving averages.

For now, our favorite indicators are signaling a continuation of the bull market into the end of the year.

For those of us who have been watching the market for a while, that seems a little too easy. There’s still a ton of negative news and negative sentiment around.

But we don’t get paid to second-guess our market timing indicators, so we will do exactly what they tell us, and will start recommending a little more buying as long as the market’s medium-term momentum is up. And, as I said above, we’ll keep our hunches to ourselves.

What do you do to keep your investing hunches from getting in the way of sound decision making?

[author_ad]

*This post has been updated from a previously published version.