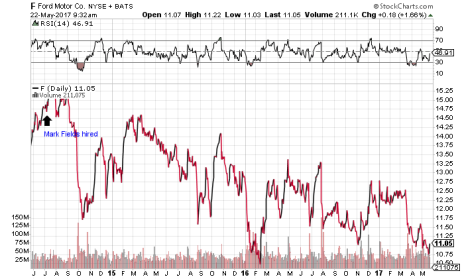

To know why Ford Motor (F) fired CEO Mark Fields after less than three years on the job, all you have to do is look at a three-year chart of Ford stock.

When Fields was hired on July 1, 2014, Ford stock traded at about $17 a share. Last Friday, Fields’ last full business day on the job, Ford stock closed below $11 for the first time since 2012. Here’s what that 37% drop-off during Fields’ tenure looks like on a chart:

When Fields took the job, Ford was the most valuable publicly traded auto maker, with a market cap of roughly $69 billion. Its market value is now down to $44 billion, trailing not only General Motors (GM) ($50 billion) but relative automotive neophyte Tesla (TSLA) ($51 billion) (though Tesla’s value is a bit misleading).

Thus, Fields is out, and Jim Hackett is in as Ford’s CEO.

[text_ad]

Among the many criticisms of Fields was that he failed to develop more automobiles with new technologies such as driverless cars to compete with Google (GOOGL) or luxury electric cars to compete with Tesla. Fields spent heavily on research and development in those high-tech areas, but the reality is Ford hasn’t made inroads with electric cars and won’t have a self-driving car on the road until at least 2021. And Ford isn’t selling enough of its traditional trucks and SUVs to pick up the slack, as sales have declined in two of the last three quarters.

So Fields was an easy scapegoat. Now we’ll find out if Ford’s problems were the result of a CEO who wasn’t forward thinking enough, or of an auto maker that built its “Ford Tough” reputation on the kinds of gas guzzlers that are no longer in fashion. For Ford to re-stake its claim atop the U.S. industry, it may need a complete image overhaul. Hackett was hired in part because he runs the company’s “smart mobility” wing, which includes driverless technology. If he can’t help Ford get with the times, then the company’s problems may run much deeper than a bad CEO.

Wall Street seemed to initially like the change at the top: Ford stock was up 1.5% in early Monday trading. But with sales and earnings expected to slide in the current quarter, it may take a while for Hackett’s changes to reveal themselves on the top and bottom lines. And with Ford stock trading below its 50-day moving average for more than two months, I wouldn’t go snatching up shares of the automotive stock until it can demonstrate some sustained momentum.

Until then, TSLA looks like a better growth stock alternative in the U.S. auto-making space.

[author_ad]