We’re primarily stock pickers at Cabot Wealth Network. But we occasionally recommend exchange-traded funds, and we recognize the increasing desire to invest in ETFs. That said, you should tread very carefully when doing so. Let me explain…

For centuries, investors have been falling for crazy or ‘just too good to be true’ investing schemes, systems and just bad investing ideas. These include the boom and bust in tulip bulbs that ended in 1637, Ponzi schemes that go back to the 1860s (including the $65 billion fraud perpetrated by Bernie Madoff that ended in 2008), the savings and loan crisis of the 1980s and 1990s that closed 747 institutions and cost taxpayers and investors $160 billion, and the tech wreck in the early 2000s that was followed by the investor fraud of Enron, WorldCom, Healthsouth and many others.

With the current up-cycle in the market, these risky schemes and frauds just keep coming. Last April, the Securities and Exchange Commission announced enforcement actions against 27 people and companies who wrote more than 250 articles in “pump and dump” machinations. Unfortunately, a great market often brings these folks out of the woodwork, and the unbridled optimism can cause investors to slack off on their due diligence, making them more vulnerable to these predators.

[text_ad]

All of this introspection on my part came about as I was planning some reallocation of my investments and reviewing sectors that looked interesting for 2018. You may recall a Wall Street’s Best Daily I wrote recently on the “Four Stock Market Sectors for 2018,” which included technology, energy, healthcare and industrials.

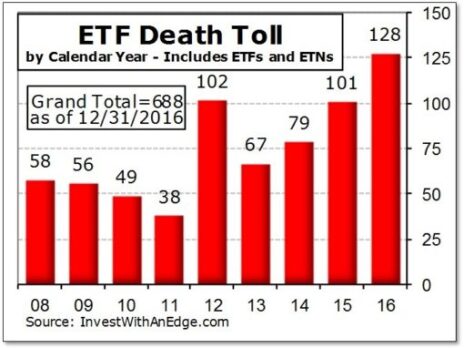

During my research, some wild and very narrowly-focused exchange-traded funds kept popping up. Although people have been able to invest in ETFs since 1774, when a Dutch merchant created the first closed-end fund, they hit their stride in 1993, with the introduction of the S&P SPDR. And while the number of ETFs has declined since the market rout of 2007–2009, there are still more than 2,000 ETFs available.

I’ve often heard that there’s an ETF for everyone, and looking at some of the offerings in the market today, I’m pretty sure that’s about right. Here’s a sample:

Some Wild and Wacky ETFs

Obesity ETF (SLIM) invests in companies expected to profit from the disease, including biotechnology, pharmaceutical, healthcare and medical device businesses.

Global X Millennials Thematic ETF (MILN) provides exposure to the millennial generation, with its largest investments in consumer cyclical and technology companies.

Spirited Funds/ETFMG Whiskey & Spirits ETF (WSKY). I think you can figure that one out!

Global X Longevity Thematic ETF (LNGR) invests in companies, primarily healthcare, that focus on profiting from our aging demographics.

And if you don’t like a particular sector—for example, you believe that the age of brick-and-mortar stores is over—you can short them, via the ProShares Long Online/Short Stores ETF (CLIX) or the ProShares Decline of the Retail Store ETF (EMTY).

Now, I’m not saying that any of these are bad investments; in fact, quite a few of them have done very well this year (although with such a fabulous market, that could just be pure luck). But the proliferation of these “thematic” investing vehicles stoked my memory of other times when the folks that create investments also created havoc in the market. Remember junk bonds or subprime mortgages? And as you can see from this chart, a lot of ETFs have gone by the wayside, too, including 128 in 2016.

Invest in ETFs by Starting Small

My point is that this may be a time when investors need to be choosy. Opting for a very narrowly-focused investment may be unduly risking your funds. If you think the investment might be profitable and “fun,” just throw a little of your money at it. It may just be a short-term fad, or it could work out to be a long-term investment. Just be cautious.

I’ve been thrilled with the market action of the past year, but I’m also cognizant that markets go up and down. Consequently, keep some of your “powder” dry, put another portion in some more speculative ideas, and invest the rest in solid, fundamentally strong companies or broad market indexes like the SPDR S&P 500 ETF (SPY), iShares Russell 2000 (IWM), PowerShares QQQ (QQQ), or the SPDR Dow Jones Industrial Average ETF (DIA), which offers you coverage across the board.

[author_ad]