I’m one of those crazy people who love to go grocery shopping! I cook and entertain frequently, so I’m often traveling the aisles of four different stores in my area, seeking out new products, and of course, better prices.

With COVID-19 came supply problems and cost increases, now pushed even higher by inflation. Prices at my neighborhood grocers keep rising, making me question, “Who’s making the money?” With that in mind, I wondered how the grocers—and grocery stocks—were really doing.

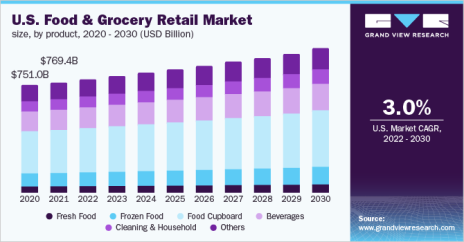

In 2022, the global grocery retail market amounted to $8,695 billion and is forecast to reach $14,772 billion by 2030. That’s a 6.9% CAGR, pretty healthy in the current market. The U.S. market is also expanding, albeit at a lower annual growth rate, as you can see below.

We can thank COVID-19 for the beginning of the surge in the grocery market. The accompanying economic shutdowns forced folks to eat at home, which originally increased profits for the grocers. And the retailers responded by expanding their networks to offer convenience features, such as buying online, curbside pickup, and home delivery.

[text_ad]

The National Retail Federation says that in 2021, “35% of consumers reported that they had used curbside pickup for groceries in the past year, up from 13% in 2019. Additionally, the same survey found that 23% of consumers had used home delivery services for groceries, up from 16% in 2019.”

Then Amazon stepped in to buy brick-and-mortar companies (like Whole Foods), thereby merging e-commerce and physical storefronts, dramatically changing the face of the industry, which demanded that other grocers innovate their order/delivery processes or lose out to the competition.

And technology is being ramped up, overseeing activities from the back end (supply chain, scheduling employee hours, and stocking) to the front end (tracking purchases and nudging customers to try specific personalized products during their shopping trip)! And artificial intelligence (AI) is making itself useful, helping grocers create more accurate sales forecasts, promotional placements, customizing products to markets, and maximizing floor space.

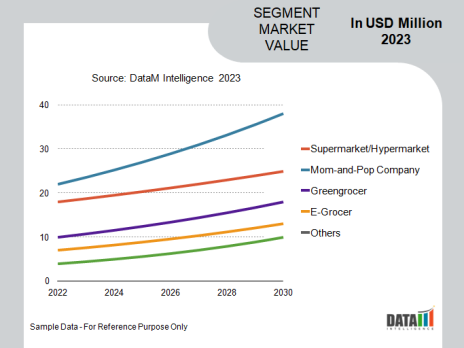

Today, the grocery market is led by mom-and-pop grocers (interesting, hmm?), with supermarkets/hypermarkets in second place. As you can see from the chart below, there seems to be plenty of opportunities for some M&A in the segment, which was pretty active in 2022. And now, of course, we await regulatory action on the Kroger-Albertson’s proposed merger.

As you can see below, the stock prices of publicly traded food retailers were mixed in 2022, and had a nice run earlier in 2023, but seem to have flattened out since with the rise of inflation.

I took a look at the leading grocery stocks to see which ones might be interesting in this mostly sideways market. My list started at around 20 companies, and then I winnowed it down to these three which seem very promising.

3 Promising Grocery Stocks

Costco Wholesale (COST). I have to admit, I’m a huge Costco fan! I can walk around that store for hours, and always find much more to buy than I had originally intended. And, as you can see, the stock has generally been a winner for its investors.

The company recently reported its fiscal fourth quarter results, with adjusted earnings soaring almost 16% to $4.86 per share. Its sales rose 9.5%, to $78.94 billion, upending the previous four quarters of declining growth.

Analysts are boosting their predicted stock prices for the company, with Argus raising its price target to 650 from 630, Truist boosting its target to 619 from 597, and Deutsche Bank pushing theirs by $1 to 652.

I’m not as familiar with Sprouts Farmers Market (SFM) since the company doesn’t operate in my area. This grocer features fresh produce, meats, seafood, dairy, cheeses, and a vitamin department focused on overall wellness. Wellness and health products are becoming an increasing business for Sprouts, with the company boosting its products in the natural and organic food arenas, including plant-based, gluten-free, keto-friendly, and grass-fed lines.

Analysts also have their eye on Sprouts, with eight of them increasing their earnings estimates in the past two months. The EPS forecast is now $2.74.

The Phoenix-based operation has some 400 stores in 23 states, with plans to open 30 more this year.

I do know Albertsons Companies Inc Cl A (ACI), as I shopped in the company’s stores when I lived in both Florida and California.

The big news with Albertsons, of course, is its almost $25 billion proposed merger with Kroger. Undergoing regulatory review right now, both stores have been divesting locations (up to 413, eventually) to gain regulatory approval. Kroger has proposed to pay Albertsons’ shareholders $34.10 per share, with $6.85 already paid out as a dividend.

The companies said they would “use $500 million in cost savings from the deal to reduce prices for shoppers and tailor promotions and savings.” Kroger also told CNN that it would invest $1.3 billion in Albertsons, “part of which will go toward lowering prices.”

If the merger is approved, the combined company would rise to number three in the industry, with $210 billion in revenue, following Walmart ($466.8 billion) and Amazon ($279.8 billion) and knocking Costco into the fourth spot, with $141.4 billion in annual sales. The merged company would end up with 4,996 stores, 66 distribution centers, 52 manufacturing plants and 2,015 fuel centers in 48 states (up from 35), and the District of Columbia. And, it would be the fifth-largest pharmacy retailer, with 3,972 pharmacies.

There are significant opponents to the merger, including politicians, consumer advocates and the National Grocers Association, due to what they see as limiting competition.

But betting the odds, most analysts agree that if the merger is approved, Albertsons’ shareholders may see a nice 25% premium to the buyout price.

I hope you find one or more of these stocks to your liking. Happy shopping!

[author_ad]