The Money Show recently unveiled its annual Top Picks Report, which every January features more than 100 stock picks for the upcoming year from some of the very best analysts in the investment advice publishing business. As always, several Cabot analysts were featured. And we’d be remiss if we didn’t share our top stock picks for 2023 with the Cabot Wealth Daily audience!

The write-ups on our top picks for this year are below. If you would like to read the full Money Show Top Picks Report, click here.

[text_ad]

Mike Cintolo, Chief Analyst, Cabot Growth Investor and Cabot Top Ten Trader

Impinj (PI)

Impinj is put in the chip stock basket, but the real theme here surrounds the Internet of Things (IoT), with the firm’s offerings allowing businesses of various shapes and sizes to connect basically everything (potentially trillions of items) to the cloud. The benefits here are potentially huge, ranging from inventory and fulfillment visibility, loss prevention for checkouts at retailers, far more efficient supply chain operations and much more. The firm is best known for its radio identification endpoint ICs (it dubs them RAIN), which cost just pennies, are battery-free, can work without a line of sight, and can be read at rapid speed (1,000 items per second at 10 meters). Impinj also offers readers, gateways and software, including a new Authenticity platform that can authenticate everyday items (counterfeiting is a huge issue globally). All in all, the firm says it’s the leader across all its product lines, having sold well north of 60 billion (!) endpoint ICs and plenty of its other offerings, too. Supply has been an issue here, but we’re not sure that’s a bad thing—according to management, demand for its endpoint ICs has run at least 50% higher than what Impinj can supply (!) for six straight quarters, and the firm sees some easing of supply restraints coming up. And even before that happens, business is picking up, with endpoint IC revenue (which makes up three-quarters of the total) hitting its fourth straight quarterly record in Q3, rising 19% from the prior quarter, with another sequential increase expected in Q4. The overall numbers are just as impressive: Sales growth is accelerating (17%, 27% and 51% the past three quarters), while earnings took off in Q3 (34 cents a share, up from a loss a year ago and double estimates), with analysts looking for another big bottom-line gain (up 40%) in 2023. Now, there are some customer concentration issues here (it sells to OEMs, and a couple of them make up nearly half of revenue), which, combined with supply worries, does raise the risk of some major potholes. That said, the top brass is on record saying demand should remain strong into 2023, and Wall Street sees great things ahead: PI made a huge comeback in the summer, pulled back reasonably into the fall and then exploded higher on earnings in late October—and, impressively, has held those gains and even nosed to new highs since then. Pullbacks will come, of course, but I’m thinking PI looks like a fresh leader should the market get its act together.

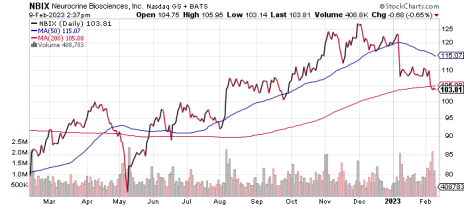

Neurocrine Bio (NBIX)

Biotechs have been in a three-steps-forward, two-steps-back uptrend since early summer, and Neurocrine Biosciences continues to look like a leader in the space, both technically and fundamentally. The story here is all about Ingrezza, which is a treatment for a rare side effect of antipsychotic drugs that causes involuntary movements in the face and body that obviously have a negative psychological impact (being self-conscious) and sometimes can become permanent without treatment. While rare, the drug is a big seller, with an expected $1.4 billion of revenue this year, up 30%-ish from last year, and more important, management sees a ton of opportunity just in its core area, with more than a half million undiagnosed patients in the U.S. alone (it thinks only 15% are both diagnosed and on treatment), so the potential is there for Ingrezza sales to easily more than double over time. Neurocrine also has another niche product likely to hit the market soon—it’s applied for approval of valbenazine (likely approval early next year), which treats another disease that causes involuntary movements (side effect of Huntington’s) that affects maybe 25,000 people. Those two should keep the numbers kiting higher, with analysts seeing the top line rising 20% next year while earnings reach nearly $4 per share—all while the firm’s excellent pipeline (12 mid- to late-stage programs in trials; a key Phase II readout for a child epilepsy treatment due by year-end, with two more Phase II results in other drugs next year) continues to progress. The stock actually broke out in the summer, held the breakout level during the market’s autumn plunge and has kicked into gear as the market has bounced. We think the stage is set for medicals and biotechs to help lead the next advance and NBIX looks like one of the top dogs in that group.

Tyler Laundon, Chief Analyst, Cabot Small-Cap Confidential and Cabot Early Opportunities

Speculative Pick

Catalyst Pharmaceuticals (CPRX) is a small-cap biopharma company focused on in-licensing, developing and commercializing novel medicines to treat rare diseases. It has a market cap of just under $2 billion.

While the company came public in 2006, current growth is a result of a collaboration struck with BioMarin (BMRN) in 2012 when Catalyst obtained the North American rights to amifampridine.

At the time amifampridine was being developed to treat Lambert-Eaton Myasthenic Syndrome (LEMS), a neuromuscular disorder that often causes severe and progressive muscle weakness and fatigue.

LEMS occurs when the immune system disrupts communication between nerves and muscles and disrupts the release of an important chemical called acetylcholine (ACh). Lacking proper release of ACh muscles don’t fully function. LEMS impacts about 3,000 people in the U.S. and many more worldwide.

In 2018, Catalyst obtained FDA approval for amifampridine tablets (commercial name is Firdapse) for adults with LEMS. Commercial launch was early 2019 and is now available for adults. A pediatric label expansion is now in a Phase 3 trial. Canada has approved the treatment for adults and expansion efforts in Japan are underway.

Catalyst is also on the prowl for assets to spur more growth. In 2021, the company began evaluating drug candidates beyond neuromuscular diseases in an effort to diversify its revenue base. Management has said it will seek to acquire companies and acquire or in-license drug products in development.

On that note, in July 2022 Catalyst acquired the rights to Ruzurgi from Jacobus Pharma. This acquisition settled an ongoing patent dispute and helped remove an overhang from CPRX stock.

Then on December 19, Catalyst announced the acquisition of the rights to FYCOMPA from Eisai. This drug is approved for epilepsy, should generate $136 million in the 12 months ending March 31, 2023, and should add to Catalyst’s earnings. The $160 million acquisition also includes an option to evaluate and potentially acquire an additional epilepsy drug from Eisai.

Clearly, Catalyst management is thinking of building a bigger company.

In Q3, the company added $35 million to its balance sheet to end the quarter with $256 million in cash. Revenue grew by 59% to $57.2 million. EPS was $0.26 (+86%).

Analysts expect revenue growth of around 49% ($210 million) in 2022 and growth of 20% ($250 million) in 2023. Expected EPS is $0.73 (+33%) this year and $0.88 (+19%) in 2023.

Conservative Pick

Huron Consulting (HURN) is a professional services company focused on helping clients develop sound business models, streamline operations, embrace digital transformation and navigate constant change.

The company was founded in 2002 and came public in 2004. It is based in Chicago and has additional locations in the U.S., Canada, India, Singapore and Switzerland.

Huron has a market cap of around $1.5 billion and is on pace to grow revenue by nearly 20% to $1.1 billion in 2022. EPS should be up 27% to $3.31. Management plans to return 25% to 50% of free cash flow to shareholders.

Looking to 2023, the current consensus is for revenue to grow 10% to $1.21 billion and EPS to grow 20% to $3.98.

As with other successful consulting firms, technology, data, analytics and people are the heart of Huron’s business. The company can’t succeed if it hasn’t hired and developed industry-specific talent required to help other organizations achieve their goals. The company ended Q3 with 4,571 revenue-generating professionals, up 23% over a year ago.

Its biggest market segments are Healthcare and Education, which represented 42% and 26% of 2021 revenue, respectively. The remaining 32% of revenue came from what Huron now calls its Commercial segment, which includes energy and utilities, financial services, industrials and manufacturing, and public sector markets.

Examples of clients include health systems, hospitals, universities, research institutions, banks, asset managers, insurance and private equity firms, oil and gas and utility companies and the federal government.

Huron company serves nearly 2,000 clients around the world. Its 10 largest clients accounted for just under 20% of 2021 revenue.

The company has recently begun to focus more on its strength of providing digital services, such as helping customers transition to cloud-based tech and analytic solutions. In fact, it has begun reporting revenue specifically related to Digital, and has been building out partnerships with major enterprise software companies in this area, including Oracle, Salesforce.com, Workday, Amazon Web Services, Informatica and SAP, among others.

It’s not the sexiest stock out there. But it’s a great business. And it’s growing revenue and earnings at double-digit rates.

Bruce Kaser, Chief Analyst, Cabot Undervalued Stocks Advisor and Cabot Turnaround Letter

AGGRESSIVE: Citigroup (C) – Citi is one of the world’s largest banks, with over $2.4 trillion in assets. The bank’s weak compliance and risk-management culture led to Citi’s disastrous and humiliating experience in the 2009 global financial crisis, which required an enormous government bailout. The successor CEO, Michael Corbat, navigated the bank through the post-crisis period to a position of reasonable stability. Unfinished, though, is the project to restore Citi to a highly profitable banking company, which is the task of relatively new CEO Jane Fraser.

Fraser, an impressive 17-year company veteran with leadership and turnaround experience in nearly every segment of the bank (she is light in investment banking but has experience as an investment banker), is focusing on Cit’s strengths in Wealth and Commercial Banking, as well as credit cards, while offloading low-value operations. Her task also includes cleaning up regulatory and compliance issues, upgrading the tech infrastructure, tightening and focusing its culture, and cutting expenses.

To an extent perhaps unmatched in the industry, Citi has operations across the globe. Global reach works best in capital markets activities like commercial and investment banking (Citi is performing well in these) but tends not to work well in local market activities like consumer banking (where Citi is struggling). Fraser has offloaded 13 consumer units including those in Australia and South Korea with its business in Mexico in active negotiations. These divestitures should boost capital levels while reducing expenses. Wealth management, which has both global and local features, is a good business for Citi, where it is well-positioned in several attractive regions including Asia.

As it sits today, Citi is in reasonably strong condition. Capital (at 12.2% CET1 ratio) is sturdy and comparable to its major peers. Credit quality is healthy as are its credit reserves. Like all major banks, Citi is struggling with slow loan growth and narrow net interest margins.

Trading at 55% of tangible book value (compared to Wells Fargo at 120% and Bank of America at 150%) and 6.5x estimated 2023 earnings, Citi shares are among the cheapest in the banking sector – a major attraction as expectations are low. As the bank grinds along with its turnaround, the valuation should improve. Investors enjoy a 4% dividend yield.

CONSERVATIVE: Nokia Corporation (NOK) – Nokia is one of the world’s primary providers of telecom equipment, along with Ericsson, Samsung and China-based Huawei. Based in Finland, the company struggled with disappointing new product initiatives including mobile phones, a lack of a major telecom upgrade cycle, a wrong-way bet on semiconductor technology, and weak leadership. Its €15.6 billion acquisition of Alcatel-Lucent in 2016 has been a disappointment as well. Current worries include the intensely competitive environment, particularly in radio access networks, a core component in telecom systems. Nokia shares have gone nowhere in the past ten years.

New leadership, however, is refocusing and rebuilding Nokia. Pekka Lundmark helped develop Nokia’s business in the 1990s, then gained valuable business and leadership experience from impressive roles at other major companies until rejoining Nokia as CEO in late 2020. Under Lundmark, the company has corrected its semiconductor mistake, reinvigorated its sales efforts, streamlined its profit structure and is investing heavily in new product development that is lifting its market share trajectory.

These improvements are showing up in the company’s financial results. Sales growth hit 6% ex-currency and earnings per share rose 25% in the most recent quarter. The operating profit margin dipped, but this was due to a timing issue with high-margin patent contracts. Nokia remains on track to maintain and build upon its already-improved margins, even as it ramps up its technology spending.

Global telecom service providers continue to ramp their spending for the rollout of 5G technology. India has been widely cited as a large and upcoming new market. Due to security concerns, China’s Huawei is being sidelined, leaving more market share opportunities for western companies like Nokia. While the industry is highly competitive, Nokia is increasingly capable of maintaining its position, at a minimum.

Free cash flow is strong, allowing the company to now hold €4.7 billion in cash above its debt balance. With its new financial flexibility, Nokia has restored its dividend and is about halfway through its €600 million share repurchase program.

The share valuation at 4.8x estimated 2023 EBITDA is unchallenging. All-in, this under-appreciated company offers an attractive turnaround opportunity for 2023.

[author_ad]