There’s a lot of noise out there. Sticky inflation and the Fed’s response to it; Iran getting involved in the Israel-Palestine war; war in Ukraine now in year three; a pivotal U.S. presidential election drawing ever closer; first-quarter earnings season underway, etc., etc. But the only thing that truly matters to the market, at least lately, is bond yields. Specifically, yields on the 10-year U.S. Treasury bonds. The last couple years, the inverse bond yield-stock market correlation is undeniable.

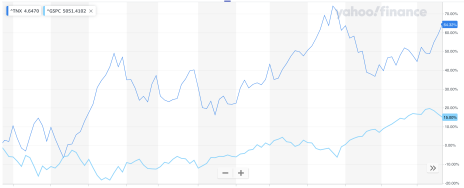

Take a look at this two-year chart comparing the S&P 500 (light blue line) to the 10-year bond yield (dark blue line):

Two years takes us almost all the way back to when the Fed began hiking the Federal Funds rate (in March 2022) from near zero to its highest level (5.25%-5.50%) in more than two decades. Look at what’s happened since. While yields on the 10-year Treasury bond have spiked 64%, the S&P has posted a ho-hum 15% gain. More tellingly, when yields spike – like they did in last October, when they nearly touched 5% for the first time since 2007, just before the financial crisis – stocks crater. In fact, each of the last two Octobers, the market has bottomed while bond yields have surged to new highs.

[text_ad]

Conversely, when 10-year Treasury yields have eased, like they did in November and December after the Fed signaled that it was ready to cut interest rates in 2024, prompting yields to dip below 4%, stocks have soared. Now that Jerome Powell and company are pushing rate cuts likely to the back half of the year – perhaps even the fourth quarter – as inflation remains stubbornly in the 3-3.5% range, bond yields are surging again, to 4.64% as of this writing – a five-month high. Predictably, stocks are sagging, enduring their first pullback of more than 3% since last October.

Yes, the bond yield-stock market correlation is alive and well. And right now, that’s a bad thing.

Is there a magic number below which bond yields drop and stocks tend to perk up? Not really. Any dip back below 4% would almost certainly result in another spending spree on Wall Street. But really, it’s about the trend. When bond yields are falling in a meaningful way, as they did the last two months of 2023, stocks rise fast.

Of course, bond yields likely won’t retreat much until the Fed sounds a bit less hawkish than they have of late, and that will surely require some more encouraging inflation data. The next key date is April 26: That’s when the Personal Consumption Expenditures (PCE) number for March – the Fed’s preferred inflation gauge – gets released. That number was down to 2.4% year over year in January and February, or less than half of what it was last January and February, when PCE was still well above 5%.

Core PCE is a bit higher, at 2.8%. But both numbers have been trending steadily downward, unlike the Consumer Price Index (CPI), which garners far more attention.

Further declines from 2.4% PCE and 2.8% Core PCE could prompt bond yields to pull back. If PCE starts to prove just as sticky as CPI, yields could stay north of 4.5% for a while. Regardless, April 26 (next Friday) is an important date for investors.

Meanwhile, I continue to think this market pullback is a good thing. For one, it’s keeping valuations in check after the S&P had reached its highest price-to-earnings ratio (28) in almost three years. Second, it’s quite normal – no bull market simply goes up unchallenged for too long. In the halcyon market days of 2020 (post-Covid crash) and 2021, stocks pulled back more than 3% five times in 21 months, and more than 5% twice. This two-week retreat is the first pullback of more than 3% since last October; it was five consecutive months of gains, just the 30th time that’s happened in the S&P 500 since 1950.

So, as value investors, we should embrace the current pullback. Heck, I wouldn’t mind stocks retreating a bit more. It would open up more value opportunities as we add to our portfolio in the coming months, giving us better entry points for when the Fed starts to finally cut interest rates, bond yields come crashing back to earth (remember when they were below 2% from 2019 through early 2022?), and share prices run higher.

Until then, pay attention to bond yields. Nothing else really matters when it comes to the market in 2024.

[author_ad]