What if I told you about a stock that was up more than 10% in the last six months, grew earnings by 28% last year and sales by 7.5%, and has raised its dividend payout every year since 2013? You’d probably be intrigued, right? Well, as is probably obvious from the title of this column, I’m talking about Boeing stock. I imagine that changes things.

As I’m sure you’re acutely aware, shares of Boeing (BA) have tanked the last few days after an Ethiopian Airlines Boeing 737 Max 8 jet crashed just minutes after takeoff on Sunday, killing all 157 people on board. Since then, more than two dozen airlines around the world have grounded Boeing’s Max 8 planes (in fact, Consumer Reports has called on ALL airlines to ground their Max 8 flights), sending shares of Boeing stock on a downward spiral. As of this writing, BA shares have plummeted more than 10% in two trading days. Yikes.

[text_ad use_post='129622']

Now, we at Cabot Wealth Network are big fans of “buying on bad news”—i.e. investing in good companies after they’ve been nailed following a round of unflattering headlines. But the buy-on-bad-news rule isn’t all encompassing.

An earnings miss, a dumb comment from a top executive (see Musk, Elon), some ongoing litigation—those are the common types of bad news that can send a stock tumbling, but don’t really change a company’s trajectory in the long run. When an aircraft maker builds a faulty aircraft that costs 157 people their lives, however, that goes beyond bad news. It erodes trust in the company itself, which is why airlines are bailing on Boeing in droves.

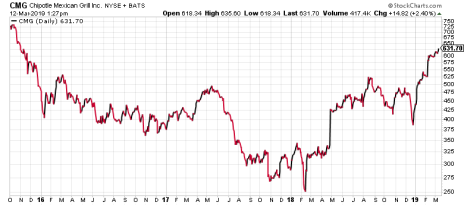

It doesn’t mean that Boeing as a company or Boeing stock are done for good. But restoring trust—and a full recovery in the stock—could take years. Chipotle (CMG) is a prime recent example.

In late 2015, food at the popular Mexican fast casual chain poisoned 60 customers in 11 states with E. coli, forcing 21 of them to go to the hospital. Chipotle shares promptly tanked, falling from more than 730 per share to 413 per share in just three months—a 43% decline! Three years later, CMG stock still hasn’t fully recovered; it’s up to 631 on the heels of a huge first two months of 2019. But that’s the highest it’s been since the E. coli outbreak (see chart below).

True, if you had bought CMG shares at their January 2016 bottom and held on to them, you’d be sitting on a 52% profit today. But it took three months of declines for Chipotle stock to put in that bottom. If you had tried to buy the bottom at any point during those three months, you may have lost so much money that there’s a good chance you would have bailed on the stock before the recovery began.

So, even if you have the stomach to invest in a company responsible for such a horrible tragedy, I wouldn’t touch Boeing stock with an 11-foot-pole (an old saying of my former colleague Paul Goodwin) anytime soon. Scandals this big tend to trigger long, painful sell-offs. The Chipotle E. coli outbreak is a good example. And that didn’t cost anyone their life.

[author_ad]