Lingering inflation has been a huge obstacle for the stock market, and the latest data shows no signs that inflation pressures are abating. Indeed, according to the CPI report for September, consumer prices rose yet again and were over 8% from a year ago—the highest yearly gain since 1982.

Commenting on the CPI report, several major financial news sites pointed out that continued inflation means the Federal Reserve will likely maintain its tight monetary policy for the rest of this year. It’s no secret that rising interest rates are one of the chief reasons why the stock market has been under the gun in recent months, which in turn is why many participants are bracing for the worst when the Fed meets to decide rates on November 1-2.

According to the CME FedWatch Tool, traders have assigned a 98% likelihood that the Fed will raise rates by 0.75% at the November meeting. Assuming it does, this would be the fourth consecutive time the central bank has hiked rates by this amount.

But what if the Fed was able to simultaneously stick to its assurance that rate hikes will continue until inflation moderates while also surprising expectations with a lower-than-expected rate increase at the November meeting? This is a possibility that some astute Fed watchers are beginning to consider.

[text_ad]

The higher inflation numbers would certainly justify a reduction in the pace of interest rate increases. One well-known stock market economist who doesn’t see the Fed continuing its rate hiking path much longer is Scott Grannis, who writes the Calafia Beach Pundit blog.

Grannis notes that M2 money supply is up at a mere 2.3% annualized rate over the past nine months and has been flat for the past six months. He writes, “If rapid M2 growth beginning in 2020 was the fuel for inflation (very likely), then the inflation fires are already dying down.”

He further believes the lack of M2 growth that began last year should result in a decline in inflation by the end of this year and that he doesn’t see the Fed “continuing on the inflation warpath for very much longer.”

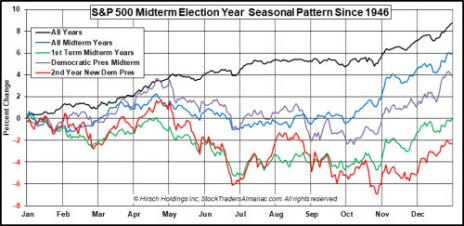

The Fed’s next policy meeting is just a few days before the November midterm elections. Jeff Hirsch of Stock Trader’s Almanac observes that “Midterm election years are usually a volatile year for stocks as Republicans and Democrats vie for control for Congress, especially under new presidents.”

Historical Stock Market Returns in Midterm Years

However, history shows that such elections tend to be major turning points for the stock market regardless of which party wins. According to Hirsch, bear markets tend to bottom in October—and specifically around late October in the second year of a new Democrat president’s term—before turning higher in November and December, as illustrated in the following chart.

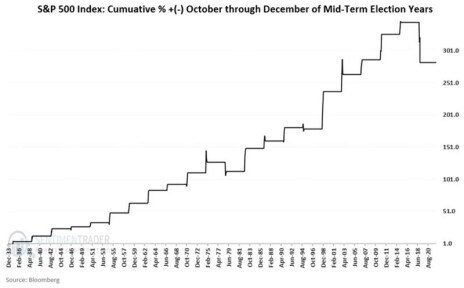

Shedding further light on this subject, Jay Kaeppel of SentimenTrader writes, “The stock market has demonstrated a historical tendency to advance from October of a midterm year through July of a pre-election year.”

According to historical data, moreover, the sectors that tend to outperform the S&P during the months following a midterm election are: materials, technology, industrials, healthcare and consumer discretionary.

All told, investors should consider that a “November surprise” is a strong possibility given that the current pace of interest rate hikes is likely unsustainable in the face of slowing money supply growth. What’s more, the stock market’s historical tendency to rally after a midterm election—especially when equities are as technically “oversold” as they are now—suggests another buying opportunity could be right around the corner.

[author_ad]