It’s earnings season and the floodgates are opening! So far—according to FactSet—just 7% of the companies in the S&P 500 have released their third-quarter earnings reports. Of those, 69% have reported a positive EPS surprise and 67% have reported a positive revenue surprise.

Here are the top 8 companies—so far—that have beaten analysts’ estimates by the highest margins:

| Symbol | Company Name | Volume | % Earnings Beat | Avg Vol (3 month) | Market Cap ($) |

| BAC | Bank of America Corporation | 58.17M | 4.48 | 39.33M | 254.72B |

| WBA | Walgreens Boots Alliance, Inc. | 10.48M | 3.89 | 7.17M | 28.75B |

| BK | The Bank of New York Mellon Corporation | 6.44M | 11.0 | 3.80M | 31.04B |

| FAST | Fastenal Company | 5.84M | 4.17 | 3.34M | 25.13B |

| PNC | The PNC Financial Services Group, Inc. | 4.73M | 3.28 | 1.70M | 60.48B |

| PEP | PepsiCo, Inc. | 5.94M | 6.49 | 4.55M | 234.47B |

| UNH | UnitedHealth Group Incorporated | 5.63M | 6.24 | 2.49M | 479.97B |

| BLK | BlackRock, Inc. | 1.28M | 24.03 | 747.14k | 83.07B |

Source: Finance.Yahoo.com

I agree that before earnings season concludes, we’ll all be sick of hearing about them! But there are two very good reasons why investors should be aware of earnings performance, including:

- Earnings can give you a picture of a company’s, an industry’s, or an economy’s general health and well-being.

- Rising earnings, in general, drive stock prices higher (the number one reason for buying a company’s stock!).

[text_ad]

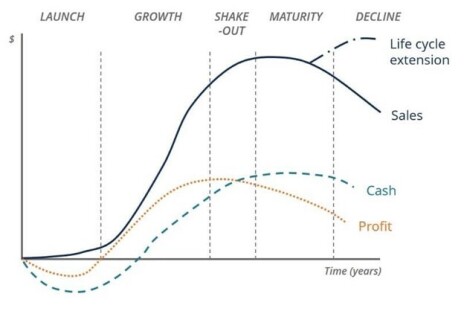

Earnings fluctuate with the life cycle of a business. As you can see from the following graph from the Corporate Finance Institute, a company—at the beginning of its life—will be growing revenues pretty rapidly, but earnings, or profitability, are more elusive. Most businesses aren’t profitable in the first few years.

But investors often buy shares of companies during those non-profit years. Think of biotechs, or technology companies like Apple, Microsoft, and Intel. Investors buy/bought these shares based on anticipation of future earnings.

Here’s how the relationship between earnings and price works.

Analysts look at a company’s earnings—its after-tax net income (also called net profits) on a quarterly and annual basis.

Earnings are used to determine a company’s profitability. The most common measure of earnings is earnings per share (EPS)—a company’s net income (or earnings) divided by the number of common shares outstanding. That ratio tells you how much a company earns for each share. And investors expect that number to grow, quarter by quarter (with a few exceptions, such as cyclical or seasonal companies, or newer businesses, as stated above).

And very importantly, the EPS is used in computing the price-earnings ratio (P/E) of a stock. To calculate the P/E, divide the stock price by the EPS. You can use the last four quarters of earnings (a trailing P/E), the total earnings for the year (a current P/E) or forecasted earnings for some future time (a forward P/E). Just make sure when comparing your stock’s P/E to the P/E of other companies, that you are using a P/E ratio calculated using the same EPS numbers.

Typically, analysts see a higher P/E as an indicator that the stock has a higher value when compared to others in its industry. Look at it this way: the P/E ratio shows what the market is willing to pay today for a stock based on its past or future earnings.

A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued, or it could mean the market is pricing the stock based on the future earnings of a company, which appear to be growing rapidly.

Vice-versa, a low P/E may mean that a company’s price is undervalued, relative to other companies in its industry, or it could just mean that the stock is a dog—the value of the stock is correctly priced.

Now, of course, businesses in their early years have no—or little profits. So, the P/E is often negative. But investors may still invest in the company—based on its projected earnings, as I mentioned above.

It’s important to note that the P/E ratio is not the only measure of a company’s profitability.

Additional Profitability RatiosThese additional ratios are used to evaluate a company’s ability to earn profits from its sales or operations, balance sheet assets, or shareholders’ equity. They tell us if the company is efficiently generating profits and value for its shareholders and will probably come across these terms this earnings season.

You’ll often hear the term, Gross Profit Margin. Companies will compare this number to previous reporting periods to let shareholders know if their “margins are growing,” meaning they are getting more dollars of profit out of each dollar spent. It is simply the difference between revenue and the costs of production—called cost of goods sold (COGS). Note that analysts also use two other profit margin ratios: Operating Profit Margin and Net Profit Margin. The Operating Profit Margin illustrates how much a company makes after deducting variable costs of production. And the Net Profit Margin considers all costs; it is the sales of a company divided by the net income, giving you the amount of net profit a company earns per dollar of revenue gained.

Return on Assets (ROA) measures net income relative to total assets. The higher the number, the better; it means a company’s assets are generating more income. And one would naturally assume that the more assets a company has, the more revenues and income it should produce.

Return on Equity (ROE) measures a company’s ability to earn a return on its equity investments. The calculation is net income divided by shareholders’ equity. Again, the higher, the better.

One caveat when using any ratio this earnings season—it’s critical to compare apples with apples. For example, you wouldn’t compare a P/E ratio of a trucking company to that of a software business. When using ratios, compare each ratio to the historical ratios (3-5 years) of your selected company, as well as the P/Es of others in its industry or sector.

Earnings Growing but Slowing DownNow, let’s talk about earnings—for the third quarter. As I mentioned earlier, we are just at the beginning of the earnings season. And things are looking good. However, while companies are reporting higher-than-estimated earnings, FactSet’s analysts aren’t grinning from ear to ear—because so far, “the blended earnings growth rate for the S&P 500 is 1.6%. If 1.6% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q3 2020 (-5.7%).”

Consequently, as economists have been predicting for a while now, growth is slowing. We may or may not have a recession, but many economic gurus believe we will have some sort of recession in 2023.

That doesn’t mean, however, that there won’t be any good stocks to buy. We’ve already seen the markets become very volatile, and most sectors (except Energy) are down for the year. That means you can find some bargains right now. But you must be selective.

Just for the fun of it, I ran each of the above 8 companies through my analysis system to see if any looked interesting enough to buy this earnings season.

I hate to say it as Financials have always been one of my favorite sectors, but none of the above Financial companies look very interesting to me right now.

However, of these 8 companies, there are two that do look attractive.

PepsiCo, Inc. (PEP). The shares of PEP have traded in a tight 52-week range of 153.37 - 181.07. Today, they’re around 171. Fundamental analysts have a Buy rating on the shares, and the technical analysts agree (not always the case!) Earnings for the company have increased by 33% this year, as many folks are still spending more time at home, so snacking has definitely been on the rise. The P/E is 24.54 and the company pays a nice dividend yield of 2.70%.

UnitedHealth Group Incorporated (UNH). At 521 and change, the shares of UNH are trading closer to their 52-week high of 553.29 than their low of 423.40. The P/E is 27.23 and the dividend yield is 1.29%. Again, both fundamental and technical analysts have Buy ratings on the shares. After its great quarterly report, the company said it was raising its full-year EPS forecast to $21.85-$22.05 from its prior view of $21.40-$21.90.

While past performance is no guarantee of future success, both of these companies look poised for continuing to grow their earnings—and potentially—their stock prices.

[author_ad]