There are a lot of reasons to be bearish right now based on macro events. But a simple look at valuations suggests small-cap stocks are poised for very attractive returns over the next decade.

Before we get to the “good news,” a few quick words about the current market funk and why we are where we are.

In simplest terms, we’re in a bear market because of the turmoil and excesses of the pandemic.

To get back to a new normal, major central banks around the world are trying to tame inflation by reducing the money supply and jacking up interest rates.

This is putting downward pressure on growth and risk assets, like small-cap stocks, most of which were inflated due to the low/zero interest rate policies that existed for years before the pandemic, then went into overdrive during it.

For small caps and the broad market to get out of the current funk, investors need clarity on the future path of inflation, which will also clear up the future trajectory of interest rate policy.

[text_ad]

These two macro factors will have a big influence on corporate earnings. Suffice it to say lower inflation readings and stable or somewhat lower interest rates would be good.

While we’re not likely to see a rapid improvement in inflation and interest rate policy in the next couple of months, we have seen signs that we’re moving in the right direction. This could set the stage for a much stronger market in 2023.

With that backdrop, it’s worth considering where small-cap stocks are trading right now. And what the upside potential is when the market improves.

Here are four of the most important considerations.

Small Caps Benefit from High U.S. Exposure

Investing in small caps is like a leveraged play on the U.S. economy. While there are plenty of problems in the U.S., the economy is doing far better than many others around the world. U.S.-focused small-cap stocks have greater exposure to the domestic economy than large caps while also having less exposure to challenges arising from a historically strong dollar, the conflict in Ukraine and trade disputes.

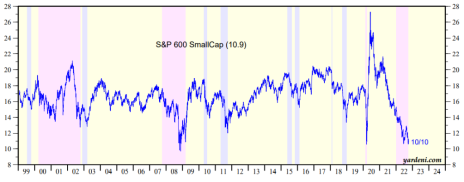

Small-Cap Stocks Are “Cheap” Based on Forward PE

The forward PE for the S&P 600 Small Cap Index is currently around 10.9. It has been as low as 10.6 in the last two weeks. This valuation multiple is roughly on par with that seen during previous recessions. The S&P 400 Mid Cap Index has also been trading with a recessionary-level valuation (forward PE of 11.1 to 11.6 lately) whereas the S&P 500 remains at a slightly higher multiple just above 15. If you prefer to look at the Russell 2000 Small Cap Index you see the same thing. The Russell 2000 forward PE of under 11 is as low as it’s been since 1990 and 30% below its long-term average since 1985.

Small-Cap Stocks Trading at Extreme Discount Relative to Large Caps

The S&P 600’s forward PE is roughly five points below that of the S&P 500 Index. That spread is extremely wide. In fact, it hasn’t been that wide since 2000. Moreover, it’s not atypical for small-cap stocks to trade at a premium to large caps. In order for that to happen, large-cap valuations need to fall a lot, small-cap valuations need to go up, or some combination of the two. It is worth noting that part of the reason for the persistent large-cap valuation premium is because the MegaCap-8 (MSFT, GOOG, AMZN, AAPL, TSLA, NFLX, META, NVDA) continue to trade at somewhat higher valuations.

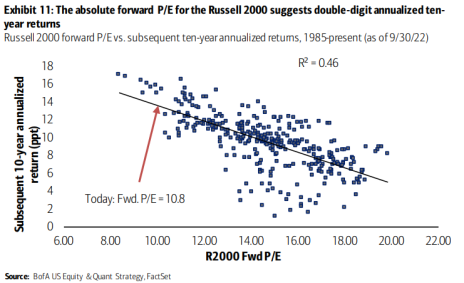

Small-Cap Valuations Imply Strong Future Returns

We all know past performance is no guarantee of future results and that there is more to generating excess returns than valuation. This is especially true in the short term as markets are slow to react to low valuations in certain asset classes, often for justifiable reasons. But over the long term, valuations matter, a lot. Recent data from Bank of America suggest roughly 13% annualized returns over the next decade for the Russell 2000 Small Cap Index. This is relative to roughly 10% returns for the Russell 1000 Large Cap Index.

What to Do Now

We currently have lighter-than-normal market exposure in Cabot Small-Cap Confidential. That will change once we know more about the trajectory of inflation and interest rate policy.

Still, we’ve found success in the current market. And as we look for a better market in 2023, now is the time to dig into stock-specific stories that have the potential to lead during a market rebound.

If you’re interested in what we’re doing now and into 2023, consider subscribing here.

[author_ad]