It has been a great year for small-cap investors, including my Cabot Small-Cap Confidential subscribers. The advisory is averaging a 80% gain across all our recommendations, capitalizing on an 11.4% jump in small caps as a group.

Last month, the S&P 600 Small-Cap Index broke out to an all-time high, though it has since retreated a bit along with the broad market.

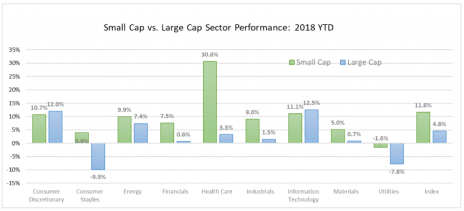

The 11.4% gain in small caps this year is better than the 8.5% gain in large caps, as measured by the S&P 500. Even more impressive is the performance of certain small-cap sectors. For example, the small-cap health care, energy and tech sectors are up 30.6%, 10% and 11%, respectively.

The three most pressing questions for investors are: (1) What’s behind the run, (2) can it continue, and (3) where should you invest?

Let’s take these one at a time.

3 Bullish Trends Powering Small Caps in 2018

Several big-picture factors are collectively driving small-cap stock performance, including a good U.S. economy, decent growth in international markets, deregulation, and a positive impact from tax reform. All together these positives are driving robust revenue and EPS growth and prompting analysts to push up forward growth estimates.

I touched on a number of these factors in my 2018 Small Cap Outlook, which was sent to subscribers of Cabot Small-Cap Confidential in January. While it took a few months for small caps to break out in earnest, these factors are all coming into play today as small caps break free.

Bullish Reason #1: Tax Cut & Jobs Act Disproportionally Beneficial for Small Caps

[text_ad use_post='129618']

When President Trump signed the Tax Cuts and Jobs Act into law last December he lowered the corporate tax rate from an average rate of 28% for large caps (S&P 500) and 32% for small caps (Russell 2000) to 21% for both. The average cut of 11% for small caps is much larger than the average of 7% for large caps. The impact is different for every company out there, and it’s a little early to point to tangible results. But in general, the tax rate appears to be raising the likelihood of reinvestment, stock buybacks, M&A activity, and higher earnings per share, all of which can be positive catalysts for small-cap stocks.

Bullish Reason #2: Small Caps Outperform During Economic Expansions

Data from Credit Suisse shows that since 1986, small caps have been up 100% of the time when GDP growth is in the 2% to 3% range. The latest estimates suggest GDP should be 2% to 3% in 2018, and current consensus has it above 2% in 2019 too. Bottom line - history shows that when GDP growth is in this range, it hasn’t paid to bet against small caps.

Bullish Reason #3: Small Caps Should Benefit from High U.S. Exposure

Remember that investing in small caps is like a leveraged play on the U.S. economy since roughly 80% of small-cap sales come from within the U.S. (compared to about 70% of S&P 500 revenues). With U.S. GDP estimates looking relatively strong, domestically-focused companies, which includes a large proportion of small caps, are doing well.

What’s the Best Way to Invest in Small-Cap Stocks?

In my 2018 Small Cap Outlook I suggested the S&P 600 Index would finish the year up 12% to 17% and would outperform large caps in the process. To arrive at that range, I figured the index would be trading with a forward P/E of 19 to 20 at year end. Using the consensus EPS estimate at that time for 2019, which was $54.95, I came up with an index value of 1,045 to 1,100.

I’m more than comfortable with that target range, especially given that the S&P 600 Small Cap Index is just 10 points away from the low end!

As we enter the final quarter of this year the market is already factoring in more of what’s expected to happen in 2019, and less of what’s already happened in 2018. If the economy is still going strong, valuations should hold up just fine, even if earnings estimates come down a little from where they are now.

For argument’s sake, let’s say S&P 600 earnings for 2019 are closer to $60 at year end. Slap a forward P/E of 19 on that figure and you get an index value of 1,140. That implies small caps will have rallied 21% in 2018, and 9.5% from where they are now.

What’s the best way to capture this upside?

The easiest is to simply buy an ETF that tracks the S&P 600 Index.

But you should really consider owning the stocks I cover in Cabot Small-Cap Confidential, which includes mostly technology and healthcare stocks. And to do that, you’ll want to grab a subscription. It’s not the least expensive advisory service we offer here at Cabot, but I provide you with in-depth research on the best small caps out there, along with regular updates.

I don’t take on crazy risk trying to double our money overnight. As most seasoned investors know, that doesn’t work with any regularity.

Instead, I put the odds in your favor by selecting stocks that have durable business models, solid management teams, good charts and compelling long-term growth. These are the types of stocks that have helped push our average portfolio gain up to 80%, including double-digit gains in 10 of my 12 recommendations.

If you’re interested in joining our select group of subscribers, I’d love to have you. Get started here.

[author_ad]

*This post has been updated from an original version.