When is a micro-cap stock worth buying? Here’s how to tell whether it’s worth buying, or whether it’s just hype—with examples of micro-cap stocks to buy (or avoid) today.

Since launching Cabot Micro-Cap Insider last year, I regularly receive questions about micro-caps that have caught investor attention. People naturally ask about which micro-cap stocks to buy.

In September, Bonanza Goldfields Corp. (BONZ) was one such stock.

Why?

Because it had recently announced that it is acquiring Marvion, a “metaverse blockchain technology company, unlocking, enhancing and preserving the value of media and entertainment intellectual property through blockchain and related technologies to create Hybrid NFTs.”

If you haven’t heard, NFTs (which stand for non-fungible tokens) are the new “it” theme capturing investor enthusiasm.

[text_ad]

As a result of the acquisition announcement, Bonanza’s stock surged up over 1,000%.

I decided to dig in to see what all the hype was about.

Luckily, it didn’t take me long to conclude this was a name to avoid.

First, the company – up until the announcement – had been a gold mining company. It is a red flag when a company makes an acquisition in an industry (especially a “hot” industry) in which it has no expertise.

Second, the company had poor financial trends. Despite touting “great” mining results, the company had failed to generate any revenue in its entire life (as far as I can tell).

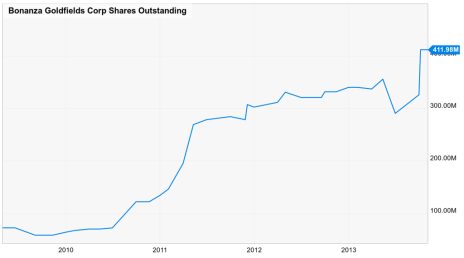

Third, the number of shares outstanding had grown exponentially.

This means that management has pumped up its stock price via promotional press releases and then sold additional stock, diluting existing shareholders.

When evaluating micro-caps, I’m looking for companies with 1) substantial growth, 2) conservative balance sheets, and 3) inexpensive valuations. Because it had none of those characteristics, avoiding Bonanza was the right move at the time. In fact, Bonanza has subsequently given back that 1,000% gain and is now down 16% on the year.

Let’s look at three micro-cap stocks that are better bets than BONZ.

3 Micro-Cap Stocks to Buy Now

Micro-Cap Stock to Buy: P10 Holdings, Inc. (PX)

P10 Holdings (PX) is an under-the-radar micro-cap operating in an extremely stable and profitable industry (private equity).

In 2019, revenue grew 56%. Over the next several years, I expect the company to grow free cash flow significantly as its private equity business expands.

The company has considerable debt on its balance sheet, but a large portion of it is attractive seller financing.

Despite its strong growth and reasonable balance sheet, PX trades at a significant discount to private equity peers such as Hamilton Lane, which trades at 20.2x free cash flow.

Over time, I expect PX to continue to appreciate and wouldn’t be surprised if the stock traded at 20 or higher in a few years, nearly double PX’s current price (13).

Micro-Cap Stock to Buy: Dorchester Minerals (DMLP)

Dorchester Minerals (DMLP) is an energy royalty company. It doesn’t have to spend any money to drill new wells. It just sits back and collects royalty checks from oil and gas assets that it owns. Despite soaring energy prices, it is still trading below pre-pandemic levels.

It is currently trading at 12.4x annualized earnings, too cheap a multiple for such a high-quality, high-margin, and no-debt business. At its current quarterly dividend, the stock is trading at a dividend yield of 8.4%.

Micro-Cap Stock to Buy: Drive Shack (DS)

Drive Shack (DS) is in the traditional (owns and manages golf courses) and entertainment (Drive Shack venues) golf businesses. Business is booming!

The company reported an excellent quarter in August with revenue growth of 130%, beating consensus expectations by 9%. The company reported EBITDA of $7.7MM versus consensus expectations of $1.2MM. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues (an indoor mini golf/ bar concept).

Finally, alignment is high as management and directors own 16.3% of shares outstanding. This is a stock that could double over the next 12 months.

Avoid Liquid Micro-Caps

One final note on micro-caps.

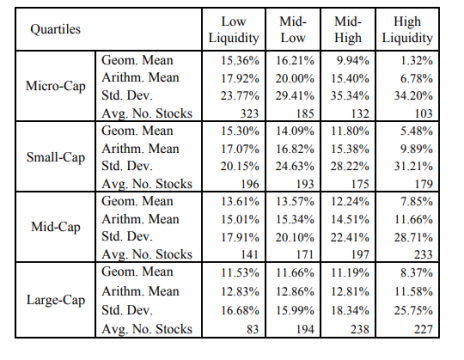

Historically, micro-caps have performed incredibly well, but most liquid micro-caps have performed poorly. See the data below.

As shown above, illiquid micro-caps (such as PX, DMLP, and DS) have generated a 15.4% average return from 1972 to 2017 while liquid micro-caps with hundreds of millions of shares outstanding (such as BONZ) have generated an average return of just 1.3%.

Remember this statistic when you are tempted to chase the next high-flying micro-cap!

Disclosure: Rich Howe owns shares in PX, DMLP and DS. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider subscribers and he will follow his own rating guidelines. To become a Cabot Micro-Cap Insider subscriber, click here.

[author_ad]

*This post has been updated from an original version, published in 2020.