From last August (when it peaked at $2,100 per ounce) until recently, gold was largely forgotten by investors as strong-performing risk assets like stocks and cryptocurrencies overshadowed it. And while it still hasn’t managed to launch a sustained rising trend, the prospects for a gold turnaround in the coming months are high in view of several key “fear factors” that should boost safe-haven demand for the metal.

Fear of the unknown is arguably gold’s biggest catalyst, and with increasing fears over inflation, sky-high real estate and equity market valuations, public health concerns and unrest in the Middle East and Russia, investors have lots of worries right now.

Historically, the yellow metal outperforms whenever such uncertainties proliferate. For when this happens, investors begin looking for a safe place to park money or hedge risk, and the inherent value of precious metals has always attracted safety-haven seekers. Not surprisingly, then, investors are giving gold and gold-related assets—including especially the equities of gold mining companies—a closer look as a defensive hedge against equity market volatility.

[text_ad]

As I’ll explain here, gold mining stocks are an excellent way to leverage a bull market in the physical metal since the shares of gold exploration and mining companies will typically experience superior percentage gains compared to the metal’s price.

Before we take a look at some of the best-performing gold mining stocks, though, allow me to explain why the longer-term outlook for gold is so promising. The first consideration is that even as the U.S. dollar (in which gold is priced) has been devalued by the past year’s unprecedented stimulus measures, global gold supplies are trending lower.

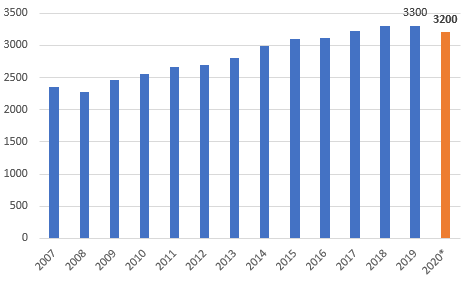

For instance, the U.S. Geological Survey estimates that world gold production in 2020 was 3% lower than in 2019—a year in which gold production was down for the first time in over a decade (see histogram below), thanks to diminished mining output.

What’s more, newly discovered gold deposits have also declined over the last three decades along with gold reserves for the firms that mine the metal. From a fundamental perspective, all these factors combine to form a positive backdrop for gold to appreciate vis-à-vis the world’s major currencies in the coming months and years.

Then there are the economic factors involved in a gold bull market. The yellow metal has historically benefited from an economic uncertainty since investors will naturally look for a safe place to park their money in tough times. With so much uncertainty concerning the inflation outlook, investors are increasingly becoming focused on capital preservation at the expense of capital gains. This should benefit gold since it has a proven track record of holding its value exceptionally well over time regardless of the prevailing economic climate.

So, no matter how you look at it, there are many reasons for believing that gold’s allure will increase in the coming years. Having said that, let’s now turn our attention to some gold mining companies that should benefit from gold’s next bull run.

Among the key attributes we want to see on when evaluating future prospects for gold and metals stocks is solid earnings and revenue growth, attractive all-in sustaining costs per ounce (a measure of how cheaply a firm can mine gold) and, whenever possible, exposure to other metals besides gold (particularly industrial metals that are in high demand globally).

With that in mind, here’s our list of the top precious metal and mining stocks ranked by attractiveness and upside potential in the coming six-to-12 months. I view each of these companies as being technically and fundamentally positioned to benefit from gold’s next sustained upside move.

Best-Performing Gold Mining Stock #5: Western Copper & Gold (WRN)

Besides gold, Western Copper & Gold (WRN) offers exposure to one of the world’s most economically important metals, copper. Along with the improving outlook for copper demand from leading manufacturing nation China and other Asian countries, the market’s expectations of lower supplies from top copper miner Chile is another key driver of higher prices. It’s also worth mentioning that copper is critical to the “clean” energy initiatives of the world’s leading nations. It’s also widely utilized in electric vehicle production and is essential to the 5G wireless revolution now underway. Western is an extremely attractively priced stock that offers investors exposure to three key metals. For starters, Western boasts large gold, copper and molybdenum resources and reserves in its billion-ton Casino project, which happens to be Canada’s premier copper-gold project (based in the Yukon). Then there’s the management factor. Indeed, Western is managed by some of the sharpest mining experts in North America. Consider that Western’s parent company, Western Silver Corporation, was acquired by Glamis Gold for $1.6 billion in 2006. I expect Western Copper & Gold to eventually be built up to a point where its value to a major mining industry player will be too great to ignore. The stock is up 19.1% in 2022.

Best-Performing Gold Mining Stock #4: Barrick Gold Corp. (GOLD)

With the release of their Q4 earnings in February, Barrick Gold made a handful of announcements that make this large Canadian mining company particularly attractive to shareholders. In addition to an 11% increase in their base dividend, the company announced a supplemental performance-based dividend as well as a $1 billion share buyback program. CEO Mark Bristow touted the company’s sustainability efforts and the company’s long-term goals for bringing value to shareholders, saying “We have a long record of exploration success and a high-quality target pipeline. In an industry running out of raw material, we keep expanding our reserves. Our strong balance sheet will fund our investment in growth projects. All our mines have 10-year business plans, based not on wishful thinking but on geological understanding, engineering and commercial reality.” Shares responded positively to the slate of announcement and have returned 20.6% YTD. First-quarter earnings are due up in the first week of May.

Best-Performing Gold Mining Stock #3: A-Mark Precious Metals (AMRK)

It’s not a gold miner, but A-Mark Precious Metals belongs on any list of the top-performing gold-related companies. A-Mark is a precious metals trading firm which offers physical precious metals coins and bars online and via brick-and-mortar locations. A-Mark has been described as a “cash cow,” and in its most recent (fiscal Q2) numbers the firm boasted a 95% earnings beat, reporting per-share earnings of $2.61. (These results were boosted by its recent acquisition of e-commerce precious metals retailer JM Bullion.) Unlike most gold mining companies, A-Mark typically makes more money when gold and silver prices are volatile—a fact that is demonstrated by its excellent stock price performance in recent months. Looking ahead, analysts foresee continued top line growth for A-Mark. Shares have been trading in a channel since the beginning of February (and are at the bottom of that channel now) but are up 30% YTD.

Best-Performing Gold Mining Stock #2: Teck Resources (TECK)

Teck Resources is Canada’s largest diversified resource company and is engaged in mining coal for steel making, zinc, gold, silver and oil sands. But copper is Teck’s calling card, and it has one of the very best copper production growth profiles in the industry with projects located in some of the most attractive jurisdictions in North and South America. The company is mainly focused on accelerating its copper production growth in order to rebalance its portfolio to what it calls “Green Metals” (including zinc) that will benefit from the expected demand growth in alternative energy and EV production due to the metals’ use in reducing CO2 emissions. Further out, Teck expects first production at its QB2 project (one of the world’s largest undeveloped copper resources) in the second half of 2022, which should double its consolidated copper production by 2023. Despite a recent bout of volatility ahead of earnings on April 26, (EPS of CAD 2.96 beat expectations), shares are 36% higher YTD.

Best-Performing Gold Mining Stock #1: Turquoise Hill Resources (TRQ)

Turquoise Hill Resources operates Oyu Tolgoi, one of the world’s largest new copper-gold mines located in Mongolia. Oyu Tolgoi has the potential to operate for approximately 100 years from five known mineralized deposits. The first of those, the Oyut deposit, was put into production as an open-pit operation in 2013, while a second deposit, Hugo North, is under development and is scheduled to begin production in 2022. The shares are, hands-down, the best-performing of the group, up 72% YTD. The jump in shares in mid-March is attributable to the recent announcement by Rio Tinto (RIO) of plans to acquire the remaining 49% stake that it doesn’t own at a price of 34 Canadian dollars per share. While shares are trading at a roughly 5% premium to those prices on the possibility of a higher or competing bid, there is little to no upside to shares at this time.

Based strictly on relative performance, these are five of the best-performing precious metals and mining stocks so far this year and possibly in the months ahead. They also stand to benefit from a sustained rising trend in the gold price. While past performance doesn’t guarantee future results, it usually pays to follow the path of the smart money traders and institutional investors. And the stocks mentioned above appear to be among the favorites of this market-moving crowd.

If you want even more ideas for the best performing precious and industrial metals stocks and ETFs right now, please consider subscribing to my Sector Xpress Gold & Metals Advisor, where I regularly provide you with some of the market’s strongest metals and mining stocks/ETFs from both a technical and a fundamental perspective.

Do you invest in gold? What do you consider the best-performing gold mining stocks?

[author_ad]

This article was originally published in 2020 and has been updated.