These days, all everyone cares about is the banking system, and so I’ve been thinking about micro-cap banks a lot.

I continue to believe that this banking crisis is manageable and NOT systemic.

Here’s how I see it…

According to the FDIC, there were $620BN of unrealized losses as of year-end 2022.

There is $2.1 trillion of tier 1 capital as of Q4 2022. Tier 1 Capital as a percentage of risk-weighted assets is 14.25%.

If we assumed that all $620BN of unrealized losses become realized, tier 1 capital will shrink to $1.5 trillion or 10.04% of risk-weighted assets.

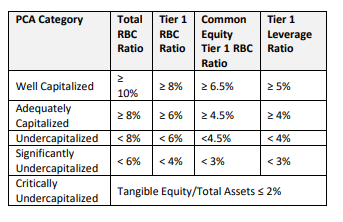

The threshold to be considered well-capitalized according to the FDIC is 8%.

Thus, even in a draconian scenario, the U.S. banking system appears well-capitalized.

Finally, Treasury Secretary, Janet Yellen, said at a conference on March 21, 2023, that depositors at small banks could be eligible for the same kind of protection extended to customers at two regional banks that failed this month.

[text_ad]

Now let’s discuss two well-capitalized micro-cap banks that have nonetheless gotten punished by the recent dislocation.

Micro-Cap Bank #1: Esquire Financial (ESQ)

Esquire is a small commercial bank dedicated to serving the financial needs of the legal and small business communities on a national basis. Esquire’s primary market is New York, but its innovative model will enable it to grow nationwide.

Let’s start with the most important thing: unrealized losses.

Like all banks, Esquire does have some unrealized losses ($31MM in total),

But the unrealized losses are immaterial when compared to Esquire’s book value of $158MM.

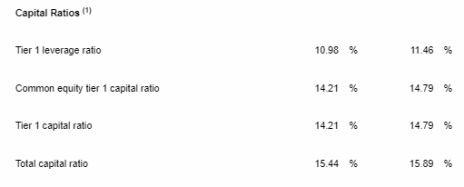

Most importantly, Esquire Financial is well-capitalized as shown by the chart below.

Esquire is truly a growth company.

Since 2015:

- Deposits have compounded annually at 23%

- Revenue has compounded at 28%

- Diluted EPS has compounded at 44%

Despite all this growth, the stock trades at just 8x forward earnings.

Finally, it’s encouraging to see an insider, CFO, Michael Lacapria, recently buy ~$56k of Esquire stock on the open market.

Micro-Cap Bank #2: Truxton Financial (TRUX)

Truxton Corporation is a micro-cap bank holding company based in Nashville. Its primary subsidiary is Truxton Bank, which has just a single branch.

Again, we can start with the most important thing: Truxton’s capitalization and unrealized losses.

Truxton is very well-capitalized as shown below.

The FDIC believes a Common Equity Tier 1 ratio of 6.5% is considered well-capitalized. Truxton’s ratio (13.4%) is more than double this level.

Truxton has ~$30MM of unrealized losses but its balance sheet could absorb those losses if needed given its overcapitalization.

Truxton is a rapidly growing company. Since 2012, revenue and assets have compounded at 12% while EPS has compounded at 17.5%.

It also has a valuable wealth management arm, with a location in Nashville and one in Georgia.

Despite this phenomenal performance and strong growth outlook, the stock trades at just 11.4x trailing earnings.

Both Esquire and Truxton look like good bets for when the current banking crisis fades from the news.

To learn which other micro-cap stocks I’m following, subscribe to Cabot Micro-Cap Insider today!

[author_ad]