I started my career at institutional money manager Eaton Vance.

It was a great place to start my career.

I got to work with insanely smart people, many of whom had MBAs from some of the best graduate schools in the world (Harvard, Chicago, Northwestern, etc.).

Everyone was incredibly friendly and welcoming. Also, the department was small relative to the assets under management. As a result, even as an entry level research associate, I had the opportunity to interview senior management teams.

They also paid for me to take the Chartered Financial Analyst (CFA) program, which was a nice bonus!

[text_ad]

The one problem with my role at Eaton Vance was I was looking at large-cap stocks. There is nothing inherently “bad” about large-cap stocks. I’ve just found it difficult to consistently beat the market with large-cap stocks. Most mutual funds struggle as well.

After seven years at Eaton Vance, I stumbled into a more attractive market niche: micro-cap stocks.

Once I discovered micro-caps, stocks with market caps less than $250MM, I immediately fell in love.

Why? It starts with outperformance.

From 1927 to 2016, the smallest decile of stocks in the U.S. generated a 17.5% compound annual return, versus 9.2% for the largest decile of stocks.

3 Reasons to Invest in Micro-Cap Stocks

But beyond excellent historical returns, there are several other reasons you should invest in micro-cap stocks.

1. Less competition

Almost all professional investors are prohibited from investing in micro-caps because they are too small. Therefore, there is less competition.

2. Simple business models

Micro-caps typically only have one line of business, and so they are easy to understand and analyze.

3. Management access

If you want to talk to Tesla’s CEO, Elon Musk, good luck getting him on the phone.

But most micro-cap management teams are eager to spend time on the phone with prospective investors. Just pick up the phone and give them a call!

At Cabot Micro-Cap Insider, we focus exclusively on identifying high potential micro-caps.

A couple months ago, I profiled a micro-cap stock that has become one of my favorite ideas for 2022.

The stock is up 27% since I originally recommended it, but I think there is significantly more upside ahead.

Leatt Corporation (LEAT)

The Leatt Corporation is a South African-based designer and developer of innovative gear for sports.

The company was founded by Chris Leatt, a doctor and surgeon.

In 2001, he witnessed the death of a fellow motorcycle rider the weekend after his son began riding.

Inspired by a desire to protect his son and other riders, he began researching and developing a neck brace that could prevent these catastrophic injuries.

He filed his first patent in 2003 in Cape Town, South Africa, and sold his first product in 2006.

The company was initially entirely dependent on the success of the neck brace.

The neck brace became the most popular in the market, but growth eventually stalled out.

In 2010, Chris Leatt hired Sean MacDonald as CEO to lead the company in a new direction.

The new plan was to leverage its brand and existing distribution channels by creating and selling other protective products.

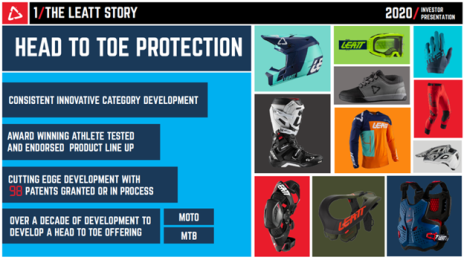

Today, Leatt sells a wide variety of products, as shown below.

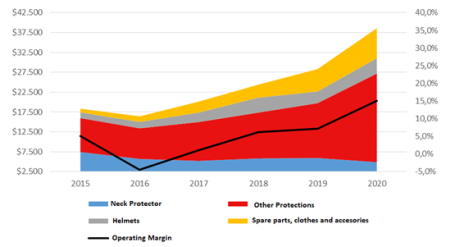

Over time, Leatt’s revenue has become more diversified, as shown below (source: Finding Moats).

Currently, most of Leatt’s revenue comes from chest protectors (23% of sales), knee protectors (22%), and neck protectors (21%).

In 2020, Covid “helped” this business tremendously, as it benefitted all other outdoor sports.

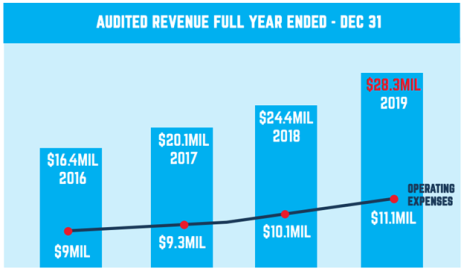

For the year, revenue grew 36% while net income grew by 222%.

What is more impressive to me is that the business was growing so strongly prior to Covid.

Strong growth has continued in 2021.

In Q3 2021, revenue increased 94% to $22.1MM while EPS increased 163% to $0.79. And that’s with supply chain issues. Pretty amazing!

On an annualized basis, it’s generating EPS of $3.16. As such, it’s trading at a P/E of 9.7x. This seems incredibly compelling.

A P/E of 20 or 30 seems more reasonable to me.

As is always the case with micro-cap stocks, be sure to use limits as Leatt is very illiquid.

And be sure to sign up for Cabot Micro-Cap Insider to learn my next idea, which will be published next week (December 10).

Do you have a favorite micro-cap stock for 2022?

[author_ad]