The market (S&P 500) continues to mostly chug along, hitting new highs last week before hitting a bit of pre-Thanksgiving turbulence this week.

The one sector that’s weathered the ups and downs fairly well is the same category of stocks that has been a disaster for the last decade: energy stocks. And my favorite energy play is Dorchester Minerals stock. More on that shortly.

The economy is recovering from the pandemic, but there is not enough oil, natural gas and coal to power the recovery.

As a result, commodities are soaring higher and oil, natural gas, and coal stocks are going to the moon.

Recently, The Economist published the following cover story.

Some investors are worried that The Economist cover signals a top for energy stocks. Indeed, The Economist covers have been a pretty good contra-indicator to watch, historically speaking.

[text_ad]

For example, in December 2020, The Economist published the below cover, which happened to be a pretty good time to buy coal stocks.

I’m carefully monitoring economic conditions and watching my cyclical exposure closely, and I still think there is significant room to run.

While I think most cyclicals look attractive, I especially like energy stocks.

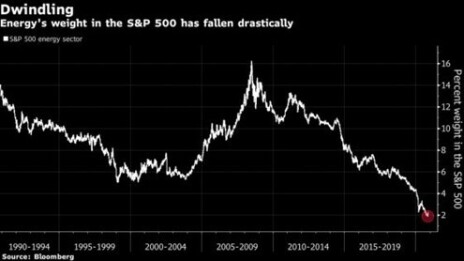

Environmental, social and governance (ESG) considerations have limited the number of investors that can invest in the space. That, coupled with real challenges in the industry which resulted in several oil price crashes over the past 10 years, have reduced S&P 500’s exposure to the energy industry.

But that is starting to change.

Many large-cap energy stocks remain incredibly cheap and on the precipice of returning significant capital to investors.

This is resulting in a turn in the market, as you can see in the chart below.

If energy stocks continue to perform well, more generalist investors will have to add exposure to avoid lagging the benchmark, which would have a domino effect.

Further, it appears we are in the early innings of a potential energy crisis as power plants in Europe, India, and China (here’s one example) are being shut down due to lack of available energy sources. This could become a lot worse as winter hits and demand for energy increases.

How should you play this energy crisis?

Dorchester Minerals Stock

One stock in my portfolio that will continue to benefit from higher natural gas and oil prices is Dorchester Minerals (DMLP).

Dorchester Minerals stock is up 103% (including dividends) since I originally recommended it to my Cabot Micro-Cap Insider subscribers in October 2020, but I think there’s significant upside ahead.

Dorchester Minerals is an energy royalty company. It doesn’t have to spend any money to drill new wells. It just sits back and collects royalty checks from oil and gas assets that it owns. Despite soaring energy prices, it is still trading below pre-pandemic levels.

Because of Dorchester’s excellent business model, it has a higher EBITDA margin than Facebook (63% vs. 50%).

It is currently trading at 12.2x annualized earnings, too cheap a multiple for such a high-quality, high-margin, and no-debt business. At its current quarterly dividend, the stock is trading at a yield of 8.5%.

Buy Dorchester Minerals stock to profit from the current energy crisis!

And if you want to know what other stocks I’m recommending in my Cabot Micro-Cap Insider advisory – where we have an average return of 73% on our 14 current portfolio holdings – click here.

Do you own any energy stocks in your portfolio? If so, tell us which ones have performed well in the comments below.

[author_ad]

*This post has been updated from an original version.