To know how ESG investing works, it’s important to first know what it means.

ESG stands for Environmental, Social and Corporate Governance, and is a variety of ethical or sustainable investing. ESG investors try to invest in companies that have good governance and are also environmentally and socially responsible.

ESG investing has previously gone by many names, including ethical, long-horizon, extra-financial, sustainable and socially responsible investing (SRI). The “twist” with ESG is that investors believe companies with good ESG scores will also be more successful, and that they make less risky investments.

For example, an oil company that tries to cut corners is more likely to have a devastating spill—and suffer the financial consequences—than an oil company that follows environmental regulations and puts a high priority on safety.

[text_ad]

But ESG investing isn’t just about avoiding risks, or not buying certain companies. The benefits of good ESG practices can be felt everyday as well. For example, companies that treat their employees well and make a priority of addressing employee issues are not only less likely to face damaging lawsuits, they should also benefit from more productive employees day to day. That’s good for the bottom line and for investors.

So ESG investors don’t simply avoid companies or industries considered “bad,” like fossil fuels or tobacco. Instead, they seek out companies doing good, and believe they will also do well.

The strategy is gaining in popularity: per the most recent report from U.S. SIF: The Forum for Sustainable and Responsible Investment (released in November 2020), ESG-focused investments now account for roughly one-third of institutional assets under managements.

But Does ESG Investing Make Money?

The ideas above make theoretical sense, but is there any evidence that using ESG filters will improve your investing performance? (After all, if doing the right thing was profitable, wouldn’t everyone do it?)

The research is limited, but so far, it actually leans in favor of ESG investing. In other words, more responsible companies do tend to be better investments.

One professor studied the performance of companies on Fortune’s “100 Best Companies to Work For” list from 1984-2009. He found that the companies were more likely to deliver positive earnings surprises than competitors, and that their stocks outperformed benchmarks by 2% to 3% per year.

Another study of 61 socially responsible funds from 1972 to 2000 found that the more social screens a fund employed, the better its results. However, the study also found a downside. While screening for companies with good community relations led to better financial performance, using environmental and labor screens hurt financial performance.

Yet another study by the same authors found that companies with some social responsibility goals are less successful than those with none, but that firms that make social responsibility a top priority are actually the most successful. So companies with the highest ESG scores are the best investments!

What Makes an Investment ESG?

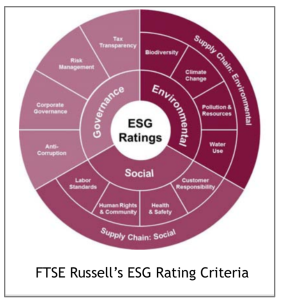

“Environmental, Social and Governance” is kind of vague … what exactly goes into calculating an ESG score or rating?

The criteria can vary a lot, and because many of the assessments are qualitative, ESG determinations are somewhat subjective. But most ESG systems have some features in common. Here’s what investors tend to look for.

Environmental

The E in ESG stands for environmental, and refers to practices that have a negative or positive impact on the environment. Contributing to climate change is a negative. Using natural resources sustainably is a positive. Some strategies also consider impact on biodiversity, pollution and water supplies. Some investors also avoid companies with nuclear power exposure.

Social

The S in ESG stands for Social, and attempts to measure how a company impacts the people around it. That includes a company’s record on diversity, health and safety, human rights and labor standards. It may also include a consumer protection filter to eliminate companies that sell products that can harm customers, like predatory lenders. Some ESG strategies also include animal rights filters.

Corporate Governance

The G in ESG (for “governance,” of course), grades a company’s management and governance policies. ESG investors believe that companies with good governance practices will be better run and less likely to get into (expensive) trouble.

That includes a good balance of power between corporate officers and the Board of Directors, and ideally an independent chairman of the board (who is not the CEO). Executive pay is considered, including its structure (what type of performance does it incentivize?) and its ratio to average employee pay. Other governance factors include risk management practices, corruption policies and tax transparency.

ESG investors also consider the company’s treatment of its employees. Companies that rank highly are those that provide good benefits, support employees professionally and personally, and ensure communication between management and employees is frequent and honest.

The Best Funds for ESG Investing

Those are the basics of ESG investing … now how can you incorporate the strategy in your own portfolio?

If you’re an individual stock investor, you can do a lot of your own research. However, you might find it challenging to weigh some factors against each other. For example, AT&T is on Fortune’s 100 Best Companies to Work For list, but the company also advocates against net neutrality. Coca-Cola has strong governance, but they sell sugary drinks that contribute to the obesity epidemic.

You may find it easier to make ESG investments through an ESG ETF. Several companies have created competing ESG ratings, and indexes based on them. In addition to evaluating public companies on ESG metrics, most rating systems also weight their scores based on how important that factor is in the industry. So good environmental protections are more important at a mining company than at a financial company. But good governance may be more important at a financial company, with its complex web of stakeholders and interests.

iShares MSCI KLD 400 Social ETF (DSI)

The largest ESG ETF is the iShares MSCI KLD 400 Social ETF (DSI), which is nearly indistinguishable from your average large-cap fund. That’s intentional: iShares made DSI so investors with a conscience can use it as a substitute for other large cap funds like SPY. Over the past year, the two funds’ returns have been very close, with a 12.6% decline for DSI and a 11.6% decline for SPY. Over the past five years, DSI has gained 62.3%, vs. a 57.4% gain for the SPY.

DSI’s top holdings are all familiar names, with no apparent social skew: Microsoft (MSFT), Alphabet (GOOG), Procter & Gamble (PG), Tesla (TSLA) and Nvidia (NVDA).

iShares MSCI USA ESG Select ETF (SUSA)

iShares also has a smaller ESG investing fund, the iShares MSCI USA ESG Select ETF (SUSA), which is more aggressively responsible than DSI. SUSA holds a smaller number of companies (174 to DSI’s 400). Companies that have positive ESG scores relative to their peers and the broad market are more heavily weighted.

Compared to the average large-cap equity fund, SUSA has a slightly higher exposure to technology, industrials and real estate, and lower exposure to financials and energy. But its performance still tends to track the S&P 500 to within a few points, down 14.8% over the last year (likely attributable to higher tech allocation), and up 59.7% over the last five.

iShares also offers ESG ETFs focused on emerging markets and the EAFE region (developed markets outside of the U.S. and Canada).

Other ESG ETFs

Many of the other ESG ETFs are pretty small. Nuveen offers one of the few ESG options that look beyond large-cap stocks, the NuShares ESG Small-Cap ETF (NUSC). It’s assets under management come in just under $940 million, and it has a lot of holdings: 567 at last count. But that’s not unexpected given the emphasis on small-cap stocks.

How important of a role does ESG investing play in your portfolio?

[author_ad]

*This post was originally published in 2017 and is periodically updated to reflect market conditions.