In November 2017 Apple (AAPL) began enrolling patients in the Apple Heart Study. This past Saturday the company released data at the American College of Cardiology (ACC). That data has been eagerly anticipated by investors in two small-cap MedTech stocks that could see an increase in demand if the Apple Watch does what it’s supposed to do.

I’ll get to details on those two companies in a minute. First, we need to talk about the Apple Heart Study, the Apple Watch, what it is, what it isn’t, and what’s coming next.

The big picture idea put forth by Apple is to use the Watch to detect and analyze irregular heart rhythms. Early detection of atrial fibrillation (AF), a leading cause of stroke, could help save lives because people can seek out medical help before they have a life-threatening event. The study was conducted in collaboration with Stanford Medicine.

How big is the market for cardiac monitoring?

[text_ad]

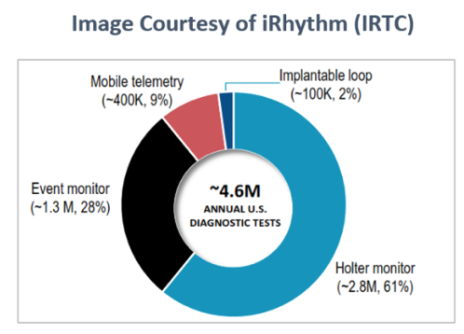

It’s big, roughly $22 billion worldwide and growing at around 5%. In the U.S., the cardiac monitoring market is worth around $1.4 billion annually, with roughly 4.6 million annual diagnostic tests. The rough breakdown of the different types of diagnostic tests is shown in the accompanying image.

The interesting thing about this study is that, while clearly it could be a good selling point for the Apple Watch, it could also act as a tailwind for companies that currently sell ambulatory electrocardiogram (ECG) devices.

That’s because Apple is not yet trying to establish the Watch as a clinical diagnostic tool (the Apple Watch Series 4 can generate an ECG similar to a single-lead electrocardiogram). The photoplethysmography (PPG) technology currently used in the device uses infrared light to measure volumetric variations in blood volume. This gives an approximate heart rate. But it isn’t as robust, or proven, as the algorithms in ambulatory ECG devices that measure the heart’s electrical impulses.

The Watch also can’t characterize arrhythmias and comorbidities. Bottom line – a physician wouldn’t use it to diagnose patients. It’s more of an initial screening device that can tip a patient and physician off to possible issues that need to be checked out.

That knowledge could increase the size of the funnel of patients using ambulatory ECG devices, which would likely boost demand for the leading companies that currently sell them. This is especially true given that a lot of people with irregular heart rhythms aren’t aware that they’re having them. The Apple Watch may change that.

What We Learned from the Apple Watch Study

Back to the Apple Heart Study.

The Apple Heart Study ended on July 31, 2018. And results were just released at the American College of Cardiology (ACC) last Saturday, March 16.

It was a prospective single-arm study with 419,297 patients. The official objective is to evaluate exactly how effective a smart-watch based photoplethysmography (PPG) algorithm is for diagnosing AF over a 90-day period.

The primary endpoint?

Measure the proportion of patients the Watch algorithm identified as having an irregular rhythm that were then confirmed as having AF after using an ePatch for up to seven days. The ePatch ECG used in the study is a small device that made by BioTelemetry (BEAT) that sticks to the skin and measures the electrical activity of the heart.

The study also wanted to measure the positive predictive value (PPV) of the algorithm when confirmed by simultaneous use of Apple Watch and the ePatch (i.e. how well the Watch matched the ECG findings when worn at the same time).

It also wanted to determine the percentage of patients that reached out to a healthcare provider through the app within three months of getting a notification from their Apple Watch. This step could help identify how much the Apple Watch expands the market by pulling in the asymptomatic population (those people unaware they have irregular heartbeats).

The results?

Roughly 0.5% (2,100 people) of the trial group received an irregular pulse notification.

Of these, 450 patients wore and returned an ePatch. One-third (34%) of them were found to have AF based on the ePatch reading. That doesn’t mean the other 66% didn’t have AF, just that it didn’t show up during the days they were wearing the ePatch.

Among the 450 patients that wore the Apple Watch and the ePatch at the same time, the PPV was 84%, meaning the vast majority of those that received a notification through the Watch were confirmed to have AF with the ECG.

Of the participants that received an irregular pulse notification from the app, around half reached out to the study doctor.

Not surprisingly, notification rates were much higher among study participants that were over 65 years of age.

The punchline for this study is that it showed the Apple Watch can help identify people with previously unsuspected AF. And that it could help save lives and increase the market size for cardiac monitoring.

That said, at the end of the day this was a relatively small sample size and it’s ultimately up to wearers of the Apple Watch to reach out to a healthcare provider and take the next step to use an ECG. It’s hard to say how many people outside of a formal study would do that.

You’d think 100% of people that are told they have a potential heart issue would get it checked out. But hey, life can get busy. Who has time to make sure their heart doesn’t suddenly stop?

iRhythm (IRTC) or Biotelemetry (BEAT): Which Is the Better Small-Cap MedTech Stock?

I wrote about these two companies and their respective roles in the cardiac monitoring market last July (you can find that article here), so I’ll just give a brief overview today.

BioTelemetry (BEAT) provides digital population health management (PHM) services, including diagnosis and monitoring of cardiac arrhythmias, and has a market cap of $2.3 billion. Revenue grew by 38% in 2017 and 39% in 2018 (to $399.5 million). In 2018 EPS grew by 100% to $1.94. BioTelemetry has rolled out two new monitors in a convenient patch form-factor; the next-generation MCT and an extended wear Holter. These ePatch devices were eagerly anticipated by BioTelemetry investors as they reduce the competitive threat posed by other players. As mentioned earlier, BioTelemetry provided the ePatch used in the Apple Heart Study.

iRhythm (IRTC) is the challenger. It too is a digital healthcare company and has developed a platform for diagnosing cardiac arrhythmias through use of a wearable ePatch (Zio, approved in 2017). The company sees itself as becoming the leading provider of first-line ambulatory electrocardiogram (ECG) monitoring for patients at risk for arrhythmias. It has a market cap of $2.3 billion. The company’s mSToPS clinical study is large (over 5,000 patients) and has shown Zio to be especially effective at identifying silent AFib in high risk, undiagnosed patients. Revenue jumped by 54% in 2017 and 50% in 2018 (to $147.3 million), when the company lost -$1.89 per share.

A detailed analysis of the technologies and algorithms of these two companies is beyond the scope of today’s article. What I will say is that BioTelemetry has a much broader product offering and is relatively new to the ePatch market, while iRhythm is much more of a pure-play ePatch ECG stock. The pitch for iRhythm often revolves around potentially superior technology at a lower cost in the patch form actor.

How does the Apple Heart Study affect these two companies?

On the one hand, as the supplier of the ePatch for the study it would seem that BioTelemetry and Apple have a relationship. And that any uptick in ECG prescriptions resulting from the Watch would disproportionally benefit BioTelemetry. It is also a more established player in the cardiac monitoring market and has a wide variety of devices beyond an ePatch that physicians can choose from.

On the other hand, outside of this study, which didn’t drive all that many people to seek out a doctor (just 450), the reality is that physicians will prescribe whatever they think is best. That could be an ECG monitor from BioTelemetry, or a Zio patch from iRhythm. Both companies are going to continue working to improve their technologies and developing their sales teams, and neither is likely to sit down and let the other just grab market share.

In my mind, there’s no need to choose one or the other. At least not yet. Both small-cap MedTech stocks are doing relatively well right now and are expected to do well in the near future. They are both going after a big market in which there is room for multiple players. And each stock has different qualities and drawbacks.

In 2019 BioTelemetry should grow revenue by almost 11% (to $402 million) and deliver EPS of $1.96, about the same as in 2018, while iRhythm should grow revenue by around 39% (to $205 million) but lose $1.65 per share (it lost $1.89 in 2018). The market caps of both companies are about the same. BioTelemetry has $81 million in cash and $200 million in debt, while iRhythm has $78 million in cash and $35 million in debt.

In other words, BioTelemetry offers slower growth but greater scale and profitability, while iRhythm offers faster growth but steep losses.

If you think the heart monitoring market is an attractive place to invest, just buy both (for that matter, it might be worth owning a little Apple stock too). If market dynamics start to favor one over the other, rebalance, or exit one in favor of the other at that time.

Consider an analogy: If you want exposure to cloud infrastructure, why choose between Microsoft (MSFT), Alphabet (GOOG) and Amazon (AMZN)? All three are good and offer different exposure, so own all three!

Owning a number of good stocks pursuing large, growing markets is a strategy that’s worked out well for Cabot Small-Cap Confidential subscribers.

I’m the Chief Analyst for this investment advisory newsletter, and we’ve been investing in small-cap MedTech stocks for years. My latest recommendation specializes in DNA testing, has a great story and is up more than 50% since January. To get all the details on that stock, plus the others that have helped push our average gain up to 70%, grab a trial subscription to Cabot Small-Cap Confidential here.

[author_ad]