The following article has been partially excerpted from the latest issue of Cabot Money Club Magazine, to read the full article, subscribe today.

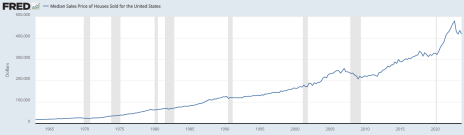

Do you feel that you missed out on the real estate boom that has happened since the recession of 2007-2009? The graph below shows just how far and fast home prices in the U.S. have moved since that time.

U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States [MSPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MSPUS, March 11, 2024.

According to the National Association of Realtors, the median price for an existing home is $387,600 today. If you bought a home at that price, with a 10% down payment ($38,760), and an average 30-year mortgage rate of 7.55%, your monthly outlay (not counting taxes, HOA, etc.) would be $2,448.

But all hope is not lost! By utilizing passive real estate investing, you can invest in real estate without breaking the bank.

[text_ad]

As you know, I own a real estate company and I’m always interested in reading about the latest developments in the industry. What prompted this piece was an article I read about Arrived, a real estate investment platform backed by Jeff Bezos, the founder of Amazon, who put in $37 million to get the company started.

Arrived created the Single Family Residential Fund which has acquired $124 million of single-family rental properties (about 400 homes) located in up-and-coming neighborhoods. It’s already attracted more than 500,000 investors who can participate in the rental income and potential share appreciation by investing as little as $100 (although in reality, Arrived says the average amount its customers invest per property is closer to $3,195).

The properties are discovered by using data analytics to determine the best investments in 27 markets across the country that are ripe for the highest appreciation. Then they work with real estate agents with local knowledge to fine-tune their purchases of single-family homes. The houses are then shown online to nonaccredited (net worth less than $1 million) potential investors.

Investors can choose between single-family homes with regular passive income or vacation rentals such as those listed on Airbnb, which may offer more lucrative income opportunities.

As you saw in the graph above, prices for real estate have been appreciating—between 5% and 12% annually for quite some time. So I’m not surprised that Bezos—who is the king of innovative ideas to make money—is involved in such a project. Plus, he is joined by other deep-pocket investors, like Uber Technologies Inc. CEO Dara Khosrowshahi and Salesforce Inc. Co-CEO Marc Benioff, who also seeded the company with serious money.

For the investors, the advantages are attractive:

· An opportunity to invest in real estate without breaking the bank with a huge investment

· No need to worry about taxes, HOA fees, maintenance, and renters

· A steady income stream (from rents)

· Diversification of income streams.

But investors will pay a 1% annual management fee, and some investors have complained that they haven’t been able to participate as the properties are sold out quickly.

But don’t worry, there are plenty of other passive real estate investing opportunities—most of which have been around for years, and so are market-tested.

To learn more about how passive strategies can help you invest in real estate without breaking the bank—from REITs to other forms of fractional ownership to hard money lending—subscribe to Cabot Money Club today.

[author_ad]