At our last editorial meeting, one of our managing editors asked that we write about dividends. Well, some may view the following as a little unorthodox, but as a professional options trader, I view many of the trades I place as basically “creating my own dividend,” so I was happy to oblige.

The foundation of the strategy I’m about to discuss starts by choosing a stock in the S&P 500 qualified as a Dividend Aristocrat. A Dividend Aristocrat is simply a company that has paid, and increased, its dividend every year for at least 25 years straight.

[text_ad]

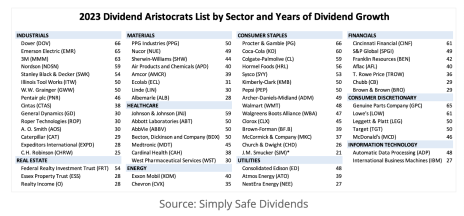

At the onset of 2023, there were 67 stocks in the S&P 500 that met the standards of a Dividend Aristocrat and thankfully, all have the capability to support the following options strategy I’m about to discuss.

The chart above gives great insight into some of the most stable companies in the S&P 500. To keep things simple, I’m going to focus on the annual dividend yields for the six companies with 60+ consecutive years of annual dividend growth.

· Dover (DOV) – 1.39%

· Procter & Gamble (PG) – 2.41%

· Coca-Cola (KO) – 2.88%

· Cincinnati Financial (CINF) – 2.90%

· Genuine Parts Company (GPC) – 2.30%

· Lowe’s (LOW) – 2.04%

While the consecutive streaks are impressive in the list above, the yields, while reliable, are fairly low.

So, what if you could take those same companies and potentially increase the annual yield by 2x, 3x, or as high as 5x? The following strategy will not only allow you to increase annual yields, it will also allow you to diversify amongst a basket of some of the most reliable low-beta stocks in the S&P 500, for far less capital.

Long Call Diagonal Debit Spread? What?

Options mumbo jumbo would call this strategy a long call diagonal debit spread, but my preference is to call it simply a poor man’s covered call. A poor man’s covered call is an inherently bullish strategy that is the same in every way as a covered call strategy, with one exception. Rather than purchase at least 100 shares of stock, you have the ability to buy what is essentially a stock replacement. The replacement? An in-the-money LEAPS call contract.

LEAPS, or long-term equity anticipation securities, are options with at least one year left until they are due to expire. The reason we choose to use LEAPS as our stock replacement is that LEAPS don’t suffer from accelerated time decay like shorter-dated options.

My Approach to Poor Man’s Covered Calls Using Dividend Aristocrats

There are numerous ways to approach poor man’s covered calls. My preference is to use LEAPS that have at least two years left until expiration.

For example, let’s take a look at one of the top three Dividend Aristocrats on the list, Procter & Gamble (PG). It’s a fairly expensive stock and that can be a huge deterrent for many investors if they have to buy 100 shares, not with a poor man’s covered call.

As you can see in the chart below the stock is currently trading for 156.39.

Now, if we followed the route of the traditional covered call, we would need to buy at least 100 shares of the stock. At the current share price, 100 shares would cost $15,639. Certainly not a crazy amount of money. But just think if you wanted to use a diversified covered call strategy on, say, numerous higher-priced stocks like Apple (AAPL), Microsoft (MSFT) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards … and that’s unfortunate, because it’s a wonderful options strategy.

But with a poor man’s covered call strategy you can typically save 65% to 85% of the cost of a covered call strategy, which makes a diversified approach far more affordable, and the ability to create more “dividend” streams.

So again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

As I said before, my preference is to buy a LEAPS contract with an expiration date of around two years. Some options professionals prefer to only go out 12-16 months, but I prefer the flexibility the two-year LEAPS offers.

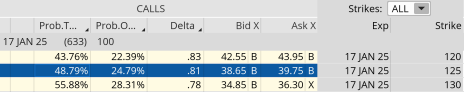

The image below shows every expiration cycle available for PG. Again, I want to go out roughly two years in time. The January 17, 2025, expiration cycle with 633 days left until expiration is the longest-dated expiration cycle and would be my choice.

So, when my LEAPS reach 10-12 months left until expiration, I then begin the process of selling my LEAPS and reestablishing a position with approximately two years left until expiration.

Once I have chosen my expiration cycle, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at PG’s option chain for the January 17, 2025, expiration cycle I quickly noticed that the 125 call strike has a delta of 0.81. The 12 strike price is currently trading for approximately $39.20. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $39.75.

So, rather than spend $15,639 for 100 shares of PG, we only needed to spend $3,920. As a result, we saved $11,719, or 74.9%. Now we have the ability to use the capital saved to diversify our premium amongst other securities if we so choose.

After we purchase our LEAPS call option at the 125 strike, we then begin the process of selling calls against our LEAPS.

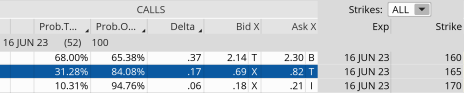

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 90%.

As you can see in the options chain below, the June 16, 2023, 165 call strike with a delta of 0.17 falls just outside my preferred range., but I want to show the benefits even at the most conservative levels. We can bring in roughly $0.76 worth of premium from the trade.

Our total outlay for the entire position now stands at $38.44 ($39.20-$0.76)., or $3,844. The premium collected is 1.9% over 53 days.

If we were to use a traditional covered call our potential return on capital would be far less than half, or 0.5%.

And remember, the 1.9% is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8-12 months. If we are able to sell calls every 45 days on average, we would have the opportunity to sell calls 7 more times for a total of 15.2% in call premium sold. Now think about stocks that offer an annual dividend of 15.2%. They certainly aren’t of the quality of a low-beta Dividend Aristocrat.

I hope all of this was helpful, particularly for those of you searching for dividends or other potential income-generating strategies. If you’re interested in learning more about how to implement these strategies in your own portfolio, consider a subscription to Cabot Options Institute today.

[author_ad]