At the Cabot Wealth Summit last week, I put forth several options trade scenarios in a presentation titled, “Supercharging your Portfolio with Options.” In the presentation, I showed how you could combine Cabot analyst’s stock picks such as Exact Sciences (EXAS), General Motors (GM) and Home Depot (HD), with options strategies, such as Buying Call Options and Buy-Writes/Covered Calls, to produce big returns.

The example that got the biggest reaction from the crowd was when I combined a stock from Crista Huff’s Buy Low Opportunities list with the sale of a put. As I broke down the trade, I could see the conference attendees were getting excited by this strategy.

[text_ad]

The next morning, a conference attendee stopped me at breakfast and told me, very politely, that she thought that my example of selling a put on Crista’s recommendation, Cimarex Energy (XEC), was a “shell game.” While I’m not exactly sure what she meant by that, I assume she was implying that the options trade was too good to be true. I promised her that put selling is not a shell game, and is in fact a great options strategy to buy a stock lower than it’s currently trading.

How the XEC Options Trade Works

Cimarex Energy is an independent oil and gas exploration and production company that has struggled in 2017, losing 21% year-to-date. However, Crista considers the stock a great Buy Low Opportunity at the current levels.

With the stock trading at 102 and Crista willing to buy the stock at this level, I showed the conference attendees that we could execute an options trade in which we could potentially buy the stock even lower if it continues to fall. And if the stock price didn’t fall, we have essentially written insurance on the stock and would collect a nice premium.

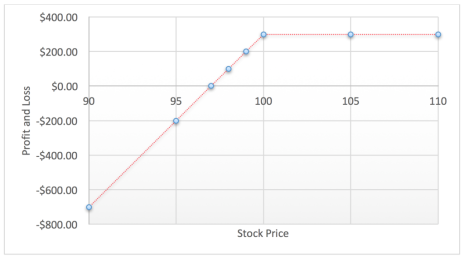

With the stock at 102, I broke down the risks/reward of selling the October 100 Put for $3.

So, what does this mean?

Put selling is a short volatility trade. If the stock does not fall below the strike in which the trader sells, the trader collects a premium.

If the stock does fall below the strike, the trader who sold the puts, would be forced to buy the stock at that strike price.

Essentially, the trader doesn’t think the stock will fall, but if it does, he is willing to buy the stock lower.

So, if I sell the XEC October 100 Put, and the stock closes ABOVE 100, which is the put’s strike that I sold, the put expires worthless. And I collect the full $300 premium. In other words, if the stock closes at 100.25, or 101, 110 or anywhere above 100, I collect that $300.

If XEC closes BELOW 100, the person to whom I sold the put will exercise his right to sell me the stock at 100. That’s the level at which I wanted to own the stock, so I’m ok with that scenario. Also, because we collected that $3 with the sale of the put, our breakeven on the stock purchase is actually $97.

Here is the profit and loss graph of this trade:

Early this week, I wrote to Cabot Options Trader/Cabot Options Trader Pro readers about wide spread put selling in many of the market leaders. Here are the large put sales from Monday morning:

Seller of 15,000 salesforce.com (CRM) October 92.5 Puts for $0.65 – Stock at 95.6 (trader willing to buy 1.5 million shares at 92.5)

Seller of 7,000 Service Now (NOW) October 110 Puts for $1.10 – Stock at 117 (trader willing to buy 700,000 shares at 110 – similar to trade made on 9/7)

Seller of 15,000 Ctrip.com (CTRP) January 50 Puts (exp. 2019) for $4.30 – Stock at 53.75 (trader willing to buy 1.5 million shares at 50)

My read on widespread put selling is that the big trader/traders are not putting on high conviction trades at the potentially elevated levels in the market, but they are willing to buy stocks like these (and XEC) on dips.

[author_ad]