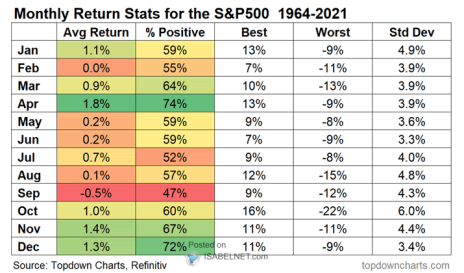

As we approach the last and best two months of the year, the S&P 500 ETF (SPY) has pushed into an area only seen a handful of times since 2019, which sets up a nice year-end trade.

Since the highs set back in late June, SPY has pushed roughly 7.8% lower. As a result, the major market ETF recently entered a weekly oversold reading, an event that historically only occurs once or twice a year.

And as you can clearly see from the chart above, when SPY hits a weekly oversold reading, a short-term to intermediate-term pop is soon to follow. Will we see a similar fate this time around? No one knows.

[text_ad]

But we can certainly place an appealing trade using an options strategy that allows me to be directionally wrong (by 6.6%) and still allows me to make a return of 12.4% over the next 52 days. Let’s go over the details of the strategy and more importantly, the trade, below.

My Favorite Year-End Options Trade to End 2023

A bull put spread, otherwise known as a short put vertical spread, is one of my favorite risk-defined options strategies.

As the name of the strategy implies, a bull put spread is a bullish-leaning strategy. But it is important to note that the strategy doesn’t require the security to move higher to make money. With bull put spreads you not only have the ability to make a return when a security moves higher, you can also make money if the stock stays flat or even if the stock pushes slightly lower. Again, in our case SPY can move 6.6% lower and yet we still have the opportunity to make a 12.4% profit.

The first step in placing a bull put spread, or any trade, is making sure the security we are interested in is highly liquid. We always want to use the most efficient products possible. It just doesn’t make sense to have to make 3% to 7%, possibly more, to get back to breakeven.

The SPDR S&P 500 ETF (SPY) is one of the most liquid options products on the market so we can easily move forward with a potential bull put trade. So, with SPY trading for 423.63 and 7.8% off the year-to-date high, in an oversold state entering a seasonally bullish time of the year, a bull put spread with a high probability of success is exactly the type of short-term, options-selling strategy (30-60 days) that I like to use.

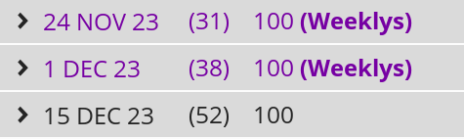

Let’s take a look at the options chain for SPY going out 30-60 days until expiration.

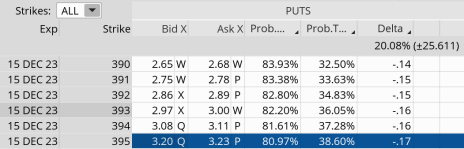

It looks like the December 15, 2023, expiration cycle, with 52 days left until expiration, fits the bill. As a result, let’s take a look at the put strike with approximately a 75% probability OTM (out-of-the-money) or greater, otherwise known as the probability of success on the trade.

It looks like the 395 put strike, with an 80.97% probability of success, is where I want to start. The short put strike defines my probability of success on the trade. It also helps to define my overall premium, or return, on the trade.

Once I’ve chosen my short put strike, in this case the 395 put, I then proceed to look at a 2.5-strike-wide and 5-strike-wide bull put spread to buy.

The spread width of our bull put helps to define our risk on the trade. The smaller the width of the spread, the less capital required. When defining your position size, knowing the overall defined risk per trade is essential. Basically, my spread width and my premium increase as my chosen spread width increases.

For example, let’s take a look at the 5-strike, 395/390 bull put spread.

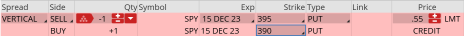

The Trade: SPY 395/390 Bull Put Spread

Simultaneously:

- Sell to open SPY December 15, 2023, 395 put strike

- Buy to open SPY December 15, 202,3 390 put strike … for a total net credit of roughly $0.55, or $55 per bull put spread.

- Probability of Success: 80.97%

- Total net credit: $0.55, or $55 per bull put spread

- Total risk per spread: $4.45, or $445 per bull put spread

- Max Potential Return: 12.4%

As long as SPY stays above our 395 strike at expiration in 52 days, I have the potential to make 12.4% on the trade.

In most cases, I will make slightly less than max profit, as the prudent move (and all research backs this up) is to buy back the bull put spread prior to expiration and lock in some of the potential gains.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But taking off risk by locking in profits is never a bad decision and by doing so we have the ability to take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we have the ability to precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) you are able to sleep well at night while simultaneously becoming a far more prepared trader.

After using a proper position size based on my own personal risk-tolerance guidelines, I look to set a mental stop-loss at 1 to 2 times the original credit. Since I brought in a credit of $0.55, I would look to buy it back if losses in my bull put spread reached $1.10 to $1.65.

If you’re looking for a short-term bullish to neutral-based options trade, this SPY bull put spread is a safe way to play it and earn a reasonably quick and realistic profit.

[author_ad]