Over the past few weeks, many of you have emailed to ask, “How can I protect my hard-earned profits using options?”

And I’m not too surprised. We’ve seen the market double since the pandemic low and the year-to-date returns have been exceptional in all of the major indexes. The S&P 500 is already up 20% in 2021 and we haven’t seen a 5% pullback in over 200 days.

So again, given the current situation in the market, it doesn’t surprise me that the emails are piling in on how to protect profits.

Now, most investors simply buy puts to protect returns.

But, in my opinion, there is a far better alternative to just buying puts. It’s an options strategy that most professionals know as a collar options strategy. The strategy’s goal is to preserve capital, while simultaneously allowing a position to benefit from continued upside in the security, albeit limited.

Unfortunately, greed deters investors from using collars.

[text_ad]

It’s because most investors don’t realize that collars not only protect unrealized profits; they also allow you to hold a position that you don’t want to sell but want some downside protection just in case the stock takes a fall. Think earnings surprises or if you own a stock that pays a healthy dividend that you want to keep holding. Or maybe investors don’t realize it is one of the cheapest yet most effective ways to reduce risk.

It doesn’t really matter the reason. It only matters that you start using this strategy to keep risk in hand.

What is a Collar?

A collar is an options strategy that requires an investor who already owns at least 100 shares of a stock to purchase an out-of-the-money put option and sell an out-of-the-money call option.

Think of it as a covered call coupled with a long put.

- Long stock (at least 100 shares)

- Sell call option to finance the purchase of the protective put

- Buy put option to hedge downside risk

That’s right, you read bullet point “3” correctly. You can actually finance most of your protection so that the cost of a collar is limited – if not free. Again, this is why intelligent investors and professional traders use collars habitually.

Collar Options Strategy in WMT

For my example, I’m going to use a popular portfolio-holding for many investors, Walmart (WMT). The retail behemoth has seen gains of roughly 15% over the past two months and is quickly approaching new all-time highs.

Let’s say we own 100 shares of WMT and would like to protect our return going forward. We still want to hold the stock and participate in further upside. But we also realize that the stock has had an incredible run and want some downside protection, specifically over the short- to intermediate-term.

The stock is trading for 152.10, as of this writing.

1. With WMT currently trading for 152.10, we want to sell an out-of-the-money call as our first step in using a collar option strategy.

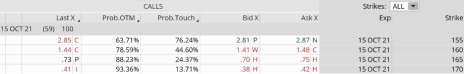

I typically look for a call that has roughly 30-60 days left until expiration. So, to keep things simple, I am going with the October expiration cycle due to expire in 59 days.

In most cases, I don’t want to sell calls that are too far out-of-the-money because I want to bring in a decent amount of premium to cover most, if not all, of the protective put I’m going to buy.

For this example, we can sell the 155 call option in October for roughly $2.83, or $283 per call. We can use the $283 from the call sold to help finance the put contract needed to achieve our goal of protecting returns.

2. The second and final step is to find an appropriate put to purchase. There are many different ways to approach this step, mostly centered around which expiration cycle to use. Should we go out 30 days in expiration? 60 days? 180 days? It really is up to you to decide based on a variety of factors.

My preference is to go out as far as I can without paying too much for my protective put.

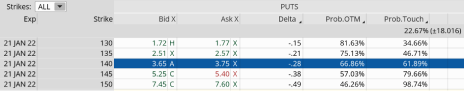

I’m going to go out to the January 21, 2022 expiration cycle with 157 days left until expiration. I plan on buying the 140 puts for roughly $3.75, or $375 per put contract.

This means that roughly 75% of the cost of the January 140 puts will be covered by selling the October 155 calls.

Total Cost: January 140 puts ($375) – October 155 calls ($283) = $57 debit

And we can actually add to our return by selling more calls in November and December while still maintaining protection through January.

So, as it stands our upside return is limited to 155 over the next 59 days. If WMT pushes above 155 per share at October expiration, our stock would be called away. Basically, you would lock in any capital gains up to the price of 155. With WMT currently trading for roughly 152, you would tack on an additional $3, or 2%, to your overall return.

But the key reason to use this strategy is not about making additional returns, it’s about protecting profits. And by using a collar option strategy, in this instance, you are protected if WMT falls below 140 (where we purchased our put option). Essentially, you would only give up 7.9% of your overall returns to insure your position against a sharp pullback.

Collars limit your risk at an incredibly low cost and allow you to participate in further, albeit limited, upside profit potential. I’m certain you won’t regret adding this easy yet effective options strategy to your investment tool belt.

Have you ever executed a collar options strategy? Tell us how it worked out in the comments below!

[author_ad]