With markets churning and persistent low interest rates (despite recent action by the Fed), it’s a challenge for savers to create yield. That said, there is an alternative way to create yield against your stock holdings: sell covered calls, which is exactly the strategy we use at Cabot Profit Booster.

How to Sell Covered Calls

A covered call is an options trading strategy in which the trader holds a long position in a stock and sells a call option on the same stock in an attempt to generate income. For example, if I owned 100 shares of Apple (AAPL) I could sell one call against my 100 shares. And when I sell that call I collect a premium (essentially collecting an insurance premium).

Me and fellow Cabot analyst Mike Cintolo combined our strengths, Mike’s ability to spot promising stock charts and stories with my covered calls prowess, to create Cabot Profit Booster. This is an excellent strategy to reduce risk, and to create yield.

[text_ad]

Here is an example of a covered call trade alert that we executed at Cabot Profit Booster earlier this year using a stock idea and analysis by Mike, combined with my covered call idea.

The Stock – Occidental Petroleum (OXY)

The oil story is fairly well known at this point, so some sort of shakeout is always possible, but the evidence still suggests that the cash flow stories in the sector are far from fully appreciated.

One newer name (for Top Ten anyway) is Occidental Petroleum, which has had a so-so history as it got too diversified for its britches and took on way too much debt in years past; the company has only recently completed a whopping $10 billion divestiture program, leaving it with core operations in the Permian, the Rockies and a little in the Gulf of Mexico and overseas, along with a profitable chemical operation that’s a global leader in caustic soda (helps make soaps, paper and petroleum products) and is the third-largest U.S. maker of PVC (Polyvinyl chloride, used to make pipes, doors and windows).

The acreage is great (Occidental has by far the largest number of top-producing wells in the Delaware basin), which along with the chemical business has led to a torrent of free cash flow of late (nearly $2.50 per share in Q3 alone!), though most of that has gone to debt reduction—Occidental paid back $4.3 billion in Q3 alone and tendered another $1.5 billion or so in December, getting the total figure down to $29 billion-ish.

Here’s why that’s key: Management has said it wants debt to decrease to the “mid-$20 billion range” before it starts boosting returns to shareholders, so it’s possible the firm could hit its target pretty soon—which in turn means it could start paying out huge dividends and/or buying back shares within a quarter or two. And that’s assuming energy prices ease back 10% or 20%–if they stay up here who knows how big free cash flow could be, even if the firm does expand output some.

All in all, Occidental looks like it’s just turning the corner in terms of shareholder returns, and Wall Street is rewarding them for it.

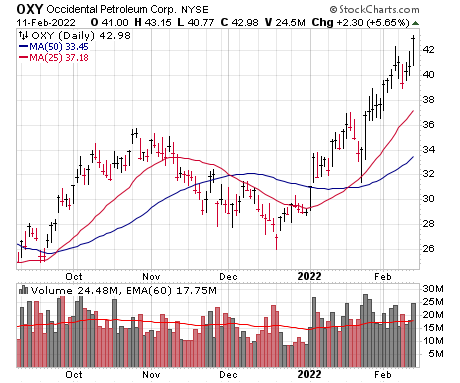

Technical Analysis

OXY hasn’t really been a leader in the oil group—after topping just below 33 last March, the stock suffered through three sharp corrections (31%, 35% and 27%), with no net progress through January of this year. But now we’re seeing a change in character, not just because the stock has moved to new highs but because of the volume (three straight weeks of above-average buying) and persistency, too. We’ll set our buy range down a bit, aiming to grab shares on a shakeout. Stop—33.5

The Covered Call Trade

Buy Occidental Petroleum (OXY) Stock at 40, Sell to Open March 40 Strike Calls (exp. 3/18) for $2.50 or a Net Price of 37.50 or less

Static Return: $250 per covered call (6.67%)

Breakeven: 37.50

Covered Call Return (if assigned): $250 per covered call (6.67%)

Please note, the stock and options prices will be moving throughout the day, so these prices are simply an approximation of prices that you should be able to achieve.

However, the important component of this equation is that the stock price paid, minus the premium received via the call sale, equals the Net Price, or 37.50 or less. (In this case 40 minus 2.50 = 37.50. Or another example is you could pay 41 for the stock and sell the call for 3.50, which also equals 37.50.)

For every 100 shares of stock you buy, you can sell 1 call. For every 200 shares of stock you buy, you can sell 2 calls. And so on …

The above trade idea is a perfect example of what you get at Cabot Profit Booster every Tuesday morning, along with access to me via email if you are new to this strategy, or if you have any general questions about how to sell covered calls.

To learn how to become a Cabot Profit Booster subscriber, click here.

[author_ad]