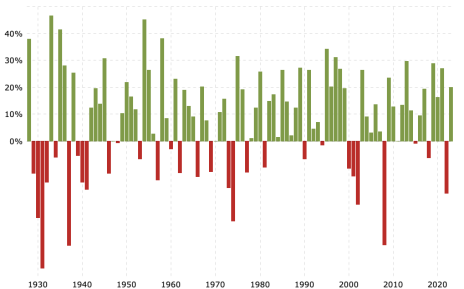

On an annual basis, the market is more likely to be up 20%, than it is to be negative.

Most investors don’t realize this fact. But since 1928, there have been 34 years where the S&P 500 has returned 20% or higher against just 26 total down years. And of the down years since 1928, only 6 have seen losses greater than 20%.

And while this does little in the way of predicting the future, examining historical annual returns in the stock market can equip us with the knowledge to anticipate a range of potential outcomes, establish a solid foundation for informed investment decisions and, with a little practice and patience, generate market-beating returns.

[text_ad]

No one can argue that overall market performance leans heavily towards the bullish side and even more so over the past 50 years.

And as my esteemed colleague, Mike Cintolo, recently stated, “There have been countless opportunities in all types of stocks and sectors—especially following a bad year or two. I’m never afraid to hold cash when the sellers are in control, but I also never take off my optimist’s hat when it comes to the market, knowing all it takes is a couple of big winners to really make a difference in your portfolio.

Thus, I offer no guarantees when it comes to 2024—the market doesn’t work that way—but after a very poor 20-plus-month period for most of the market, with the Fed likely done raising rates and with the market and leading stocks showing some muscle, now’s the time to make sure you have that optimist’s hat on, too, and are ready to benefit should a true bull market be underway.”

I couldn’t agree more.

And that’s why I’m holding a special, year-end event on December 14 at 2:00 PM ET where I’ll discuss my simple strategy that has greatly outperformed the market over the last 2 years — and why I believe it will do even better and help you beat the market in 2024! Click here to sign up to attend or to receive a recording of the event. In the event, I’ll be going over several real-time trades.

The Strategy

One of the areas, among many others, that I will be focusing on as we enter 2024 is the regional banking sector as seen through SPDR S&P Regional Banking ETF (KRE). After taking a beating back in early to mid-2023, the regional banks have made a concerted effort to push back to new highs, but still remain more than 50% below the highs set back at the onset of 2022.

But more importantly, I’ll be employing a strategy that offers a lower capital requirement (65% to 85% less), limited downside risk, income generation, leverage and complete flexibility.

Quick Background – Poor Man’s Covered Calls

A poor man’s covered call strategy is essentially a long call diagonal debit spread that is used to imitate a covered call position, but for far less capital.

How? The strategy doesn’t require buying 100 shares of stock. In fact, no shares are needed.

Like a covered call strategy, a poor man’s covered call is an inherently bullish options strategy. But again, rather than spend an inordinate amount of money to purchase at least 100 shares of stock, you have the ability to buy what is essentially a stock replacement. The replacement? An in-the-money LEAPS call contract.

LEAPS, or long-term equity anticipation securities, are options with at least one year left until they are due to expire. The reason we choose to use LEAPS as our stock replacement is because LEAPS don’t suffer from accelerated time decay like shorter-dated options.

Poor Man’s Covered Call

SPDR S&P Regional Banking ETF (KRE) is currently trading for 48.88.

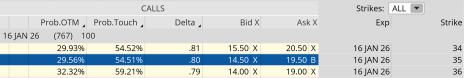

We could buy 100 shares outright and spend $4,888 or buy LEAPS as a stock alternative and spend far less. There are many different ways to approach buying LEAPS, particularly when deciding on which expiration cycle to choose. For simplicity’s sake, I’m going out as far as I can in time by choosing the January 16, 2026, expiration cycle.

Let’s continue to keep it simple and choose the 35 call strike price. It’s currently trading for approximately $17.00.

So, rather than spend $4,888 for 100 shares of KRE, we only need to spend $17.00, or $1,700.

After we purchase our LEAPS call option at the 35 call strike, much like a traditional covered call, we begin the process of selling calls… only against LEAPS, not shares.

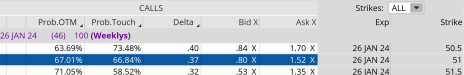

For our example, let’s go with the 51 call strike.

We can sell the 51 call option for roughly $1.15.

Our total outlay for the entire position now stands at $1,585 ($1,700 – $115). The premium collected is 6.8% over 46 days. Might not sound like much, but by holding the LEAPS, we have the ability to potentially sell calls eight times, possibly more, throughout the year for an annual return on premium of 54.4%.

Certainly not a bad potential return. And remember, the return is created solely through the process of selling call premium against our LEAPS. If KRE pushes higher, even better—we also have the ability to generate capital return on our LEAPS position.

I like those prospects and many more as we head into 2024. As an investor, there are a lot of things to be positive about in 2024, and I hope you can join me in discussing the many opportunities I see ahead and the strategies I intend to employ to take advantage of those opportunities and (hopefully) beat the market for yet another year.

Until next time, I hope all of you have a wonderful holiday season, and as always, a prosperous year ahead.

[author_ad]