Well, it’s December, which means two things—one, I’m already behind on my Christmas shopping (naturally), and second, this is my last Wealth Daily of the year. With all that’s going on in the market during the past month and with the calendar flipping in just a few weeks, I figured now was a good time not to focus on a single idea or two, but to simply relay a handful of thoughts on the market (everything from the big picture to individual stocks) I have as we all look ahead into 2024. In no particular order, let’s get to it:

[text_ad]

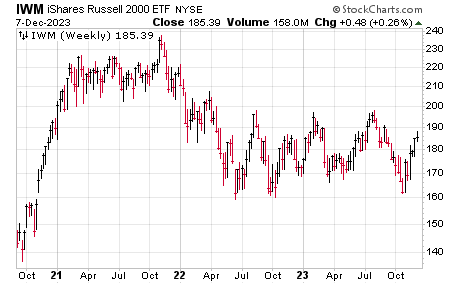

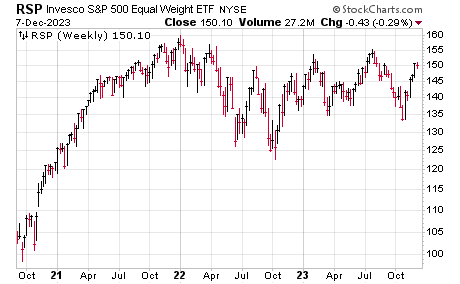

- Most people’s attention is on the big-cap indexes every day, which makes sense, but that’s led to few people realizing that small-cap stocks retested their bear market lows (from 2022) at the end of October—the S&P 600 Index had lost about 28% over the prior two years. If rates really have topped and/or the Fed maybe cuts rates a couple of times next year, I think small-cap funds (like, say, IWM) and even equal-weighted big-cap indexes (RSP) could surprise on the upside as the broad market repairs the damage from the past two years.

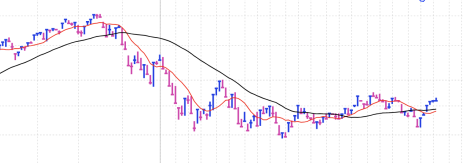

- Similarly, I’m hearing a lot of talk right now about how growth stocks have greatly outperformed value stocks this year—but that’s because most of these indexes are super-weighted to the Apples, Microsofts and Nvidias of the world. But if you’re talking about emerging blue chip-type growth stocks (which is my focus), they’ve been at best rangebound if not out of favor for a while, as you can see via the IBD Mutual Fund Index (weekly chart shown here), which measures the performance of many of the best real-money growth funds. Thus, while the “Magnificent 7” are certainly popular and well known, most growth titles that I follow have been through the wringer for two years—and should have upside if we truly are in a new bull market.

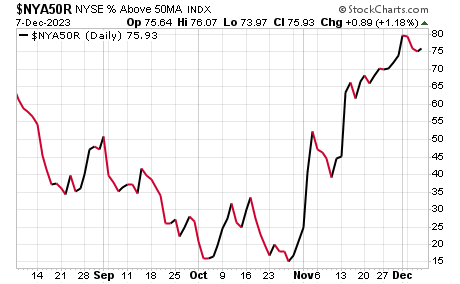

- “Wait, Mike—are we in a new bull market?” Well, I’m trying to stay away from labels at this point, but one thing I am watching on this front is whether one of the market’s granddaddy blastoff measures flashes in the weeks ahead: The 90% Blastoff Indicator flashes green when 90% of NYSE stocks close north of their 50-day lines on the same day, and it has a pristine history of occurring relatively early in a prolonged move. As we’ve seen over the past couple of years, no indicator is perfect, but that (assuming other things are also in gear) would be a great sign the slow times are in the past.

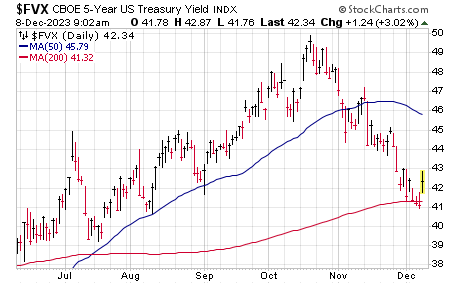

- In a similar vein, one big question I’m getting of late is, essentially, “What makes the current rally different than what we saw in May and June?” I would say two things. The first, of course, is interest rates—the intermediate-term trend of rates is down, while the Fed is almost certainly on hold here (and may even cut rates next year). Interestingly, five-year note yield is down to its long-term 200-day line.

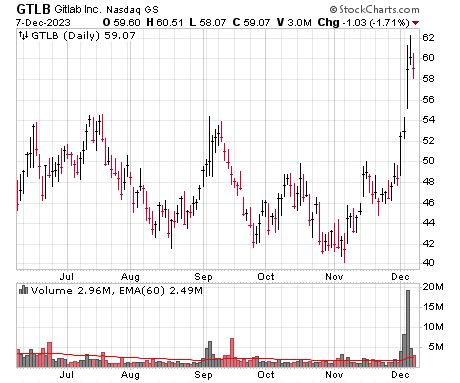

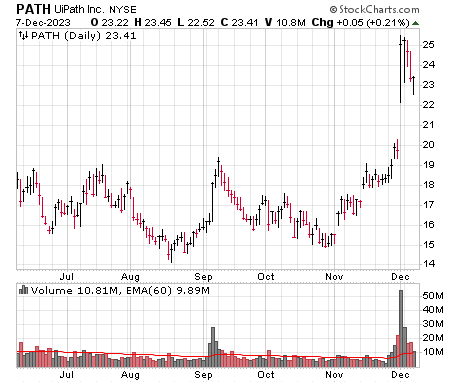

- The other big difference is the reactions to earnings we’re seeing among growth stocks—the Q2 reporting season, in fact, was one of the worst I can remember, with just a ton of names disintegrating after their reports. Q3 has been nearly the mirror image, with names like Duolingo (DUOL), Snowflake (SNOW), Gitlab (GTLB), UiPath (PATH), Nutanix (NTNX), you name it. That’s often a good sign that investor perception is changing for the better.

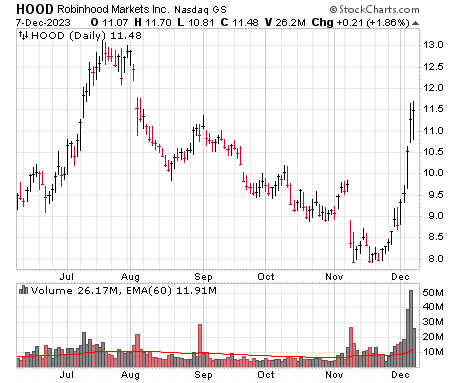

- Now, short term, I am seeing one thing that gives me pause, and that’s the rise in many junky stocks. Yes, during an upmove, many are these names are going to go up, but recently we’ve seen the Beyond Meats (BYND) and Robinhoods (HOOD) of the world start to spike—and in the past couple of years, a few weeks of such action has come near tops. It’s not crazy hot-and-heavy just yet, but another week or two would have me wondering.

My last pre-New Year’s thought is something I always come back to around this time of year—but is especially meaningful this year. I’ve personally been at Cabot more than 24 years, and I consider myself lucky to have experienced many “never seen before” events, such as the biggest bubble ever (1999/2000), a 78% decline in a major index (Nasdaq 2000-2002), a financial crisis (2008), quantitative easing and tightening, a pandemic, various wars and terrorism and much more.

Yet through it all, there have been countless opportunities in all types of stocks and sectors—especially following a bad year or two. I’m never afraid to hold cash when the sellers are in control, but I also never take off my optimist’s hat when it comes to the market, knowing all it takes is a couple of big winners to really make a difference in your portfolio.

Thus, I offer no guarantees when it comes to 2024—the market doesn’t work that way—but after a very poor 20-plus-month period for most of the market (including most growth stocks), with the Fed likely done raising rates and with the market and leading stocks showing some muscle, now’s the time to make sure you have that optimist’s hat on, too, and are ready to benefit should a true bull market be underway.

Until next time, I hope you and your family have a joyous holiday season and, of course, hope for a prosperous New Year.

[author_ad]