After another bout of bearishness, investor sentiment is once again in “sitting on hands” mode. No surprise, as we’ve seen this numerous times over the past several years.

However, I’m always puzzled as to why so many individual investors, seeking to learn alternative ways to invest, immediately move to cash when the market turns sour, especially when there are numerous alternative investment strategies that take advantage of volatile and challenging markets.

I mean, on the surface, I understand the move to cash, but oftentimes there are far better alternatives, especially if you know how to properly incorporate investment strategies that take advantage of bullish, bearish and sideways markets. It behooves us as individual investors to learn as much as we can about how to make money in all market environments, not just bullish ones. And that’s the beauty of risk-defined, high-probability options strategies—they allow us to make money regardless of the overall market trend.

Because, as we often say here at Cabot Wealth, “No one has a crystal ball!” No one knows where the market is headed next.

So, as investors we must open up our toolbelt and use investment strategies that make sense given current market conditions. Since starting my Cabot Options Institute investment service roughly 16 months ago, during what has been one of the most tumultuous and challenging times for investors over the past several decades, my Quant Trader advisory strategy has a win rate of 87.5% (35 out of 40 winning trades) for a total return of just over 165%. Our average trade has lasted only 20.8 days.

One of the three strategies that led me to that performance was an options strategy known as a bear call spread.

[text_ad]

Bear call spreads using highly liquid ETFs are one of my favorite defined-risk, non-directional options trading strategies. It’s a strategy that will allow us to make 10% to 20% over 30 to 60 days while the market forever vacillates between bullish and bearish trends. Remember, we are placing trades that only last, on average, around 20 days. As a result, intermediate to longer-term trends don’t really factor into our decision. So, the ongoing macroeconomic news simply doesn’t have a significant impact on our results. Our decisions are based on a series of statistically based factors, a purely quantitative approach, not piggy-backing on the results of economic reports and the talking heads that try to decipher if they are good or bad for the market.

Let’s walk through a brief example of a potential trade.

Bear Call Spread in S&P 500 (SPY)

With SPY currently trading for approximately 434.50, let’s say we decide to place a trade in the highly liquid S&P 500 ETF (SPY) going out roughly 45 days until expiration.

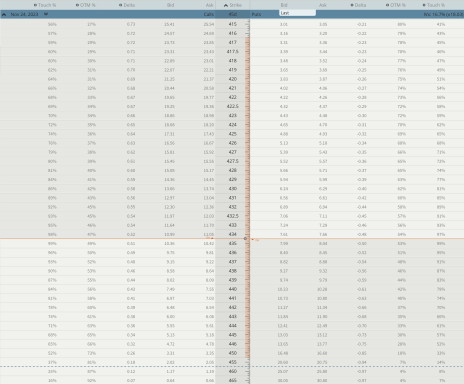

As seen above if you follow the numbers alongside the orange line, the expected move, also known as the expected range, is from roughly 416 to just over 450 for the November 24, 2023, expiration cycle.

Some of you may be asking, what is the expected move? The expected move is the amount that a stock is predicted to increase or decrease from its current price. It’s based on the current level of implied volatility. The expected move is useful for trading options on stocks and ETFs. It can provide insight into market expectations, potential price fluctuations and most important, how the market anticipates current and future movements of an asset. In our case, the market is predicting that SPY will stay within the range of 416 and 450 over the next 45 days.

In most cases, my goal is to place my trade outside of the expected move to increase that cushion even further, thereby increasing my probabilities of success. I prefer to have my probability OTM, or probability of success around 80%, oftentimes even higher.

Choosing the Expiration Cycle and Strike Prices

Since I know the expected range for the November 24, 2023, expiration cycle is from 416 to 450, I can then begin the process of choosing my strike prices.

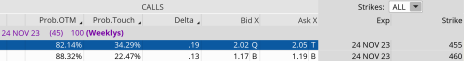

The high side of the expected range is, again, roughly 450 for the November 24, 2023, expiration cycle, so I want to sell my short call strike above the 450 strike. In this case, I have the ability to go well above the 450 call strike and increase my probabilities of success on the upside of the range. By choosing the 455 put strike my probabilities of success on the trade stand at 82.14%. Statistically speaking, this is a very conservative approach to a trade and one of the key reasons why so many professional option traders use this strategy as one of their “bread and butter” investment strategies.

Now, once I’ve chosen my short call strike, in this case the 455 call strike, I then begin the process of choosing my long call strike. Remember, buying the long call strike defines my risk on the trade. For this example, I am going with a 5-strike-wide bear call spread, so I’m going to buy the 460 strike.

So again, with SPY trading for roughly 434.50, the underlying ETF can move higher 4.7% over the next 45 days before the trade is in jeopardy of taking a loss.

Here is the theoretical trade:

Simultaneously…

- Sell to open SPY November 24, 2023, 455 calls

- Buy to open SPY November 24, 2023, 460 calls

We can sell this SPY bear call spread for roughly $0.83. This means our max potential profit sits at approximately 19.9% over the next 45 days. Again, I wanted to choose a bear call spread that is outside of the expected move and has a high probability of success. This is why I chose the 455 calls.

Remember, when approaching the market from a purely quantitative angle, it’s all about the probabilities. The higher the probability of success on the trade, the less premium I’m able to bring in, but again, the tradeoff is a higher win rate. And when I couple a consistent and disciplined high-probability approach on each and every trade I place, I allow the law of large numbers to take over. Ultimately, that is the true path to long-term success. I’m not trying to hit home runs. I understand that true, consistent opportunities, particularly when seeking income, come with using high-probability options strategies coupled with a disciplined approach to risk management—the latter being the most important.

Again, to reiterate, by using a combination of bear call spreads, bull put spreads and iron condors we have managed to win 35 out of 40 trades since starting our Cabot Options Institute Quant Trader service. And that’s why now is the time to start selling options premium using risk-defined strategies. Give Quant Trader a try – I promise you won’t regret it.

[author_ad]