I’m always puzzled why so many investors move to cash when the market turns sour, especially when there are risk-defined strategies to take advantage of a volatile and challenging market.

I mean, on the surface, I understand the move, but oftentimes there are far better alternatives, especially if you know how to properly incorporate options strategies. And if not, well, it behooves us as self-directed investors to learn as much as we can about how to make money in all market environments, not just bullish ones. And that’s the beauty of options strategies—they allow us to make money regardless of the overall market trend. It’s all in the approach.

Because as we hear often here at Cabot Wealth, “No one has a crystal ball!”

[text_ad]

So, as investors we have to open up our toolbelt and use strategies that make sense given current market conditions.

Iron condors using highly liquid ETFs are one of my favorite defined-risk, non-directional options trading strategies. It’s a strategy that will allow us to make 10% to 20% over 30 to 60 days while the market forever vacillates between bullish and bearish trends. As a result, intermediate to longer-term trends don’t really factor into our decision. Our decisions are based on a series of statistically based factors, starting with probabilities.

Let’s walk through a brief example.

Sample High-Probability Options Trade

Iron Condor S&P 500 (SPY)

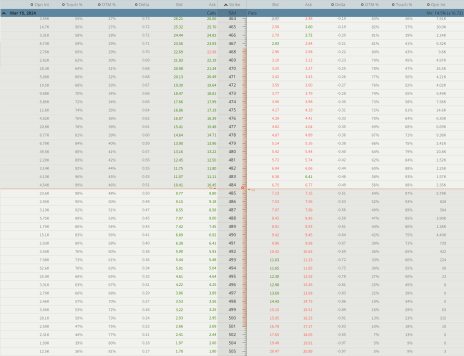

With SPY currently trading for approximately 484, let’s say we decide to place a trade in the highly liquid S&P 500 ETF (SPY) going out roughly 52 days until expiration.

As seen above, the expected move, also known as the expected range, is from roughly 467 to 501 for the March 15, 2024, expiration cycle.

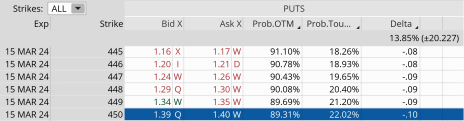

In most cases, my goal is to place the short strikes of my iron condor outside of the expected move to increase that cushion, thereby increasing my probabilities of success. I prefer to have my probability OTM, or probability of success around 75%, if not higher, on both the call and put side.

Choosing Expiration Cycle and Strike Prices

Since I know the expected range for the March 15, 2024, expiration cycle is from 467 to 501, I can then begin the process of choosing my strike prices.

The low side of the expected range is, again, 467 for the March 15, 2024, expiration cycle, so I want to sell my short put strike below the 467 strike. In this case, I have the ability to go well below the 467 put strike and increase my probabilities of success on the downside, by choosing the 450 put strike. Statistically speaking, a very conservative approach to the trade and it increases my margin of error.

Now, once I’ve chosen my short put strike, in this case, the 450 put strike, I then begin the process of choosing my long put strike. Remember, buying the long put strike defines my risk on the downside. For this example, I am going with a 5-strike-wide iron condor, so I’m going to buy the 445 strike.

Again, it’s all about the probabilities when using options selling strategies. The higher the probability of success, the less premium you should expect to bring in. But as long as I can bring in a reasonable amount of premium, I always side with the higher probability of success, as opposed to taking on more risk for a greater return.

So again, with SPY trading for roughly 484, the underlying ETF can move lower roughly 7.6% over the next 52 days before the trade is in jeopardy of taking a loss.

As to the call side, the high side of the expected range is, again, 501 for the March 15, 2024, expiration cycle, so I want to sell the short call strike just above the 501 strike, possibly higher.

The 510 strike fits the bill. By choosing the 510 call strike I am able to give myself a cushion of 5.4% to the upside over the next 52 days.

Once I’ve chosen my short call strike, I then begin the process of choosing my long call strike. Remember, buying the long strike defines my risk on the upside of my iron condor. For this example, I am going with a 5-strike-wide iron condor, so I’m going to buy the 515 strike.

So, with a range of $60 (450-510) and SPY trading for roughly 484, the underlying ETF can move lower by 7.6% and higher by 5.4% over the next 52 days before the trade is in jeopardy of taking a loss.

Here is the theoretical trade:

Simultaneously…

- Sell to open SPY March 15, 2024, 510 calls

- Buy to open SPY March 15, 2024, 515 calls

- Sell to open SPY March 15, 2024, 450 puts

- Buy to open SPY March 15, 2024, 445 puts

We can sell this SPY iron condor for roughly $0.70. This means our max potential profit sits at approximately 16.3% over the next 52 days.

Again, I wanted to choose an iron condor that was outside of the expected move and has a high probability of success. This is why I sold the 510 calls and the 450 puts.

Remember, when approaching the market from a purely quantitative approach, it’s all about the probabilities. The higher the probability of success on the trade, the less premium I’m able to bring in, but again, the tradeoff is a higher win rate. And when I couple a consistent and disciplined high-probability approach on each and every trade I place, I allow the law of large numbers to take over. Ultimately, that is the true path to long-term success. I’m not trying to hit home runs. I understand that true, consistent opportunities, particularly when seeking income, come with using high-probability options strategies coupled with a disciplined approach to risk management—the latter being the most important.

Again, to reiterate, by using a combination of bear call spreads, bull put spreads and iron condors we managed to win 37 out of 46 trades (80.4%).

[author_ad]