Two weeks ago, after another poor inflation reading, the market opened the day significantly lower only to close the day, well, significantly higher. And since the low that was established two weeks ago the market has rallied almost 10%, in just ten trading days. Could a nice trade setup be in play using one of our favorite options strategies?

To monitor such short-term moves, each week I send out my High-Probability Mean Reversion Indicator which includes roughly 25-35 highly liquid ETFs and stocks to my Quant Trader subscribers. We’ve managed to lock in 14 out of 15 winning trades since starting the service back in early June.

The list contains the overbought/oversold levels of each ETF as well as several other statistical readings. And at the moment, we have quite a few ETFs that are considered overbought. Currently, one of the most overbought ETFs is, you guessed it, the major market index SPDR S&P 500 (SPY).

The world’s largest and most liquid index fund has pushed into one of the most short-term overbought extremes in years. And again, it should be no surprise since we’ve seen SPY push almost 10% higher over the past 10 trading days.

[text_ad]

Typically, when this type of short-term extreme is hit a short-term reprieve is right around the corner. Simply stated, mean reversion takes over.

As I’ve explained in the past, there are numerous options strategies that we can use when a highly liquid ETF hits an extreme overbought state, but my favorite is a bear call spread.

As the name of the strategy implies, a bear call spread is a bearish-leaning strategy.

But it is important to note that the strategy doesn’t require the security to move lower to make money. Unlike the binary nature of stock strategies, a stock can either go up or down with a bear call spread. So, you not only have the ability to make a return when a security moves lower, you can also make money if the stock stays flat or even if the stock pushes slightly higher.

Short-Term Overbought State in SPY

With SPY now trading for roughly 383 I want to place a short-term bear call spread going out around 30-50 days. As a reminder, this trade is for educational purposes.

As always, my intent is to take off the trade well before my chosen expiration cycle, in this case the December 16, 2022, expiration date with 51 days left until expiration.

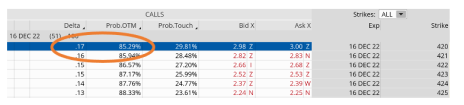

Once we choose our expiration cycle (it will differ in duration depending on outlook, strategy and risk), we begin the process of looking for a call strike within the December 16, 2022, expiration cycle that has around an 80% probability of success.

If you don’t have access to probabilities of success on your trading platform look towards the delta of the various strikes on your trading platform. Without going into too much detail, look for a call strike that has a delta around 0.15 to 0.20, as seen below.

Since we are focused on using a bear call spread, we only care about the upside risk at the moment.

The 420 call strike, with an 85.29% probability of success, works. I want to have an opportunity to bring in 17.1% over the next 51 days, while keeping my probability of success at the onset of the trade to around 80% or higher. The short 420 call strike defines my probability of success on the trade. It also helps to define my overall premium, or return, on the trade.

Basically, as long as SPY stays below the 420 call strike at the December expiration in 51 days we will make a max profit on the trade. By choosing the 420 call, noted below in the chart, we have a 9.7% cushion, or margin of error, to the upside. Remember, we’ve already seen a 10% move in just the past ten trading days, so that would equate to almost a 20% move in just a few months.

But, as I stated before, my preference is to take off profits early and, in most cases, reestablish a position if warranted, much like I have since initiating Quant Trader options strategies back in early June.

Also, time decay works in our favor on the trade, so as we get closer to expiration our premium will erode at an accelerated rate. As a result, we should have the opportunity to take the bear call spread off for a nice profit prior to expiration–unless, of course, SPY spikes to the upside over the next 51 days and tests our short call strike of 420. But still, that doesn’t hide the fact that with this trade we can be completely wrong in our directional assumption and still make a max profit.

Once I’ve chosen my short call strike, in this case the 420 call, I then proceed to look at the other half of a 3-strike-wide, 4-strike-wide and 5-strike-wide spread to buy.

The spread width of our bear call defines our risk/capital on the trade.

The smaller the width of our bear call spread the less capital required and vice versa for a wider bear call spread.

When defining your position size, knowing the overall defined risk per trade is essential. Basically, my premium increases as my chosen spread width increases.

Bear Call Spread in SPY

Bear Call Spread: December 16, 2022, 420/425 Bear Call Spread or Short Vertical Call Spread

Now that we have chosen our spread, we can execute the trade if we so choose. Remember, this is more about learning the mechanics of how I approach a bear call spread when a stock has reached an overbought state.

Simultaneously:

Sell to open SPY December 16, 2022, 420 strike call.

Buy to open SPY December 16, 2022, 425 strike call for a total net credit of roughly $0.73, or $73 per bear call spread.

- Probability of Success: 85.29%

- Total net credit: $0.73, or $73 per bear call spread

- Total risk per spread: $4.27, or $427 per bear call spread

- Max Potential Return: 17.1%

Again, as long as SPY stays below our 420 strike at expiration in 51 days, I have the potential to make a max profit of 17% on the trade. In most cases, I will make less, as the prudent move is to buy back the bear call spread prior to expiration.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But, taking off risk, or at least half the risk, by locking in profits is never a bad decision, and by doing so we can take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I also tend to set a stop-loss that sits 1 to 2 times my original credit. Since I’m selling the 420/425 bear call spread for $0.73, if my bear call spread reaches approximately $1.46 to $2.19, I will exit the trade.

To learn more about all my favorite options strategies, subscribe to a Cabot Options Institute advisory today!

[author_ad]