As 2017 draws to a close, I’m as grateful as anyone at the great year the market has bestowed on us. Bull markets fatten our wallets, lift our spirits (amid a period of unparalleled political rancor) and allow growth investors to indulge in the fantasy that we’re really smart and have this investing thing figured out. If you own TAL Education stock, you definitely know what I mean.

In my last piece for Wall Street’s Best Daily, I profiled Weibo (WB), a Chinese company that plays like a combination of Twitter (TWTR) and Facebook (FB). But another stock has been a huge winner for China investors of late.

TAL Education Stock: 260% Gain in Two Years

If you’re not familiar with it, TAL Education (TAL) is a leading private education provider that has thrived as Chinese parents seek every educational advantage for their kids. TAL Education provides after-school tutoring services for students from kindergarten through 12th grade. Classes in English, Chinese, physics, chemistry and biology are offered in three formats: personalized premium services, small classes and online courses. The company has 474 physical learning centers in 27 key Chinese cities.

[text_ad]

Revenue growth has been exceptional, soaring from 38% in fiscal 2015 to 43% in 2016 and 68% in 2017. And that growth hasn’t slowed in the two most recent quarters, which came in at 65% (in Q2) and 68%. Earnings growth for fiscal 2018 is estimated at 14%, then zooms to a 72% jump in 2019. There’s even a small dividend.

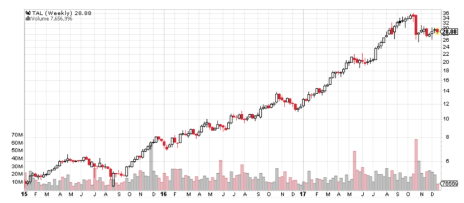

I added TAL Education stock to the portfolio in December 2015; it’s the longest I’ve ever held a stock in Cabot Global Stocks Explorer. There have been a lot of changes along the way, including a stock symbol change (from XRS to TAL) and six-for-one stock split. Here’s what the weekly chart looks like.

You can see the pullback that TAL faced right off the bat, and the jumpy, three-steps-forward-two-steps-back pattern that characterized it through the end of 2016.

I was fortunate to be able to stick with TAL during that late-2015 correction, but the stock wasn’t any problem at all through most of 2017. The couple of months that the stock spent trading sideways in May and June were easy to hold through, as the portfolio’s gain was already about 150%. And when the stock took off again in July, the additional gains were gratifying.

The serious question I wrote about earlier has arisen since TAL gapped down after a disappointing earnings report on October 26. TAL dropped from its October high at 36 to 27 as November began.

It wasn’t all TAL’s fault. The whole Chinese ADR universe suffered a pullback in late October, which reinforced the decline. And TAL has found firm support at 27 as it works to repair the damage.

Mike Cintolo and I always tell our subscribers that rallies can’t go on forever, and you’re going to have to deal with a prolonged flat patch or major correction sooner or later. So how do you handle a stock in which you have a 260% gain?

Buy, Sell or Hold TAL?

TAL Education’s competitors (primarily New Oriental Education (EDU) and Distance Learning (DL)) aren’t doing much better. But the private education story in China appears to be intact.

I have TAL Education stock on Hold for my subscribers, with the understanding that they can take partial profits any time they want to. And another sizable down-leg will likely have me changing my thinking. But TAL isn’t broken at this point, so I will let the portfolio’s big profit keep me in the stock in the hope that another rally will come along.

[author_ad]