Chinese stocks are having a nice year. Chinese ADRs are having an incredible year.

The 90 Chinese stocks that trade on either the New York Stock Exchange or the Nasdaq—called Chinese ADRs (American Depositary Receipts)—have outpaced the Shanghai Stock Exchange by more than 6-to-1 in 2017. That benchmark Chinese stock market is up a respectable 10% so far this year. Chinese ADRs, as measured by the PowerShares Golden Dragon China ETF (PGJ), are up more than 61%.

It’s not a big surprise that Chinese ADRs are outperforming other Chinese stocks. After all, they are vetted for quality and longevity by the two major U.S. exchanges on which they trade, so they are basically a collection of the best, most stable public companies in China. However, the discrepancy in performance this year is quite pronounced.

[text_ad]

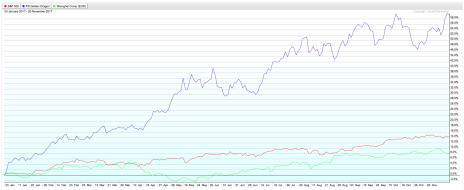

Though a 10% annual return is nothing to sneeze at, Chinese stocks have only achieved about two-thirds of the return of the S&P 500 (+15%) this year. The average investor in China is likely underperforming the average U.S. investor this year. But U.S. investors who bought Chinese stocks this year have likely outperformed them all (see chart below—the green line is the Shanghai Composite, red line is the S&P 500 and the purple line is the PGJ).

At present, 15 Chinese ADRs have more than doubled in 2017—most of them by a long shot. Some of the names will look quite familiar. Others might surprise you. In alphabetical order, they are:

Alibaba (BABA): +116%

Autohome (ATHM): +155%

Baozun (BZUN): +203%

BeiGene (BGNE): +177%

China Lodging Group (HTHT): +137%

DaQo New Energy Corp. (DQ): +147%

Fanhua (FANH): +164%

GDS Holdings Limited (GDS): +133%

Jupai Holdings Limited (JP): +148%

New Oriental Education & Technology (EDU): +113%

58.com (WUBA): +179%

Weibo (WB): +200%

Xunlei Limited (XNET): +488%(!)

Yirendai Limited (YRD): +103%

YY Inc. (YY): +205%

That list is why investing in emerging market stocks is a must!

Will Chinese ADRs continue to outpace not only U.S. stocks, but their Chinese brethren? Who knows.

Here’s what I do know: Paul Goodwin, our resident emerging markets expert, has recommended five of the 15 Chinese ADRs that have doubled this year to his Cabot Global Stocks Explorer subscribers. The 11 emerging market stocks in Paul’s portfolio (which is heavy on Chinese stocks, but also includes recommendations from other emerging markets) boast an average return of 70%. All but two of them were bought within the last 15 months.

So, if you want advice on what to do with Chinese ADRs on the heels of such a major boom, or simply want someone to dig up the next emerging markets stock set to double for you, I highly recommend subscribing to Cabot Global Stocks Explorer. To do so, click here.

[author_ad]