U.S. stocks look expensive, which is why we’ll get to a few Canadian micro-cap stocks in a moment.

I’m going to share two charts to make my point.

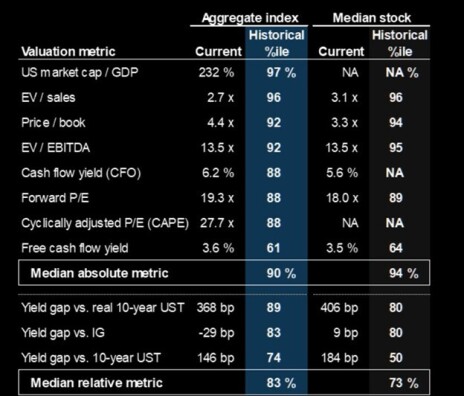

First, if you compare U.S. valuations to historical valuations, stocks look expensive on most metrics.

Next, let’s take a look at the S&P 500 valuation versus the current risk-free rate. As you can see below, the S&P 500 has an earnings yield of ~5% which is roughly at the same level as the 3-month Treasury, the risk-free rate.

This doesn’t make much sense to me.

Why would you invest in the S&P 500 if you can get the same yield owning government-backed securities?

What’s an investor to do?

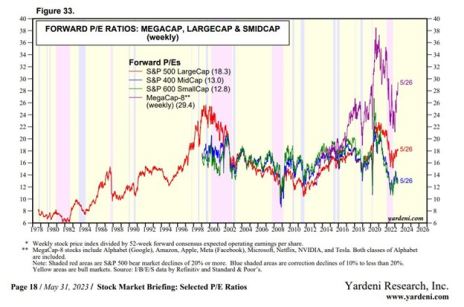

Invest in small-cap stocks!

[text_ad]

Small-cap stocks look incredibly cheap as shown below (courtesy of Yardeni Research).

One of my favorite places to find small-cap bargains is Canada.

The country has a stable and well-regulated economy, which makes it an attractive destination for investment.

Many Canadian companies are multinational corporations with significant operations and global reach.

And being located just north of the U.S., Canadian companies benefit from opportunities for cross-border trade and access to the large U.S. market.

To top it all off, Canadian companies generally trade at a discount to U.S. companies so it’s easier to find bargains.

Today, I’m going to highlight three of my favorite Canadian stocks.

My 3 Favorite Canadian Micro-Cap Stocks

Currency Exchange International (CURN)

Currency Exchange is a Canadian company that specializes in selling foreign banknotes through their retail and wholesale channels while also offering payments solutions to integrated banking customers.

The company is benefitting from a post-pandemic travel boom that shows no signs of slowing.

Last quarter, Currency Exchange showed 32% revenue growth and beat consensus expectations across the board.

Insider ownership is high, and the company has a rock-solid balance sheet.

Finally, Currency Exchange has a hidden asset (payments business) which is highly valuable.

Currency Exchange’s valuation looks attractive at 9x forward earnings and 7x forward free cash flow.

Medexus Pharmaceuticals (MEDXF)

Medexus is a specialty pharma company that just reported a blowout quarter.

Revenue grew 41% y/y while adjusted EBITDA grew over 100% to $4.8MM.

Despite phenomenal growth, the stock trades at just 7x forward earnings, an EV to forward revenue of 0.6x, and an EV to forward EBITDA of 3.8x.

Finally, insider ownership is high ensuring that shareholders are aligned with management.

What’s the catch?

The company has a convertible debenture that comes due in October.

If Medexus has to repay the debenture in shares, dilution will be significant.

Luckily, Medexus is generating significant cash and expects to have $20MM of cash available to repay the debentures and also has a credit facility for $20MM that it can potentially utilize. Finally, Medexus has been buying back its debentures in the open market.

RediShred (RDCPF)

RediShred is a Canada-based, leading document destruction services company.

Insiders own more than 30% of the company.

It has grown revenue at a 31% CAGR and EBITDA at an 80% CAGR over the past 10 years through organic and inorganic growth.

Future growth is poised to continue yet the stock trades at just 5x forward EBITDA.

Want more ideas like this?

Sign up to join Cabot Micro-Cap Insider to get my full investment case for each of these compelling Canadian companies.

[author_ad]