As we celebrate our independence tomorrow, it’s easy this time of year for the sound of fireworks or the smell of a good barbecue to make us Americans forget about the rest of the world. If you’re an investor, doing so means missing out on what’s going on in the Indian stock market right now. Many of the best investments in India are outpacing some of America’s greatest growth stocks.

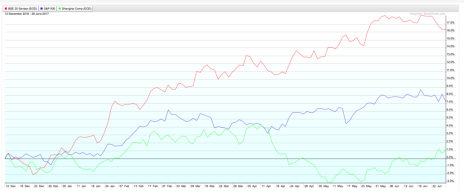

This year, India’s benchmark Bombay Stock Exchange is up more than 16%, outpacing the S&P 500 (+8%), the Nasdaq (+14%) and China’s Shanghai Composite (+2.7%).

Part of the run-up is due to India’s improving economy under Prime Minister Narendra Modi and its ever-exploding population. Part of it is simply a natural rebound after tumbling more than 3% in the last two years. Whatever the case, Indian stocks are back, with Bombay Stock Exchange trading above its 50-day moving average all year.

How can the American investor take advantage of all that momentum? The easiest way is to buy Indian ADRs (American Depositary Receipts), or Indian stocks that trade on U.S. exchanges. Our emerging markets expert Paul Goodwin recently dug up an Indian ADR that is already up more than 42% in 2017!

[text_ad]

The stock is a bank that has achieved 23% profit growth last quarter and double-digit revenue growth in four of the last five years, thanks largely to two big tailwinds in the Indian economy. Paul explained those tailwinds to his subscribers in a recent issue of his Cabot Emerging Markets Investor (now Cabot Global Stocks Explorer) advisory:

“The first is the Indian market of 1.3 billion people. More than two-thirds of India’s population is below 35 years of age, which is prime home-buying age. A little less than one-third of the country’s population now lives in cities, and that number is expected to rise to 40% by 2030. And only 9% of Indians have mortgages, compared with 22% for China and 63% for the U.S. So the potential for growth in mortgage lending is substantial.

“The second big story is a program called the Credit Linked Subsidy Scheme (CLSS), which is part of the government’s headline-making ‘Housing for All by 2022’ push. Under CLSS, the government pays an upfront interest subsidy to the beneficiary that reduces monthly payments. This program was extended in March to include middle- and lower-income groups.

“Personal loans have been the dominant business line for (this bank), but it’s still a mortgage giant that sources 82% of its home loans through itself or its affiliates. And the CLSS program is expected to grow the mortgage pool in India by a big margin.”

Here’s what the stock’s long-term chart looks like.

Paul recommended this Indian bank to his subscribers in mid-June. Put simply, this stock is one of the best investments in India at a time when the entire Indian stock market is in full rebound mode.

To find out what the stock is, click here. If you’re an American, don’t worry—it can wait until after the fireworks!

[author_ad]