Given China’s urban density of 156 cities with populations of more than one million, online retail is one area that should be in high growth mode for a long time. And Chinese internet stocks should follow.

Goldman Sachs research projects an annual growth rate of 25% and estimates that this market could reach $2 trillion by the end of 2020.

China’s logistics and technology capabilities are already going full tilt, with 140 million parcels delivered each day. And the total cost of delivery per parcel in China is only $1 – compared to $5 in the U.S.

Today, let’s take a deeper look at China’s beaten down internet sector.

BAT Stocks Struggling

China has the biggest number of internet and mobile phone users of any country in the world as the country moves towards becoming a digital economy.

[text_ad]

Interestingly, China’s Tencent Holdings (TCEHY), Alibaba (BABA) and Baidu (BIDU), which have a combined market cap of over $800 billion, are all listed outside China.

China’s two largest “mega techs,” Alibaba and Tencent, are both among the world’s largest companies by market capitalization, and are best understood as Google, Facebook, Twitter, Amazon, PayPal, Charles Schwab, Orbitz, Uber and Spotify all rolled into one giant conglomerate.

The huge scalable advantage both these companies have is access to tremendous amounts of data.

One analyst with UBS Group expects the gaming industry in China to grow to three times its current size by 2030. Well, Tencent distributes some of the most played games in the industry and is the largest video game company in the world based on game sales.

Meanwhile, Chinese mega techs are heavyweights when it comes to putting up venture capital funding. For example, of the 34 new unicorn companies in the country in 2017, 60% of them received funding from Alibaba, Tencent or Baidu.

No question, Chinese mega techs have played an important role in helping fuel the growth of many small companies in the country.

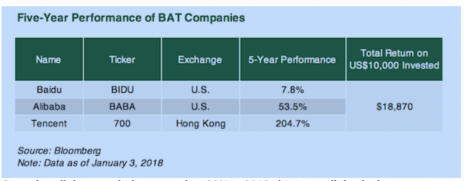

But how have these three stocks done for investors over the past five years?

Given that all three stocks lost more than 20% in 2018, these results are not all that bad.

But in comparison, FAANG stocks, led by Netflix (NFLX), turned $10,000 into $32,000.

What should you do with the BAT stocks now?

This might be a good time to look beyond these three stocks, and take a closer look at other Chinese internet stocks.

Two Ways to Play Beaten-Down Chinese Internet Stocks

When it comes to online travel agencies in China, Ctrip.com (CTRP) is the undisputed top dog. Shareholders have been rewarded for this position in kind, with the stock rising 400% in the last decade.

Recently, the company has hit a speed bump, however. Growth has slowed markedly in one of its key segments, and higher costs are hitting gross margins.

Given that its share price has plummeted from 52 in June 2018 to 29 now, it might be a good time to begin picking up CTRP stock at a discount.

Let me also offer you an easier and more conservative way to take a stake in Chinese internet stocks: KraneShares China Internet ETF (KWEB).

KWEB tracks a foreign equity index composed of overseas-listed Chinese internet companies. So while not perfectly capturing China’s internet economy, KWEB is a good pure-play on Chinese internet software and service providers.

KWEB has fallen from a high of 68 to 40 in the last year, presenting investors with a nice entry point.

The top 10 stocks in this ETF basket represent 60% of total assets and include names such as Baidu, Alibaba, NetEase (NTES), Ctrip and Tencent.

Your potential upside is always better selecting the right individual stock but this particular ETF is a good way to play the impending rebound in Chinese internet stocks.

Now, if you want some more specific names of Chinese internet stocks, check out which ones I’m recommending in my Cabot Global Stocks Explorer advisory by clicking here.

[author_ad]