It’s easy to compare Alibaba to Amazon. And BABA vs. AMZN stock has been a virtual standstill. Which is the better stock going forward?

The “BAT” stocks—Baidu (BIDU), Alibaba (BABA) and Tencent Holdings (TCEHY)—tell a compelling China story. The three companies have a combined market capitalization of over a trillion dollars and dominate their industries in China: online search, e-commerce and messaging, respectively. Cabot Explorer subscribers made outstanding profits in these stocks, once upon a time.

Today, I want us to compare a couple of strong growth stocks, though comparing these three would be like comparing apples, oranges and small potatoes, especially since Baidu is a relative pipsqueak at just $71.5 billion in market cap.

I think a better comparison would be between Alibaba and Amazon (AMZN) because 1) they’re in the same industry, 2) they dominate their respective markets within that industry and 3) each one has a dynamic leader whose ambition seems to extend to other galaxies.

[text_ad]

With that in mind, here’s a comparison of BABA vs. AMZN, the globe’s two biggest e-commerce companies along with a personal opinion as to which one is a better investment right now. As usual, using Cabot’s approach to growth stocks, we’ll look at the stocks’ stories, numbers and charts.

BABA vs. AMZN: Stories, Numbers, Charts

Let’s begin with the charts, because the early similarities between the two since the start of the latest bull phase in 2016 seem remarkable to me. Here’s the chart.

From late 2016 until June 2018, the performance of these two e-commerce giants was often so parallel that you could barely put a playing card between them. Yes, Amazon (the black line) had a flat patch from April to October in 2017, and there was a conspicuous divergence between the two stocks in the second half of 2018.

But after the steep correction in late 2018, both stocks became re-synchronized and both made considerable gains in the two years that followed (BABA rose almost 20% in the pandemic-impacted year of 2020—and was up as much as 45% intra-year—while AMZN gained an eye-popping 80% last year).

The lesson here is that the appetite of big investors for mega-cap e-commerce stocks knows no borders. Big money wants to buy big, fast-growing companies, and while Amazon clearly enjoyed an advantage over Alibaba last year, the distinction between developed and emerging markets is narrowing.

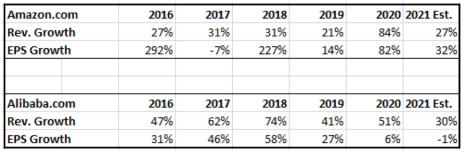

Despite the trade war-related setback both companies suffered in 2019, the long-term growth numbers for AMZN and BABA are strong in the last few years, which isn’t surprising. Here are a couple of tables summarizing revenue and earnings growth.

While AMZN outperformed BABA in some key metrics in 2020, both online juggernauts posted strong growth thanks to last year’s pandemic, which encouraged millions of people globally to turn to e-commerce. Indeed, in both China and the U.S., lockdowns and pandemic-related restrictions resulted in a dramatic shift among virtually all demographic segments of both countries to shop less at physical stores and buy more things online.

In value terms, AMZN trades at a P/E of 65 and BABA’s P/E is 28. Since most of the growth stock screens that I’m familiar with call for greater than 20%, I think these companies qualify.

Both stocks are hugely liquid and have a ton of institutional sponsors, so there’s nothing there to choose.

With Jeff Bezos at the helm of Amazon and Daniel Zhang in charge at Alibaba, neither company lacks for ambitious, intelligent leadership. (Jeff will step down as Amazon’s CEO on July 5 and accept the role of executive chairman, while the capable Andy Jassy becomes the new CEO).

Both Jeff and Daniel have been using their massive free cash flows to move into cloud services and original content production, while also acquiring (or forming joint ventures with) businesses in allied fields. Jeff bought the Washington Post newspaper and Daniel (with a big hand from predecessor Jack Ma) has turned China’s Singles Day (November 11) into an online media event that gets as much press as Black Friday.

My decision on which stock to favor in BABA vs. AMZN comes down to this: If you can only buy one, I’d favor Alibaba, if only because China’s population is bigger (about 1.4 billion versus the U.S.’s 327 million) and China’s projected GDP growth rate of 8% for 2021 is still faster than the U.S. projected growth rate of 6.6%, though the gap is narrowing.

Looking ahead, the U.S. is predicted to post 3.8% GDP growth in 2022 and 2.5% in 2023, according to the Conference Board. For China, the growth rate is projected to be 5.6% in 2022 and 5.4% in 2023, according to the IMF. Each of these statistics points to greater potential in Alibaba.

However, it makes no sense to me to buy only one. Buying a stake in both AMZN and BABA stock gives you a little protection should either company falter. And while the old notion that emerging markets would provide a hedge if developed markets ran into an iceberg (or vice versa) has been undercut by globalization, owning positions in both stocks looks like a potentially useful diversification.

[author_ad]

*This post has been updated from an original version, published in 2017.