Tesla (TSLA) CEO Elon Musk vowed to leave his position on two White House councils if President Donald Trump elected to pull the U.S. out of the Paris climate accord. Last Thursday, he followed through on that promise, following Trump’s decision to cut the climate accord cord, saying, “Leaving Paris is not good for America or the world.” It also might be bad for TSLA stock.

Inventors of the luxury electric car, Tesla prides itself on being an emissions-free, environmentally friendly automaker. So Trump’s decision to pull out of an agreement signed by 195 countries in Paris in December 2015 is not good for business. As part of the Paris climate deal, the U.S. pledged to reduce its greenhouse gas emissions by 26% to 28% from 2005 totals by 2025. Instead, Trump exited the pact to benefit the American worker, choosing “Pittsburgh over Paris,” as he put it.

Whether or not you agree with Trump’s decision to side with emissions-producing oil, gas and coal companies is your business. If you’re an investor in U.S. energy stocks focused primarily on domestic production, you’re probably quite happy with Trump’s decision. But if you’re an investor in TSLA stock, it probably has you worried. And with good reason.

[text_ad use_post='129627']

Pact Exit Ripple Effect

Few companies are more levered to the global shift toward reducing carbon footprint than Tesla. Electric, battery-charged cars and SUVs like the Model S, Model X and soon-to-be-released Model 3 are Tesla’s way of catering to a world that’s slowly shifting away from gas guzzlers like the Ford F-150 and the Chevy Tahoe. Musk doubled down on his bet on an increasingly climate-conscious world when he merged Tesla with SolarCity, the solar roofing company Musk started with two of his cousins. Trump’s decision to exit the Paris accord is in direct conflict with both of Musk’s enterprises.

And it’s not just symbolic. Consumers aren’t likely to stop buying Model Ss and solar roofing panels just because Trump pulled out of the Paris pact. But in doing so, Trump could cut billions of dollars in subsidies and tax credits for low-carbon technologies. According to the Los Angeles Times, Tesla receives $4.9 billion in government subsidies. Considering the company has just $4 billion in cash and has never turned an annual profit, those subsidies are essential to Tesla’s business, at least for now.

While Trump has managed to push through some of his policies through Congress (ObamaCare repeal, at least in the House), others have been either strongly rebuffed (Muslim ban) or left to lie mostly dormant (infrastructure spending). So there’s no guarantee mass cuts to low-carbon tech companies are forthcoming. Anyone who tells you they know exactly what this unpredictable president will do next—and how it will be received in Congress—is lying. Thus, you should not invest in stocks based on what Trump might do.

Don’t Sell TSLA Stock

And that includes TSLA stock. It’s true that Trump’s decision to turn America’s back on the Paris climate pact is ostensibly bad news for Tesla. Elon Musk’s immediate withdrawal from his two presidential councils is a tacit admission of that. But you shouldn’t sell Tesla stock because of it. Fortunately, few TSLA shareholders are selling: the stock scarcely budged in the two trading sessions following the announcement.

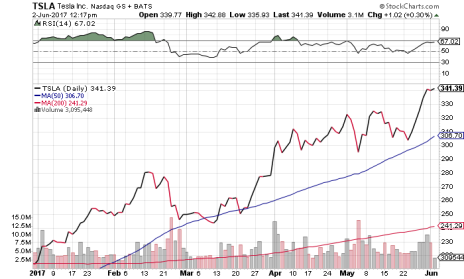

For now, TSLA stock remains red-hot, up nearly 60% year to date! That kind of buying momentum, plus the nearing Model 3 launch, are more than enough reason to still be bullish on TSLA.

[author_ad]