Regardless of how you feel about Elon Musk and his antics du jour, Tesla (the car company) has been revolutionary, having paved the way for the abundance of EVs now hitting America’s roadways. For many investors, Tesla (the stock) has been even better, minting millionaires out of its earliest believers (although past performance is no guarantee of future performance).

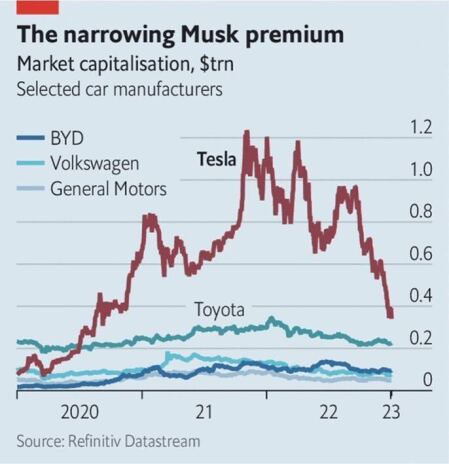

But, as you can see in the chart below, the recent performance of Tesla (TSLA) has been abysmal, with shares shedding 65% in the last year and off 70% from all-time highs in November of 2021.

It’s convenient to hand-wave away that sell-off by attributing it to the Twitter debacle, the possibility that Elon Musk (who made history as the first individual to lose $200 billion) may have to continue liquidating significant chunks of his TSLA holdings to support the Twitter buyout (Musk continues to hold a 13% stake in the company even after selling $22 billion of shares last year), or just the general risk-off sentiment in the market (TSLA is not the only high-flying growth stock to lose 70% in this bear).

There is another possibility though. Rather than punishing shares for the actions of Musk, Tesla may have matured enough that investors are now approaching it as an established car company.

[text_ad]

The following graphic, which compares the market caps of select auto manufacturers, recently made the rounds on Twitter (credit to @buccocapital).

Now, comparing market caps is not a particularly useful endeavor (although it makes for an entertaining graphic).

But it did raise a worthwhile consideration. What would it look like for the market to re-rate Tesla to a car company from a growthy start-up?

A Tesla Re-Rate

A re-rate is just a consensus shift in market sentiment where investors, collectively, decide that prior valuation metrics are no longer applicable and that a company should be valued differently. As an example, imagine if Amazon (AMZN) decided to completely abandon online retail, Amazon Web Services, and all the other growth components that lead it to trade with a trailing P/E of 76, and decided to start manufacturing ball bearings.

The largest bearing manufacturer is Swedish company SKF. It has 44,000 employees and has been in business for over 100 years. It also trades at a trailing P/E of 16.

Even if a hypothetical Amazon Ball Bearing Co. usurped SKF, became the world’s biggest bearing manufacturer, and manufactured bearings faster and cheaper, it wouldn’t support those sky-high valuations.

So, if investors are beginning to value TSLA more like a car company, what are they comparing it to?

| Company | Trailing P/E | Forward P/E |

| Tesla (TSLA) | 38.9 | 22.6 |

| Toyota (TM) | 10.2 | 8 |

| Honda Motor (HMC) | 8.3 | 6.1 |

| Ford (F) | 5.6 | 6.9 |

| General Motors (GM) | 6.1 | 5.9 |

That’s just a sampling of some auto majors, although tracking from NYU’s Stern School of Business has an average trailing P/E of 10.3 and forward P/E of 10.2 across 31 “Auto and Truck” companies.

Another caveat is where revenue is coming from. Tesla generates about 89% of its revenue from auto sales with most of the balance coming from battery technology. Similarly, GM derives revenue from auto sales (at a comparable ratio to Tesla), GM Financial, and its OnStar subscription service.

The same is true for Honda and Toyota, which each derive revenue from non-auto sources as well, although, in each of these cases, auto sales generate the lion’s share of revenue.

That would, seemingly, put a P/E target for TSLA in the 6-10 range, although given Tesla’s impressive market-share growth, perhaps it could command something closer to the forward-looking estimates in the 16-20 range.

Sell-side analysts largely disagree with the assessment, as the average price target for TSLA is 222, and Goldman, Morgan Stanley, Baird, Wedbush and Canaccord have all recently reaffirmed either buy or overweight ratings (although at least one analyst in the contrarian camp has a price target of only 24.33).

The best-case scenario, if we are truly seeing a Tesla re-rate, is likely somewhere between that contrarian price target and where shares are trading now. Keep in mind, Tesla nearly doubled earnings YOY in the last two quarters, which themselves came on the heels of 630% and 750% earnings growth in the quarters prior to that.

That is significant earnings growth, and Tesla has grown market share impressively, rising from 1% to over 3% in the U.S. in just the last four years. For investors that bought shares early with Top Ten Trader and Stock of the Week, who are sitting on significant profits, the bullish analyst sentiment and earnings growth may justify holding on. But for new investors? The crummy short-term chart and potential for more pain to the downside probably make this one a stay-away.

To learn about Cabot’s favorite stocks this month, click here to download your free report.

[author_ad]