The market has been gyrating wildly on a ton of news items of late, from bank failures to inflation reports to dozens of key earnings releases. With all of this going on, along with the endless will they/won’t they guesses surrounding the Fed’s next move, we figured we’d yank Mike Cintolo, Cabot’s Chief Investment Strategist and head of Cabot Growth Investor and Cabot Top Ten Trader (you get lots of titles when you work here 24 years, I guess), over for a quick interview to get his latest thoughts and insights on everything he’s seeing and thinking with today’s market. Here we go.

Brad: Hey Mike, thanks for joining us today—though I suspect you’re not too upset about being pulled away from this meat grinder environment, as you’ve written. Let’s just start with your overall view of where the markets stand.

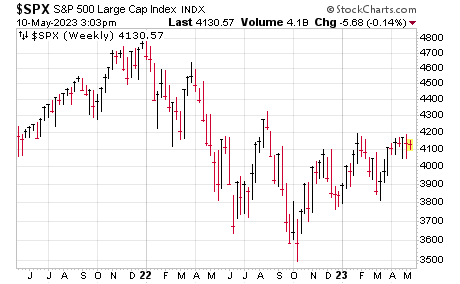

Mike: Hey Brad—and yes, I always try not to stare at a quote screen all day, and that’s been especially true of late as things are just getting tossed around. As for the market, it’s interesting as there’s plenty of encouraging signs, but also plenty of bad out there, and the major indexes are just flopping around. Don’t get me wrong, there are some names and areas that look good, but it’s one of those environments where, if you own five stocks, two are doing OK, one does nothing and a couple hit potholes—hence my less-is-more stance, at least for now.

[text_ad]

Brad: Right, and you’re holding about 60% cash in Cabot Growth Investor, which tells people what you’re thinking. OK so beyond your indicators and all that, you mentioned there are real positives out there. Let’s go with that: What are they and what would it take for you to take action on them?

Mike: Yes, good question—and after 18 months of bearish action, it’s important for all of us to remember the sun is going to come up at some point and in a big way. Right now, I would say there are three main positives I see. The first is something I’ve written about, and it’s simply that the major indexes, all of them, really haven’t gone down net-net during the past year despite a ton of Fed rate hikes, recession fears and now a rolling run on regional banks. To me, if the market wanted to cave in recent months, it easily could have as the Fed continued to tighten even as a couple of giant banks walked the plank.

Second is sentiment, which is not a core indicator for me, but I really do believe the weak market and recession fears have seeped into the public’s consciousness at long last. Money has been pouring out of funds and expectations are just low for today’s market, for the country, for everything. Moreover, one of my favorite market-isms is that the market is usually a bad teacher—“teaching” you to always buy the dip right before a bear gets underway or to sell out and think small just as new leaders are set to launch. I tend to think, in a general sense, the latter is going on right now.

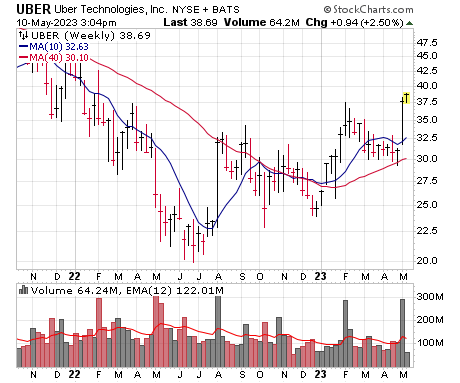

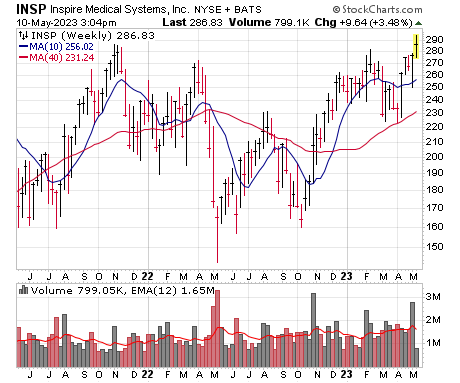

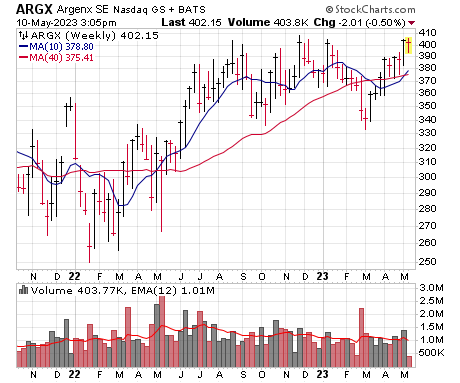

Finally, the third thing is really intertwined with sentiment—I’m seeing a lot of growth stocks and many other stocks using the past three months, since the market ran into trouble in early February of this year, to etch tighter, more proper launching pads. That’s something that I’ve seen in real-time in the past and learned through studies; early on in bears, corrections are obviously super deep, but then usually over many months, stocks and the market will begin to tighten up. Heck, we’ve seen some of these sorts of names take off in recent days.

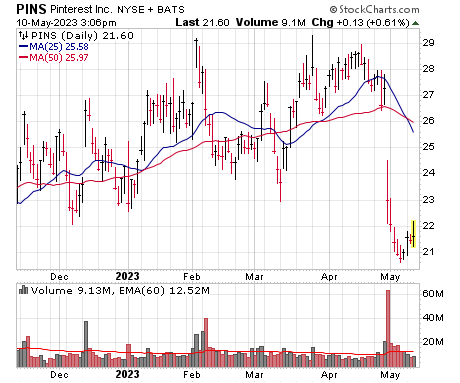

And beyond the tightness, I’m just seeing a lot of setups—and the combination of lots of proper-looking setups among solid fundamental stocks with great pessimism and worry, that always gets my attention as any good news could see a bunch of stocks get moving. (See some examples below.)

Brad: So that’s interesting—you’re seeing a lot of stocks sort of in pole position to get going, but they haven’t yet, at least en masse?

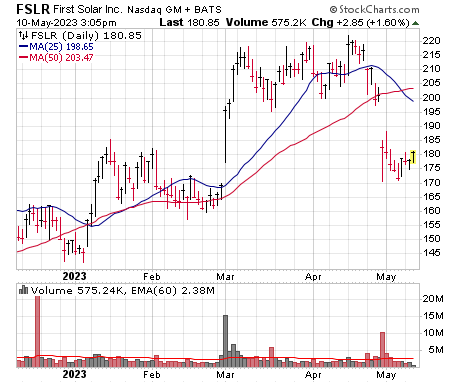

Mike: Basically, yes—don’t get me wrong, it’s not 1999 out there, and some stocks have certainly failed on earnings. In fact, two weeks ago we saw many names like First Solar (FSLR) give up the ghost. But I think there would be a good amount to work with if the market changed its tune.

Brad: And what would it take for you to say “Hey, it’s go time, we need to start buying?” And what might be the catalyst for that?

Mike: Well, that sort of gets to the point about what’s wrong with today’s market—and of course, there are a few things. The first I would mention is the broad market and the fact that financial stocks are still acting like garbage, led by regional banks. In other words, in the intermediate term, most stocks and sectors are still acting iffy at best.

More than that is the #1 bugaboo that has been with us for nearly all of the bear phase, since late 2021—selling on strength. Time after time, I’ll see stocks set up, look good, tighten up—and then sell off, either before or after poking out above key resistance. To me that’s a clear sign that big investors aren’t confident enough, except in a select few stocks, to really pile in.

Anyway, to answer the question, the thing that would get me off the sideline in a big way is simply to see these negatives change—to see stocks really break out and the broad market run and all that.

Brad: That makes sense. I know you’re not a macroeconomy or politics guy, but as someone who’s been around the block, any opinion on the Fed, interest rates, the debt ceiling and all of that?

Mike: Not really. I mean, I follow this stuff along with every other investor and see the CPI reports and the headlines about the debt ceiling. But I prefer to just stay flexible and stick with the action of the market and leading stocks. There’s been a lot of unprecedented stuff in recent years, or things that haven’t been seen in 40 or 50 years, but following the rubber-meets-the-road evidence has always kept us on the right side of things. That doesn’t mean inflation can’t pick up again or our Washington peeps can’t ruin things, but I have no edge guessing about that—it’s best to just follow the evidence, which is basically telling you what big investors are doing.

Brad: Last “question” of sorts is something you mentioned on a recent internal Cabot call, and you mentioned you’d like to end with. So, take it away.

Mike: Yes, listen, I certainly don’t have all the answers, nobody does in this business. But I do have some experience, coming up on 24 years, more than half my life, at Cabot. And since that time, I’ve seen some whopping declines—a three-year bear market after the biggest bubble ever, a housing collapse, a pandemic crash and then the current 18-month rigamarole—and like I said above, some rarely- or never-seen-before stuff like quantitative easing and tightening and terrorism and more. And a lot of people out there that just started investing five or six or even 10 years ago look at all of this as unprecedented.

But, at day’s end, there are always rarely-seen-before worries in a bear market—and each and every time the market gets back on its feet—and doesn’t just enjoy a rally, but a new bull market that takes the indexes to new highs and, more importantly to me, launches dozens of new leaders that will be “the next” Twilio or “the next” Chipotle.

In other words, this isn’t our first rodeo—we’re not perfect, but we know how to stay mostly safe in a downtrend or a choppy environment for as long as needed, and we also know what to look for to tell us when a new bull is underway—and where to find the new leaders, too. Right now, at least for growth stocks, it’s a time for patience, but the reason we tune in every day is because we know a huge upmove is coming with huge winners.

In a sense, now is the best time to start or stay engaged with the market, as the next couple of years should be fantastic in general. Just something to keep in mind as the bad news bombards all of us each day.

Brad: Well said, and a good way to finish up. Thanks for your time, Mike.

[author_ad]