Alphabet (GOOG) has never been mistaken for a value stock. Since the debut of GOOG stock on the NASDAQ in 2004, it has been one of the market’s best growth stocks. Today, as one of four prongs in the so-called FANG stocks, GOOG is as synonymous with growth as ever. Lately, however, it hasn’t been growing.

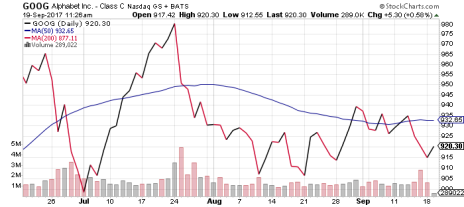

Since hitting an all-time high of 983 in June, seemingly steamrolling its way to 1,000 along with fellow market leader Amazon (AMZN), GOOG stock is down 6.5%, at one point dipping below 900. As it has for most of the last three months, GOOG is trading below its 50-day moving average. Here’s what its three months of backsliding look like on a chart.

Along the way, Google stock has become something it rarely has been: cheap. At less than 23 times forward earnings estimates (and with a trailing P/E of 33), GOOG is far and away the cheapest of the FANGs.

[text_ad use_post='129627']

The reason behind the dip in Alphabet’s value seem obvious: earnings were down 28% last quarter, and are expected to slide nearly 11% for the year. However, given that the bottom-line regression appears temporary—analysts anticipate a 31% increase in profits in 2018, which would represent Alphabet’s best earnings growth since 2009—I doubt this downturn in GOOG stock will last much longer.

No stock ever grows upward in a straight line. Even the best growth stocks hit the pause button now and then as investors seek out cheaper alternatives, or companies that are in earlier stages of growth. With EPS expected to decline another 8.2% in the third quarter, the pullback in GOOG stock may not be over yet—at least not until after the next earnings season. But as a company, Alphabet is simply too diverse, too innovative and too much of a market leader to stay down for long. Its earnings may not be expanding at the moment, but its sales are: the company has posted four straight quarters of at least 20% sales growth, and expects to do so again this quarter. Apple (AAPL) would kill for that kind of top-line growth.

Every now and then, great stocks like GOOG hit the skids enough to offer up a nice entry point for investors who are late to the party. There may be more shakeout action ahead, especially in advance of next month’s likely underwhelming earnings report. But once GOOG breaks above its 50-day line for more than a couple of trading sessions—something it hasn’t done since July—I’d consider buying the stock (or adding to your position if you already own it).

Once it does that, chances are GOOG stock will get going in a hurry. It did, after all, jump from 771 to 983 (0r 27.5%) in the first five months of this year. Another Google rally likely isn’t far off. Just pay close attention to the chart, and you may be able to nab a premier long-term stock at a relative bargain.

[author_ad]