I have to laugh every time I walk into a dollar store. You see, my mother always tried to drag me into these very discounted stores when I visited her, but I didn’t want any part of what I assumed were dark, dirty, cheapo stores that sold off-brands! However, after seeing the bags of goodies she would bring home—including name brands—at incredibly discounted prices, I decided to see for myself.

And I’m glad I did! I have thrown some very successful parties with decorations and silly prizes coming from dollar stores. The savings are immense. In fact, a couple of years in a row, I held Halloween events with decorations and a variety of photo props—for less than $50!

Looking at the data on dollar stores, it’s easy to see that I’m just one of millions of shoppers who are avid dollar store shoppers. Statista.com reports that there are currently more than 35,000 dollar stores across the United States.

[text_ad]

The big four dollar store stocks that are publicly traded are:

| Stock | Symbol | 2021 Sales ($) | # of Stores (2021) |

| Dollar General | DG | 34.22 billion | 18,216 |

| Dollar Tree | DLTR | 26.32 billion | 15,115 |

| Big Lots | BIG | 6.15 billion | 1,400 |

| Five Below | FIVE | 2.84 billion | 1,200 |

Dollar store sales—and the companies’ stock prices—have been on a pretty good trajectory for the last few years, and COVID-19 propelled them even further. Last year, total dollar store sales rose reached an all-time high of $95 billion. With consumer spending rising but many still feeling the pinch of the pandemic, the demand for inexpensive groceries and household items took off. Rural areas—with fewer shopping choices—were especially strong.

IBISWorld is predicting that dollar store revenues will cool slightly to $94 billion this year, although profits may take a bit of a beating due to rising freight costs, inflation and labor shortages.

Dollar Store Stock #1: Dollar General (DG)

Dollar General (DG), with products priced mostly under $5, reported full-year sales growth of 1.4% on the heels of 20%+ growth the year before.

It seems like there’s a Dollar General every couple of miles. Here in my small town in Tennessee, there are 20!

And while Dollar General has been popping up new stores very rapidly for the past few years, it is now getting ready to expand its target markets. The company plans to open stores under the Popshelf brand, marketing goods to affluent, suburban customers.

30 analysts follow DG and are forecasting a median price target of 249, with a high estimate of 285 and a low estimate of 197.

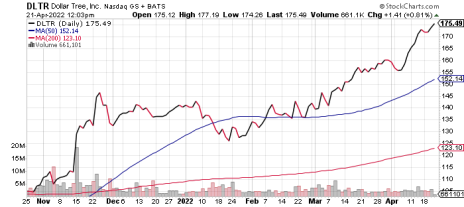

Dollar Store Stock #2: Dollar Tree (DLTR)

Dollar Tree (DLTR), which also owns Family Dollar, saw 4.6% sales growth last year. The company made headlines earlier this year when it announced plans to raise prices on most items to $1.25. It is the first store on my list when I’m looking to buy decorations or even cute boxes to hold candy that I make at holidays.

More than 24% of its customers are classified as “affluent,” making more than $100,000 per year. The company is boosting its presence by combining the Dollar Tree/Family Dollar stores in some rural areas. Its Family Dollar stores are now using Instacart for same-day delivery on certain products, and that brand is expanding its fresh produce and meat sales this year. In Dollar Tree stores, last fall the company installed a Crafter’s Square section to accommodate the uptick in demand for homemade goods. Dollar Tree is also expanding its Dollar Tree Plus brand, which carries merchandise at multiple price points (usually $3-$5), to 500 stores from the current 120.

John Reese of Validea Hotlist Newsletter recently had this to say about DLTR:

“Dollar Tree is considered a ‘True Stalwart,’ according to this methodology, as its earnings growth of 18.24% lies within a moderate 10%-19% range and its annual sales of $25,702 million are greater than the multi-billion-dollar level.

“This methodology looks for the ‘Stalwart’ securities to gain 30%-50% in value over a two-year period if they can be purchased at an attractive price based on the P/E to Growth ratio. DLTR is attractive if DLTR can hold its own during a recession.”

Dollar Store Stock #3: Five Below (FIVE)

Five Below (FIVE) sells items for $5 or less, with most products directed toward teens. For fiscal 2021, the company reported 45% net sales growth to $2.8 billion and signaled its plans to triple store count.

Mike Cintolo, editor of Cabot Growth Investor and Cabot Top Ten Trader, has been in and out of FIVE many times given his propensity for “cookie-cutter” stocks with a proven track record of expansion.

Right now, the stock is perched between its 50- and 200-day moving averages and right in the middle of its YTD trading range. The company just reported earnings on March 30 and shares are in the midst of a gradual uptrend.

Dollar Store Stock #4: Big Lots (BIG)

Big Lots (BIG)—my favorite dollar store—actually sells products at many price points, but they are heavily discounted. If you are looking for inexpensive spices, gourmet food gifts, or great holiday paperware, this is the store for you!

For its fourth quarter, the company reported net income of only $49.8 million on sales of $1.73 billion, with EPS of $1.63 being dragged down by an estimated $0.30 per share loss due to product shrink.

The company has attributed the recent sales declines to significant supply-chain hurdles, but CEO Bruce Thorn believes the company can address both those hurdles and the shrink, saying they “are actively implementing new processes and technologies that [they] are confident will improve shrink results going forward. In addition, [they] are aggressively tackling the current macro inflation and supply chain headwinds and building a more mature pricing organization to optimize margin, while continuing to provide excellent value for [their] customers.”

With the stock having given back all of 2021’s gains in the back half of the year (and declining 20% since), it would be prudent to wait for supply-chain headwinds to clear before initiating any new positions. That being said, the consumer trends that drove early growth are likely here to stay.

I don’t expect sales to grow as dramatically, post-COVID, but with the stores’ expansion into other markets and pricier products, I expect these dollar stores will continue to thrive.

I’m partial to Big Lots, but which of these dollar stores is your favorite (as a consumer or an investor)?

[author_ad]

*This post has been updated from an original version, published in 2018.