I’m going to keep my column relatively brief today as I work hard to consume some of the massive amount of candy my kids got on Halloween. (Tough life, I know.) But seriously, with the S&P 500 tagging new all-time highs this week, three things are sticking out to me: investor sentiment bottoming out, cyclical stocks breaking out, and a few growth stocks setting up nicely.

Let’s get to each of them below.

Investor Sentiment at New Lows

[text_ad]

I wrote about this a bit in my last Cabot Wealth Daily column, so I won’t beat a dead horse. But I remain intrigued by how, with each successive attempt at new highs this year (and, really, for the past two years), there’s been less and less optimism that the move can continue. The chart I showed last time—a long-term moving average of bullishness among individual investors—is one example.

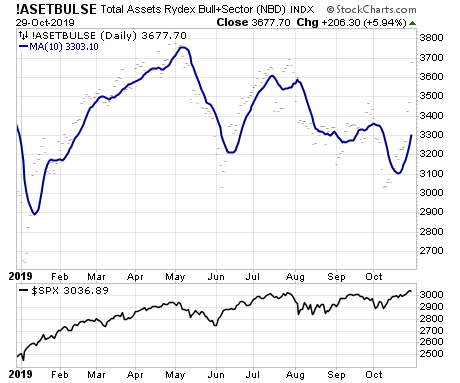

Another comes from the assets in bullish index and sector funds, via Rydex. While most use ETFs now to trade leveraged index funds, this measure still has a good contrary record. And you can see that the assets in these funds have been hitting lower highs all year with each successive rally toward new highs (April, July, September and now), including the rally this week. Beyond that (not shown on this chart), the asset level is near its lowest level of the past five years.

Possibly even more striking was this weekend’s “Big Money” poll in Barron’s, which was an eye opener: the percent of money managers that are bullish for the next 12 months is down from 56% a year ago and 49% in the spring to just 27% today—the fewest number of bulls in more than 20 years. Imagine!

Sentiment is always a secondary indicator, with price, volume and trend of the major indexes and leading stocks the thing to really focus on. But there’s no doubt in my mind that most weak hands have been worn out during the past few months as the market has chopped around and the news has been brutal.

Cyclical Stocks Breaking Out

I’m a growth investor, but I’m also a student of the market and always keep my eyes open for where the big money is flowing. (That’s really the basis for my Cabot Top Ten Trader advisory, to always be on top of where big investors are putting money to work.) And I have to say, while I’m never going to own a ton of cyclical stocks, I’m impressed with many of the earnings breakouts and upside follow through action I’ve seen from a handful of names.

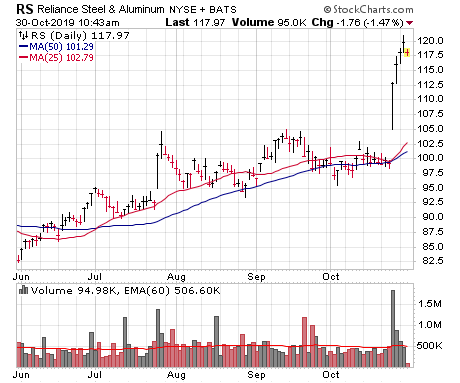

Take Reliance Steel & Aluminum (RS), which is the largest metals service center firm in the country. The numbers aren’t great, but the latest quarter beat expectations and investors are clearly thinking better times are ahead. And take a look at that earnings reaction—not only did the stock gap out of a nice flat base from the prior 10 weeks, but it soared the next three days, too, which is just the type of action you want to see.

And, while RS is obviously just one stock, I’m seeing a good number of earnings gaps and upside follow through among many rail, airline, chip equipment and other cyclical stocks.

Strong Setups among Growth Stocks

Meanwhile, while cyclical stocks have been doing well, many growth stocks (especially the leaders from earlier this year) have been lagging. However, as time has passed I’m seeing an increasing number of setups among growth names—if earnings reports are well received (admittedly a big if), I think there could be a ton of breakouts to sink our teeth into.

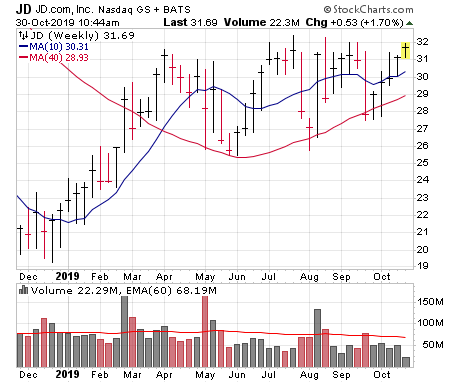

Take a gander at JD.com (JD), a leading Chinese e-commerce play. After a good off-the-bottom rally through March, the stock has consolidated with resistance around 32 and has slowly tightened up a bit (higher lows) over time. A breakout above 32.5-33 would be intriguing.

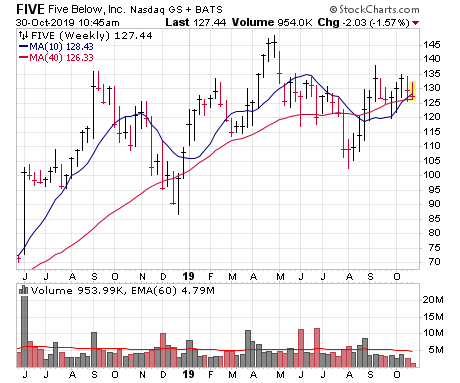

Five Below (FIVE) has been pushed and pulled by the trade war during the past year, but after shaking out to the 100 area, it rallied five weeks in a row and has now etched a fairly tight zone (123 to 137) since early September. A breakout on powerful volume would be a good sign.

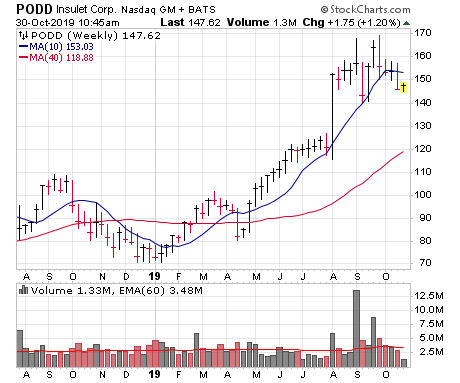

There’s also Insulet (PODD), which is 10%-plus from a breakout, but has basically consolidated sideways since mid-August after an early-stage breakout in May and sharp run-up. Earnings are due November 5, which could be a catalyst for this maker of diabetes pumps.

Of course, it’s possible these and other stocks that are set up nicely will report earnings and then fall apart! That’s why, if you buy ahead of reports, I suggest going small—personally, I tend to just wait for the report itself and the reaction to make a go/no-go decision.

But my overall point is that, for the first time in five or six months, it appears that not just the major indexes but the broad market are set up for a sustained upmove. Now it’s a matter of having your shopping list ready and seeing if big investors are, for the first time since April, ready to embark on a persistent buying campaign.

In the meantime, if you want to know what else is on my shopping list, I highly recommend you subscribe to my Cabot Top Ten Trader advisory, a weekly reveal of the 10 best momentum stocks on the market. To learn more, click here.

[author_ad]