Big picture, nothing has changed my view that the odds strongly favor we’re five months into a new bull phase—obviously, there are never any guarantees, but the prior bear period, the bullish long-term trend, tons of leadership during the recent rally and many bullish studies—simply put, the upmove of the past few months was rare in its power and persistency, usually leading to good things—tell me that the last few months was likely the first “leg” of a bigger move. Again, no guarantees, but the odds favor it, which could be good news for the Bull Market stocks below.

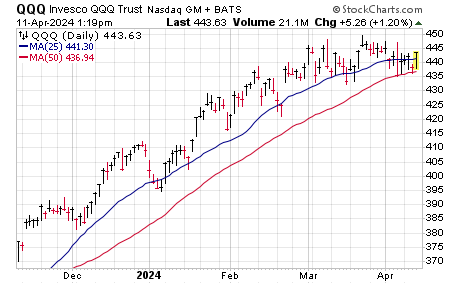

That said, near term, the market has been a game of ping-pong: Many leaders have stalled out during the past month or two—heck, the Nasdaq 100 itself (shown below) has made no net progress since early February—so it’s a coin flip as to whether we finally get an intermediate-term correction of some sort (driven by higher interest rates and profit taking) … or whether this is a resilient pause that refreshes (resilient because few stocks have cracked despite rate cut hopes being dashed steadily over the past two months).

For me, I’ve been gradually trimming my sails—we own a few of what I think are true leading stocks, but I have booked a little partial profit in most of them and have been doing more holding than buying of late for the most part; coming into this week we were over one-quarter in cash.

[text_ad]

That said, whether the market takes off soon (shrugging off this week’s inflation report) or later (after a dip to raise the fear level), one group I’m likely to add exposure to when the buyers pounce again is Bull Market stocks—firms whose earnings and cash flow are directly impacted by asset prices, trading activity and the like. I’ve been watching them for a while and think many will go much higher down the road.

As an added bonus, most are acting just fine so far during the sloppy action of the past couple of months. And it’s an interesting group in that there’s something for everyone.

3 Bull Market Stocks for the Next Leg Higher

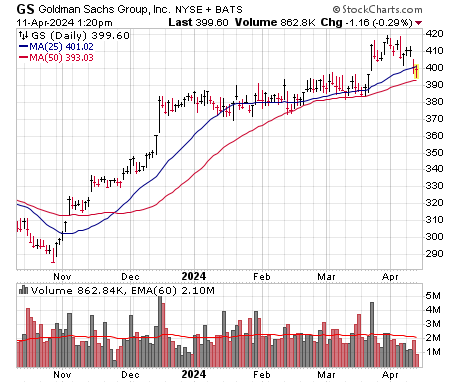

First are some big outfits, with our pick of that litter being Goldman Sachs (GS) which needs no introduction, as it’s one of the granddaddies of the investment banking industry. No, it’s not going to double in a month, but the stock does have a history of making very solid moves when the bulls are running (the last big upmove was from 200 to 420 in late 2020/early 2021)—and, interestingly, GS actually just recently broke out of a very tight zone and is holding up fairly well. Consider it a conservative way to play the sector.

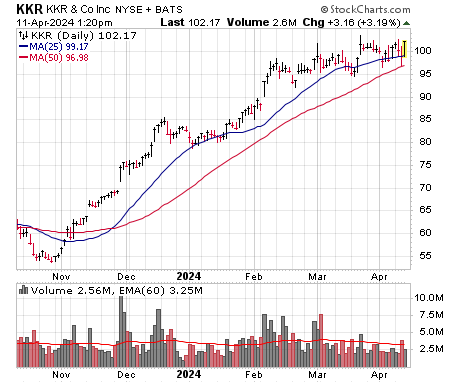

Smaller than the behemoths but still very big are the asset managers, especially the alternative managers that deal in everything from private equity to fixed income to real estate. There are three big ones out there, but the strongest name since the market got going last Halloween has been KKR Inc (KKR), which ended the year with $553 billion of assets (mostly private equity and credit-related), 81% of which were fee-generating. But the special sauce here is the firm’s buyout of insurers Global Atlantic late last year, which will boost originations and assets to manage in a big way. I’m not ruling out KKR correcting further, but I’m very impressed how it has shown no desire to give ground at all despite the renewed interest rate/Fed worries and related market wobbles.

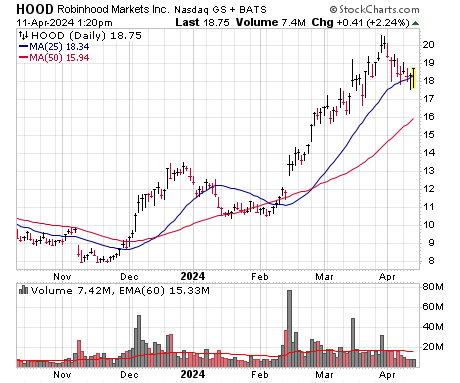

Then we have the brokerages, which, frankly, are my favorite—though it’s not always easy to find a new, dynamic up-and-comer in this field as the market should be early-ish in a bigger advance. But this time we have one: Robinhood (HOOD) is a name that was, frankly, a meme stock in 2021 but now has many irons in the fire and is already seeing a big pickup in growth. Here’s what I wrote about HOOD in Cabot Top Ten Trader earlier this week:

“There are many Bull Market stocks that are still acting well, but Robinhood is probably the highest potential issue, as it’s still young and is much more leveraged to newer investors—thus, if big-picture sentiment improves over time, it’s positioned to gain lots of users and capital. Of course, it’s not just all about the market here: While there are still limitations of what can be traded (like bonds, preferred stocks and the like), the company is expanding internationally (in the U.K. late last year, while introducing crypto trading in Europe in December, too), is focusing on alternative products for more frequent traders (including 24-hour trading for lots of stuff, with index options and futures being added) and is making a swing for traditional users, too (new retirement account program that includes matches from the company!). There’s also a subscription offering (Robinhood Gold), that for $5 per month gives you things like higher yields on cash deposits, better trading tools and a higher match on IRA deposits, too. There’s also some hubbub about a new credit card that may launch, that, for Gold members, gives 3% cash back on all spending; some think this isn’t sustainable (interchange fees won’t cover it), but there’s reportedly large interest in it and, of course, it could bring more people to its platform. Growth has been solid (partly from higher interest income) and recent monthly metrics show how quickly Robinhood could grow—in February, custodial assets rose 16% from January (!), while trading volumes all grew double digits from the prior month and cash sweep balances (big for interest income) were up 8%, too. Obviously, if the market stumbles in a big way, all bets are off, but we think Robinhood will surprise on the upside. Earnings are due May 8.”

The stock had a big run after Q4 earnings and has been pulling back, but all in all, it strikes me as very normal so far, especially given its lower share price (more volatile). It’s on my Watch List.

[author_ad]