There’s an ongoing debate—and has been, for years—about which is better—stock buybacks or dividends.

I’m not going to tell you there is a definitive answer to that question; instead, I think there’s a case for both.

But know this—stock buybacks are on fire! In 2021, total stock buybacks were $850 billion. But last year, they reached a record $1.22 trillion, according to EPFR Trim Tabs. At the beginning of February, companies had announced $173.5 billion worth of planned buybacks—double last year’s pace. And they just keep adding up. Just take a look at this chart—all of these buyback announcements were in February alone!

| Company | Date | % of Shares | Buyback Amount |

FISV Fiserv | 2/23/2023 | 75.00 million shs | |

HLX Helix Energy Solutions Group | 2/20/2023 | 16.5% | $200 million |

CFG Citizens Financial Group | 2/17/2023 | 5.6% | $1.15 billion |

R Ryder System | 2/15/2023 | 2.00 million shs | |

DHX DHI Group | 2/9/2023 | 4.4% | $10 million |

RHI Robert Half International | 2/9/2023 | 10.00 million shs | |

REG Regency Centers | 2/9/2023 | 2.3% | $250 million |

NYT New York Times | 2/8/2023 | 3.8% | $250 million |

CDW CDW | 2/8/2023 | 2.8% | $750 million |

MGM MGM Resorts International | 2/8/2023 | 12.6% | $2 billion |

PRU Prudential Financial | 2/7/2023 | 2.6% | $1 billion |

ON onsemi | 2/6/2023 | 8.1% | $3 billion |

SWKS Skyworks Solutions | 2/6/2023 | 11.5% | $2 billion |

DGX Quest Diagnostics | 2/2/2023 | 6.0% | $1 billion |

Source: Marketbeat.com | | | |

And despite dire earnings projections that some analysts have forecast for the companies in the S&P 500 Index, yesterday, Salesforce (CRM) reported first-quarter revenue above analysts’ estimates and doubled its share repurchase to $20 billion!

Let’s talk about the differences between buybacks and dividends so that you’ll be able to assess both strategies for the shares in your own portfolios.

[text_ad]

A stock buyback is simply when a company declares that its board has authorized the repurchase of a certain amount of its own stock. Investors like stock buybacks because they reduce the number of outstanding shares and also enhance the company’s per-share profitability measures, such as EPS, Return on Equity, and cash flow per share. Over time, those better ratios will often lead to higher share prices, adding to investors’ pocketbooks. And, very importantly, the buyback isn’t taxed until the stockholder sells his shares.

From a corporate standpoint, buybacks are optional, but are often done for two reasons:

- The company has excess cash. If excess cash is the impetus, the company has the choice of what to do with its extra cash—it is not obligated to repurchase shares. It can just plow the money back into the company.

- Its share price—in its estimation—is cheap. If the company’s C-suite thinks the shares are undervalued, they may use buybacks as a way to (hopefully) improve the share price.

The timing of a buyback is also important. Companies want their buybacks to look like a show of strength—confidence in the company’s future. And while share prices can—and often do—rise after a buyback, if, for some reason, they took a dive, the buyback may be considered a failure.

And if the shareholders believe the company should be investing its excess cash back into the growth of the company instead of repurchasing shares, the buyback could backfire.

Warren Buffett had a few things to say about stock buybacks in his recent letter to Berkshire Hathaway’s shareholders, saying, he “believes buybacks are beneficial to shareholders as they provide a lift to per-share intrinsic value.” He went on to comment, “When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).”

And while I love Warren Buffett, it is true that there are some disadvantages to a stock buyback:

- The company doesn’t see a better use of its cash, such as buying the competition or investing in new products or technology. That may raise some questions as to the company’s confidence in future growth—and for investors, appreciation of their stock.

- The buyback process can be time-consuming and expensive, as a company must provide stock exchanges and regulators reams of disclosures, and usually, it also has to hire investment bankers.

Also, a company might use stock buybacks to camouflage the number of shares it’s handing out to its top executives in the form of stock options. The buybacks may balance out the options issuance, keeping the total number of shares constant, and essentially not benefiting the shareholders.

In contrast, dividends are issued for a couple of reasons:

· To attract new investors with steady cash flow

· To reward existing investors with occasional dividend increases, and sometimes special dividends

Dividends are incredibly important to many investors. In fact, according to Fidelity, its research shows that since 1930, dividends have accounted for roughly 40% of the total return of U.S. equities. And dividend increases have been no slouch recently, either. According to Janus Henderson, dividends paid by companies in the U.S. in 2022 reached $1.56 trillion, up 8.3% year over year.

You might consider the dividends that your investments pay as sort of a profit-sharing plan. But there is a downside—dividends are paid-out after tax by corporations, and then shareholders are taxed when they receive them. That’s called double taxation. The advantages of dividends are obvious—free money, and if you hold those stocks in a retirement plan, you can defer the taxes until your golden years, when your tax bite will probably be lower.

Another potential downside to dividends is that when an economy hits a rough spot and earnings decline, so do dividends. For the 12 months ending September 2022, 232 companies decreased their payouts, amounting to $15.2 billion. And in severe earnings droughts, dividends can be suspended, such as during the early days of the pandemic in 2020, when more than 190 companies suspended their dividends.

Do Dividends or Buybacks Reward Shareholders the Most?

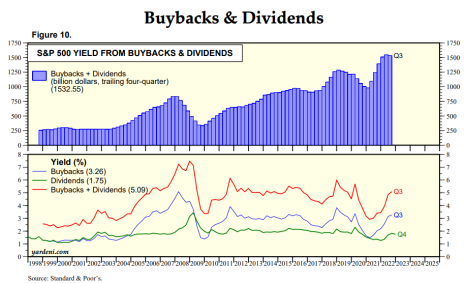

It’s often a toss-up, as you can see in the following graph from Yardeni Research. Over the last few years, buybacks have been returning more to investors.

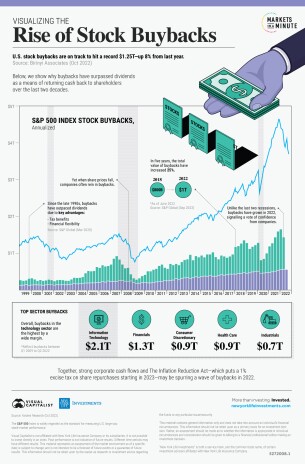

The following pictorial gives you the big picture of the buyback scenario, as well as the sectors that have been most active in stock repurchases.

The buyback trend looks good for 2023, too, where industry experts are predicting about the same amount of buybacks.

I gave you a list earlier, of the February buyback announcements. I took a quick look at each of those companies to see if they looked like good investment ideas. I came up with three that you may want to consider.

| Company | Industry | Price ($) | P/E | Analyst Ranking | Earnings Growth (5-yr., %) |

Fiserv Inc (FISV) | Payments, Financial Services | 115.68 | 29.48 | Strong Buy | 20.91 |

CDW Corp (CDW) | Information Technology, hardware/software | 199.56 | 24.62 | Strong Buy | 18.13 |

Skyworks Solutions (SWKS) | Semiconductors | 110.10 | 15 | Strong Buy | 12.17 |

As always, please make sure that any investment, including these, is right for you and your portfolio strategy and risk profile.

[author_ad]