Rising dividend stocks have been harder to find of late.

Between the end of November 2019 and June 25, 2020, 41 companies in the S&P 500 index suspended their dividends, and 15 others reduced them. By mid-July, that total number had climbed to 63. And they were—for the most part—companies that are household names, but in industries that have been decimated by COVID-19. Some of the cuts, as you can see, were pretty hefty.

Recent Dividend Cuts:

Wells Fargo (WFC), $0.31 to $0.10

Schlumberger (SLB), $0.50 to $0.125

Occidental Petroleum (OXY), $0.79 to $0.11.

Apache (APA), $0.25 to $0.025

Targa Resources (TRGP), $0.91 to $0.10

DCP Midstream (DCP), $0.78 to $0.39

[text_ad]

Dividend Suspensions:

Here are some of the best-known companies that have suspended their dividends:

Dick’s Sporting Goods (DKS)

Estee Lauder (EL)

Gap (GPS)

Carnival (CCL)

Goodyear Tire & Rubber (GT)

Las Vegas Sands (LVS)

Boeing (BA)

Marriott International (MAR)

Ford (F)

Delta Air Lines (DAL)

Freeport McMoRan (FCX)

Darden Restaurants (DRI)

Bloomin’ Brands (BLMN)

BJ’s Restaurants (BJRL)

Macy’s (M)

Nordstrom (JWN)

Sabre (SABR)

As you can see, these companies operate primarily in the energy, airlines, restaurant, and retail arenas.

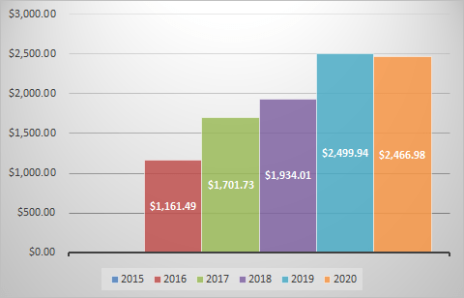

The following graph shows the dollar amount of the dividend cuts through the end of June, which just about total all of 2019’s cuts.

Source: Timeinthemarket.com

Since then, scores of other companies have cut or suspended their dividends.

5 Rising Dividend Stocks

The good news is, some companies are now increasing their payouts, including:

- Toronto-Dominion Bank (TD), from $0.57 to $0.59

- Intuit (INTU), from $0.53 to $0.59

- Dick’s Sporting Goods (DKS), brought back its dividend, $0.31

- Lowe’s Companies (LOW), from $0.55 to $0.60

- Algonquin Power (AQN), from $0.16 to $0.31

There are plenty more companies that are raising or reinstating their dividends. But, just as a dividend cut doesn’t necessarily mean you should sell your stock, an increase in the payout also doesn’t mean the company is a great buy.

With that in mind, I thought I would take a brief look at the five companies I’ve listed that have recently raised their dividends, to see if they look like attractive investments.

Here’s what I found.

| Company | P/E | Rising Earnings Estimates | Dividend Yield (%) |

| Toronto-Dominion Bank (TD) | 10.5 | Yes | 4.95 |

| Intuit (INTU) | 47.4 | Yes | 0.71 |

Dick’s Sporting Goods (DKS)

| 18.0 | Yes | 2.28 |

Lowe’s Companies (LOW)

| 20.7 | Yes | 1.53 |

Algonquin Power (AQN)

| 14.3 | No | 4.52 |

All but Algonquin look fundamentally and technically attractive. And as earnings generally drive stock prices, the first four companies look interesting.

Financial stocks have had a rough road this year, down on average 17.8%, so I might be a bit wary about diving into that sector just yet.

Technology stocks, of course (minus last week), have been the best-performing sector, gaining 28.9% year-to-date, so Intuit is worth a look.

Surprisingly, Consumer Discretionary stocks have also done well, up 17.3%, the third-best-performing sector.

Of course, the do-it-yourself, as well as the housing markets, continue to thrive, so Lowe’s looks good, and is trading at an undervalued level.

Utility stocks have lost an average of 8.1% in 2020, and Algonquin stock hasn’t done much. I would stay out of it at this time.

These are just a few ideas for you. But as always, they are just a point of reference to begin your research to see if they might fit into your portfolio strategy and goals.

[author_ad]