How would you like to own shares in a company that sends you a check every month, regular as Social Security? You can do so, with monthly dividend stocks.

There aren’t many of these companies. Most stocks that pay dividends do so quarterly—that’s every three months. Public companies that send shareholders dividend checks every single month are as rare as white whales. But the handful that exist tend to be laser focused on rewarding shareholders and a source of very reliable income. They’re also usually quite high-yielding, paying 5%, 6%, 7% or even 8% per year!

Of course, as with any high-yield investment, monthly dividend payers can be high risk. You have to watch out for unsustainable business models as well as too-good-to-be-true promises. Luckily, I’ve already done a lot of the leg work for you! I just compiled a report on the best stocks and REITs that pay investors monthly, with yields between 4.2% and 8.4%.

[text_ad use_post='155985']

In addition to high yields, I made sure these companies have steadily rising revenues, multi-year track records of monthly dividend payments, experienced management teams and are in stable industries. Click here to download the report now.

One Monthly Dividend Stock to Buy Now

The list includes monthly dividend stocks from a variety of industries, including oil and gas, real estate investment trusts (REITs) and financials. One company has paid a dividend every single month for 24 years. Another has increased their distribution every quarter for the past two years.

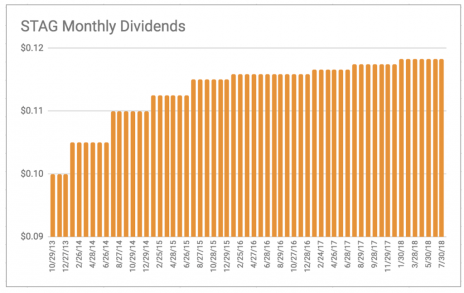

One of the companies on the list is STAG Industrial (STAG), which has raised its monthly distribution by an average of 8% per year every year for the past seven years.

I like the company because it’s a play on the booming e-commerce space. If you’re like most of my friends, you order something from Amazon or another online retailer at least once a week. All those packages have to get to their destinations somehow, and that’s where STAG Industrial comes in.

The company is a REIT, or real estate investment trust, that owns 370 industrial properties in 37 states. About 88% of STAG’s square footage is warehouse space, and major tenants include DHL, FedEx and XPO Logistics. STAG’s warehouses play a key role in these companies’ ever-growing distribution networks. As more e-tailers, including Amazon (AMZN), offer one- or two-day delivery, they need more warehouses closer to their customers to fulfill demand. That’s creating a strong tailwind for STAG, pushing up rents and keeping properties 96% occupied.

A combination of high-quality tenants, long-term leases and built-in rent escalators mean cash flow is both stable and predictable. STAG’s largest tenant is the Federal Government’s General Services Administration. And the company’s current tenants have a weighted average of 4.8 years remaining on their leases. Funds from operations (a widely-used measure of REIT cash flow) have risen every year since STAG came public in 2011.

Growth comes primarily from acquisitions, and STAG has already acquired 21 new buildings so far this year, adding 3,818,030 square feet of space. The new properties are almost all already leased, with a weighted average of 7.3 years remaining on the leases.

And of course STAG passes a good chunk of that income on to investors through monthly distributions. The company currently pays 12 cents a share per month, for an annual yield of roughly 5%. Payments will usually appear in your brokerage account on the 15th of every month. The income is regular enough that you can use it to pay bills. Or, if you don’t need income from your investment portfolio right now, you can reinvest it in the stock.

Monthly Dividend Stocks Report

If you do need income from your stock portfolio there’s no better way to get it than with monthly dividend stocks like STAG. My new report has all the information you need to build an income-generating portfolio of these cash cows now. Click here download the report now.

[author_ad]

*This post has been updated from an original version.