The U.S. stock market is showing signs of gaining momentum to the upside, as evidenced by the Nasdaq’s new all-time high set at the end of March. The weakness in value stocks during the month of March has created some excellent buying opportunities, but which undervalued stocks will lead the way?

Growth Stock Surge

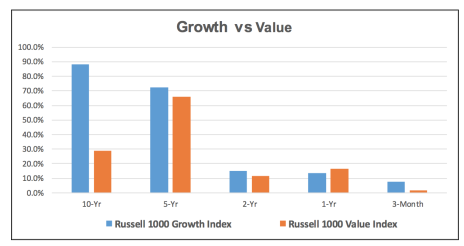

During the past decade, growth stocks have ruled the roost led by the so-called FANG stocks which include Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG). As illustrated in the chart below, the Russell 1000 Growth Index has soared 88.5%, well ahead of its counterpart, the Russell 1000 Value Index, which has managed to advance only 28.7%.

[text_ad]

Similarly, growth stocks have outperformed value stocks during the past 5-year, 2-year, year-to-date and 1-month periods. Only during the latest 1-year period has value outperformed growth. So why am I optimistic about a resurgence in value stocks?

Growth stocks have outperformed value stocks since 2000, one of the longest periods of outperformance. The huge difference between growth and value gains is the largest ever recorded, but the wide outperformance enjoyed by growth stocks will end at some point, and now might be the turning point where value stocks develop a winning streak of their own.

Growth stock valuations are stretched to the limit while value stocks are too inexpensive to ignore. The Russell 1000 Growth Index sports a lofty P/E (price divided by earnings per share) of 23.6 compared to the Value Index’s 18.9 P/E. The divergence in the P/BV (price divided by book value per share) is even wider: 5.68 for growth and 1.98 for value. Value stocks, as usual, provide a higher dividend yield currently at 2.13% versus 1.26% for growth stocks. As I mentioned, value stocks are totally neglected and due for a comeback.

Previous periods of growth outperformance, including the Nifty Fifty market of 1966-73 and the technology bubble of 1998-99, were followed by strong periods for value investing, including seven straight years of value outperformance from 2000 through 2006. “Momentum (growth) stocks trade at an extreme premium to value stocks, with the valuation spread the highest since 1980, except for during the tech bubble,” JPMorgan strategist Dubravko Lakos-Bujas wrote recently.

Rapidly increasing sales and earnings gains in the technology and healthcare sectors have bolstered the performance of the Russell 1000 Growth Index, whereas sagging sales and earnings in the financial, industrial, retailing and energy sectors have held back performance in value stocks.

10 Value Stock Gems

The attraction of investing in stocks with rapidly increasing sales and earnings has lured the majority of investors into growth stocks. In 2017, though, undervalued bargains in value stocks are gaining attention. After a long period of disfavor, value investing could be on the verge of a multiyear comeback, but investing in value stocks will require patience.

A year ago, in the Cabot Wealth Advisory (the predecessor to Wall Street’s Best Daily), I presented 10 high-quality undervalued stocks that had performed poorly during the prior 12-month period. My approach to finding stocks that would appreciate rapidly turned out to be spot on. All 10 stocks recommended on March 17, 2016 advanced. The average increase of 27.7% easily beat the increase of 15.8% for the Standard & Poor’s 500 Index. When dividends are added, the total return of my 10 recommendations topped 30.3%!

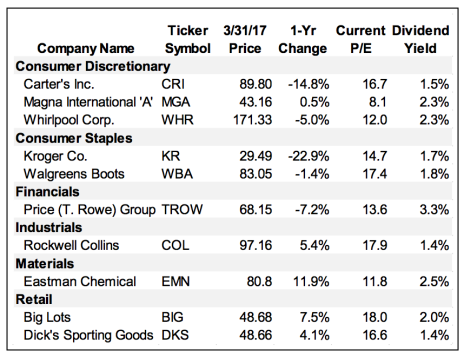

Even after the stock market surge since the November 8 election, there are hundreds of undervalued stocks in the market today. I have listed 10 high-quality companies that have underperformed during the past 12 months, but will likely recover during the next 12 months.

All 10 of the stocks in my list are rated as undervalued by Standard & Poor’s, and each stock is rated above average quality by S&P.

Each stock is selling at a reasonable price to current earnings ratio, and all 10 stocks pay attractive dividends. Finally, all 10 companies are expected to report higher sales and earnings for the next 12 months. All 10 of these stocks are poised to surge during the next 12 months.

“There are really good, well-run companies, attractively priced,” says Kevin Toney, co-manager of the American Century Equity Income Fund. You can easily find additional undervalued companies and learn about them in my Cabot Benjamin Graham Value Investor. Subscribe today. You’ll be glad you did!

[author_ad]