You hear a lot about sectors if you listen to investing TV or read the mass media, with many talking heads relaying what areas of the market led today’s trading and which ones look like they’re headed higher. I have nothing against this sort of “top-down” analysis, which is based on the thought that most of the outperformance (or underperformance) will come from what group a stock sits in. It makes sense if you’re mostly looking at just the couple hundred biggest stocks in the market, but not if you’re, say, looking for undiscovered software stocks.

But I focus on emerging blue chips—stocks that have fast-growing sales and earnings, a great story and ideally a new product or service—so I’m more of a “bottom-up” investor, looking for unique individual firms that have something truly special. In fact, some of our best investments ever didn’t even come from a “sector”—there was no solar sector when we rode First Solar (FSLR) to a many-fold gain in 2007-2008, and there was no “satellite radio” sector when we did the same with XM Satellite Radio in 2003-2004.

[text_ad]

All that said, I do use a bit of top-down analysis, but not exactly how most do—traditional sectors like “industrials” or “financials” are all well and good, but they’re very static and don’t really adjust to what’s going on fundamentally (including all the innovation that’s taking place) in the world today.

Instead, I like to look at themes, which delve more deeply into what’s really going on. For example, when looking at sectors, a lot of investors talk about software—and for good reason, as many names in the group look pretty good. You then will regularly hear people dig a bit further down, talking about cloud enterprise software, which of course, was one of the leading groups in the past bull cycle, launching many winners (especially during the pandemic).

I dug a bit deeper and have one of my favorite themes should this market continue its winning ways: Cloud software firms that specialize in a specific niche that has plenty of room for improvement, be that a certain business function or serving a single industry. I see more than a few names in this theme that have great growth and are setting up well on their chart—and aren’t very well known, so if all goes well, a lot of big institutional investors may pile in and drive stocks nicely higher.

3 Undiscovered Software Stocks to Play That Theme

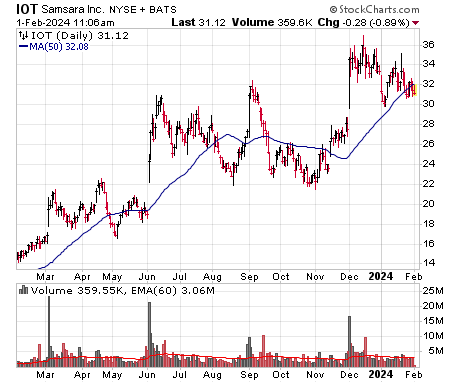

One name I’ve written about is Samsara (IOT), which has a platform that allows enterprises with tons of physical assets—think trucks, machinery, equipment, you name it—to dramatically boost their productivity via telematics, safety training and monitoring and much more. This is probably my favorite story in this theme (and one of my favorite in the entire market), though admittedly, the stock has been waterlogged in the 30 to 35 area, likely due to its massive valuation ($17 billion or so, vs. $1 billion-ish annual revenue run rate). It’s still a name I watch closely, though, waiting for a “real” breakout. Earnings here aren’t likely out until early March.

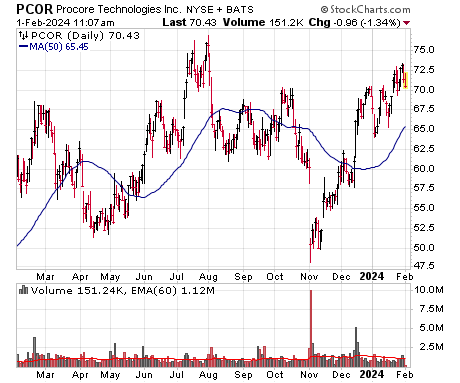

Then there’s Procore Technologies (PCOR), which is another undiscovered software stock with a story that simply makes sense: The firm’s cloud platform is built specifically for giant construction outfits, linking the huge number of players involved (owners, builders, contractors, sub-contractors, financiers, you name it) to save time and money; the firm claims its platform cuts the length of projects in a big way, which of course is huge. The stock spent most of last year building a bottom and then was slammed on earnings just as the market was bottoming—and PCOR has been marching back toward two-year highs of late. Earnings are due February 15.

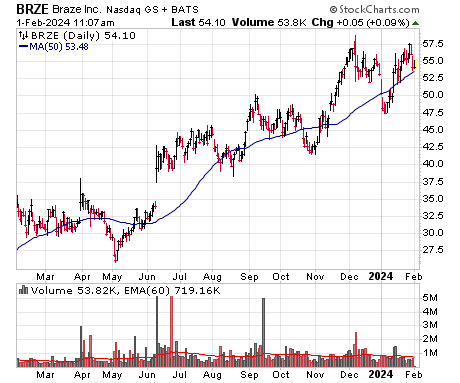

Then there’s Braze (BRZE), whose focus is on new-age marketing, especially for consumer-facing outfits—companies like 1-800 Flowers, DraftKings, FanDuel, Etsy, GoFundMe, Stubhub, CVS, the NBA, Burger King, Nascar, Shake Shack, Grubhub, Venmo, IBM and dozens more have signed up to align their marketing across channels, so that their marketing emails line up with and reinforce their notifications, texts, WhatsApp messages, in-browser messages and more, leading to more personalized and effective campaigns—and more engagement and usually sales. (Fun fact: The firm’s platform sent 2.2 trillion messages in 2023!) More than 2,000 firms in total have signed up (up 17% from a year ago), and they’re buying more of Braze’s services over time (same-customer revenue growth of 18% in the most recent quarter), leading to excellent top-line growth (up 33%) as earnings and free cash flow approach breakeven.

Interestingly, BRZE saw selling after earnings in December and then nosedived early in January, which had me taking it off my watch list—but the stock has moved straight back up toward its old peak, resulting in a nice-looking nine-week launching pad. A big push higher would be tempting and likely kick off a sustained upmove.

If you’re interested in branching out from undiscovered software stocks and reading more about technology stocks as a whole, you can find all of our Cabot Wealth Daily coverage of tech stocks here.

For more coverage of small-cap cloud software stocks in particular, read “Small-Cap Cloud Software Stocks Are Back.”

[author_ad]