Happy New Year!

What a strange year in the markets! Stocks (as measured by the Dow Jones) were pretty much sideways until November, when they began shooting upward, with the Dow rising more than 5,000 points before the end of the year.

2023 was the year for Growth stocks, which gained 41.19%, followed by mid-caps (up 24.42%) and small caps (up 17.34%). Value stocks were the runners-up, but still managed to make some decent returns with large caps gaining 8.72%, mid-caps 9.97%, and small caps 11.56%.

[text_ad]

Sector-wise, Tech stocks rose by 54.47%, on average. But it was almost a tie between them and Communication Services equities, which gained 51.47%. As you can see in the table below, the laggards were Utilities (down 11.03%), Consumer Staples (-3.86%), and Energy (-3.54%).

U.S. Sector Performance

| Name | Symbol | 1 Year |

| Technology |

XLK | 54.47% |

| Communication Services |

XLC | 51.47% |

| Consumer Discretionary |

XLY | 38.07% |

| Industrial |

XLI | 15.61% |

| Financial Services |

XLF | 9.65% |

| Basic Materials |

XLB | 9.34% |

| Real Estate |

XLRE | 7.49% |

| Healthcare |

XLV | 0.03% |

| Energy |

XLE | -3.54% |

| Consumer Staples |

XLP | -3.86% |

| Utilities |

XLU | -11.03% |

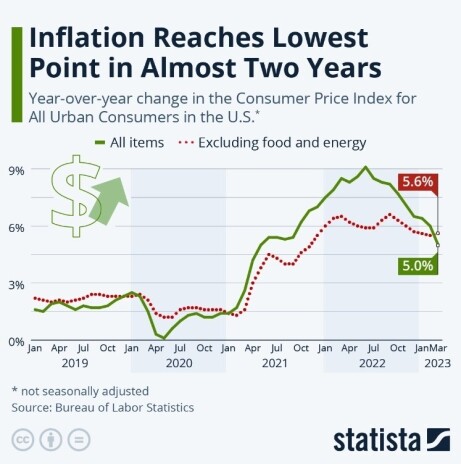

At the beginning of 2023, more than half of economists were predicting a recession. At that time, inflation was still digging deeply into our pockets, and the Fed’s four interest rate hikes were highly anticipated.

Today, inflation is receding (although I haven’t seen any proof of that in my grocery bill!), and recession fears remain, due to forecasts of a slowdown in the economy, but most economists are still calling for a “soft landing”—so far.

Yet, companies are still expected to turn in double-digit earnings growth (11.8%), according to FactSet, which is year-over-year, the earnings growth rate for CY 2024 is 11.8%, which is “higher than the trailing 10-year average (annual) earnings growth rate of 8.4% (2013 – 2022).”

And since earnings usually are the biggest drivers of stock prices, I’m optimistic for the 2024 market. But having said that, I’m also not in the dart-throwing state of mind. I believe we will continue to see volatility, so judicious stock-picking is still my focus.

With that in mind, some of the sectors I believe will perform well this year are financials, healthcare, automotive, and industrial stocks, in particular.

And I also think that 2024 may be the year of value and small-cap stocks. With that in mind, I’ve run scores of companies through my analysis parameters and found three that I hope will be of interest to you.

3 Small-Cap Stocks for 2024

Teekay Corporation (TK) operates a fleet of 54 vessels that transport crude oil worldwide.

A small-cap stock, Teekay has a market cap of $663.02M and trades at a P/E of 4.86. Recently, analysts have been boosting their earnings predictions. The company reported third-quarter EPS of $0.27 compared to $0.15 in the same quarter a year ago.

Capital Southwest Corporation (CSWC) is a business development company (BDC) specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, recapitalizations and growth capital investments. The company does not invest in startups, publicly traded companies, real estate developments, project finance opportunities, oil and gas exploration businesses, troubled companies, turnarounds, and companies in which significant senior management is departing.

The company’s market cap is $946.8M and it trades at a P/E of 12.81. Wall Street analysts have increased the earnings estimates for this company in the past 90 days.

Titan International, Inc. (TWI) manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in North America, Latin America, Europe, the Commonwealth of Independent States region, the Middle East, Africa, Russia, and internationally. The company operates in Agricultural, Earthmoving/Construction, and Consumer segments.

The market cap of TWI is $ 922.5M and its P/E is 7.64.

Cost-cutting and tech innovations are boosting this industry, and the earnings estimates for TWI have been creeping up.

I hope you find one or more of these stocks as a suitable addition to your portfolio. But as always, please make sure that any potential investment aligns with your strategy and goals.

Best wishes for a healthy, happy, and prosperous 2024!

[author_ad]